- Overvew

- Table of Content

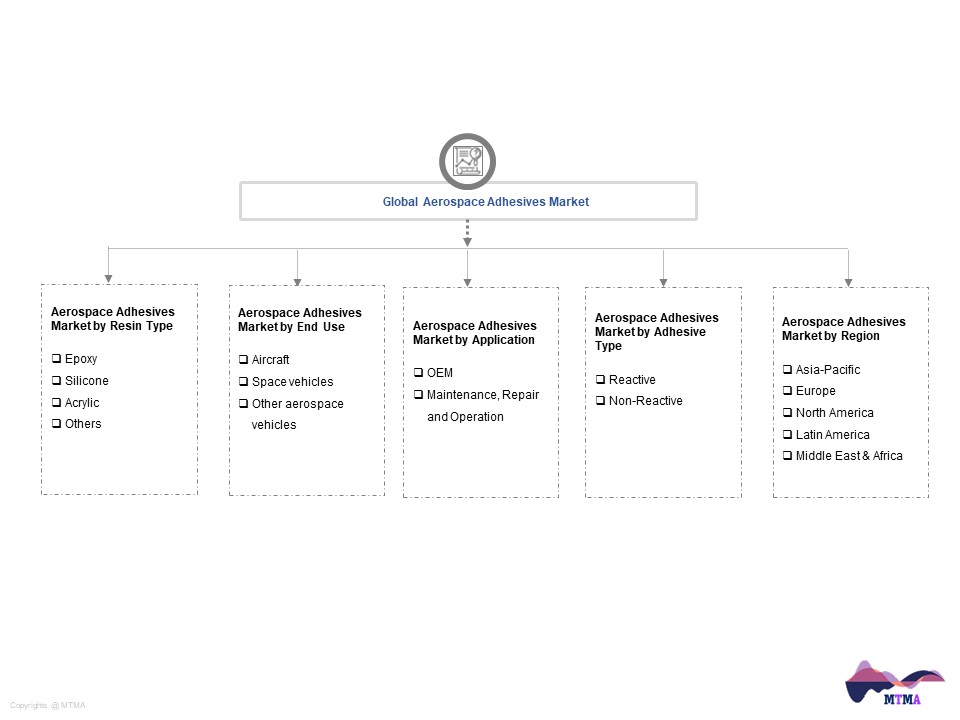

- Segmentation

- Request Sample

Market Definition

Adhesives are compounds that are used to affix two or more substances to one another in order to build a solid, sturdy structure. Adhesives are classified according to their adhesion value, which is mostly determined by the type of resin used. Epoxy, polyurethane, acrylic polymer, and natural glues are examples of resin kinds. Reactive and non-reactive adhesives are two other categories. Contact adhesives, pressure sensitive adhesives (PSA), drying adhesives, and hot melt adhesives are examples of non-reactive adhesives. Both synthetic and natural adhesives are reactive adhesives. Aerospace adhesives are employed in a variety of aerospace applications, including metal and fibre composites, fuel assembly, optical fibres, antennas, electronic assembly, and sensors in all types of aircraft as well as the growing fleet of commercial spacecraft.

Market Insights

In 2022, the market for aerospace adhesives was valued at over $1,012.45 million and the market is expanding at a CAGR of 5.5%. The demand for aerospace adhesives is primarily driven by the North American and European markets. This is because there are significant aircraft and component producers in Europe and North America. These areas also export their manufactured aircraft to other areas. Asia-Pacific is one of the biggest markets for commercial aircraft, thus throughout the forecast period it might be a good market for aerospace adhesives.

According to resin type (epoxy, silicone, acrylics, and others), end use (aircraft, spacecraft, and other aerospace vehicles), application (OEM and MRO), adhesive type (reactive and non-reactive), and geographic regions (North America, Europe, Asia-Pacific, South America, the Middle East, and Africa), the market for aerospace adhesives is divided into different categories. The market drivers, restraints, opportunities, and challenges that shape the market’s size and trends are covered in this analysis. China, France, Saudi Arabia, Russia, India, the United Kingdom, and Japan together do not spend as much on national defence and security as the United States does. The United States accounts for 35% of all military spending worldwide. The nation is placing more emphasis on producing more fighter jets and choppers due to evolving warfare technology and the growing significance of air combat.

The commercial aviation market has experienced unprecedented long-term expansion in the Asia-Pacific region. This has had a significant financial impact. The global positioning of the area is catalysed by the aviation industry. Additionally, it has aided in boosting world connectedness. The expansion of sectors dependent on aviation, such as tourism, regional retail, and many other small-scale ones, is supported by the increased connectivity.

By evenly spreading carbon nanotubes (CNT) within the epoxy environment, modified epoxy materials were created. Epoxy adhesives’ electrical conductivity and thermal stability are improved by CNT. The breakdown temperature of the CNT-modified epoxy adhesive is higher than that of regular epoxy adhesives. Epoxy-functionalized CNTs are multi-wall structures that come in many forms. These are produced using a variety of covalent functionalization techniques. The upgraded epoxy possesses improved adhesive qualities. Epoxy adhesives’ sensitivity to pressure and temperature is enhanced by CNT. Epoxy adhesives modified with CNT are therefore frequently utilised in spacecraft. According to testing, CNT increases the adherence of epoxies by more than 36%. Thus, the technology that combines epoxy adhesives and carbon nanotubes is helping to increase demand for epoxy adhesives in the aerospace industry.

Market Dynamics: Drivers

Rising Demand for Aircraft in Asia-Pacific and Middle East

The market for commercial aviation has experienced unprecedented long-term growth in Asia-Pacific. There has been a substantial financial impact from this. The region’s worldwide placement and increased connectivity are both facilitated by the aviation sector. The expansion of industries that depend on aviation, such as tourism, regional retail, and many other small-scale ones, is aided by increased connectivity. In addition to commercial aviation, air force investment has increased in the Asia-Pacific region. Due to this, aircraft manufacture has increased throughout the area, particularly in India, Australia, China, and Japan. The substantial number of aircraft scheduled for delivery to the area suggests that this rapid expansion will certainly continue. By 2030, it is predicted that air travel in the Asia-Pacific region will likely surpass that in both Europe and North America put together. According to the International Air Transport Association (IATA), one of the main economic drivers in the Asia-Pacific area is the aviation sector’s financial contribution.

Market Dynamics: Challenges

Poor Performance at Extreme Temperatures and Varied Conditions

All types of spacecrafts employ adhesives extensively, primarily for mechanical, structural, and electrical functions. Potting, bonding, compressing, sealing, and venturing are under this category. Since they are positioned in between the components they hold together, the majority of adhesives used in and on spacecrafts are not shielded from atomic oxygen and are not exposed to ionizing radiation. However, these adhesives are made to withstand strong pressure and chilly weather. They are therefore expected to perform well regardless of the surroundings they are in without affecting other space components. In spacecraft, adhesives are typically close to optical components. Contamination at these locations may cause serious operating problems. For instance, a lot of adhesives can vaporize and release unsteady substances that can contaminate optical and other precise devices. The performance of the entire system may be harmed by this contamination. As a result, it’s crucial to do routine maintenance inspections and replace adhesives, particularly in spacecrafts.

Market Segmentation

- Based on Resin Type, the Global Aerospace Adhesives market is segmented into

- Epoxy

- Silicone

- Acrylic

- Others

- Based on End Use, the Global Aerospace Adhesives market is segmented into

- Aircraft

- Space vehicles

- Other aerospace vehicles

- Based on Application, the Global Aerospace Adhesives market is segmented into

- OEM

- Maintenance, Repair and Operation

- Based on Adhesive Type, the Global Aerospace Adhesives market is segmented into

- Reactive

- Non-Reactive

- Based on Geography, the Global Aerospace Adhesives market is segmented into

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- All market revenue has been given in US Dollar.

Historical Year: 2020-2021

Base Year: 2022

Estimated: 2023

Forecast- 2024-2030

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of Global Aerospace Adhesives Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the Global Aerospace Adhesives Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in Global Aerospace Adhesives Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during Global Aerospace Adhesives Market study?

- Introduction

- Product Definition

- Market Taxonomy

- Research Process

- Brief on Secondary Sources Used

- Primary Research

- Sample Size

- List of Companies Interviewed

- Market Sizing Model

- Assumptions Used

- Model Description

- Forecast Model

- Executive Summary

- Impact of COVID-19 on Global Aerospace Adhesives Market

- Global Aerospace Adhesives Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Resin Type

- Epoxy

- Silicone

- Acrylic

- Others

- By End Use

- Aircraft

- Space vehicles

- Other aerospace vehicles

- By Application

- OEM

- Maintenance, Repair and Operation

- By Adhesives Type

- Reactive

- Non-Reactive

- By Region

- Asia-Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

- By Competition

- By Resin Type

- Market Size & Forecast

- North America Aerospace Adhesives Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Resin Type

- Epoxy

- Silicone

- Acrylic

- Others

- By End Use

- Aircraft

- Space vehicles

- Other aerospace vehicles

- By Application

- OEM

- Maintenance, Repair and Operation

- By Adhesives Type

- Reactive

- Non-Reactive

- By Country

- United States

- Canada

- By Resin Type

- Market Size & Forecast

- Asia-Pacific Aerospace Adhesives Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Resin Type

- Epoxy

- Silicone

- Acrylic

- Others

- By End Use

- Aircraft

- Space vehicles

- Other aerospace vehicles

- By Application

- OEM

- Maintenance, Repair and Operation

- By Adhesives Type

- Reactive

- Non-Reactive

- By Country

- Singapore

- Australia

- South Korea

- Hong Kong

- China

- By Resin Type

- Market Size & Forecast

- Europe Aerospace Adhesives Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Resin Type

- Epoxy

- Silicone

- Acrylic

- Others

- By End Use

- Aircraft

- Space vehicles

- Other aerospace vehicles

- By Application

- OEM

- Maintenance, Repair and Operation

- By Adhesives Type

- Reactive

- Non-Reactive

- By Country

- United Kingdom

- Switzerland

- Germany

- The Netherlands

- By Resin Type

- Market Size & Forecast

- Latin America Aerospace Adhesives Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Resin Type

- Epoxy

- Silicone

- Acrylic

- Others

- By End Use

- Aircraft

- Space vehicles

- Other aerospace vehicles

- By Application

- OEM

- Maintenance, Repair and Operation

- By Adhesives Type

- Reactive

- Non-Reactive

- By Country

- Argentina

- Brazil

- Chile

- Colombia

- By Resin Type

- Market Size & Forecast

- Middle East & Africa Aerospace Adhesives Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Resin Type

- Epoxy

- Silicone

- Acrylic

- Others

- By End Use

- Aircraft

- Space vehicles

- Other aerospace vehicles

- By Application

- OEM

- Maintenance, Repair and Operation

- By Adhesives Type

- Reactive

- Non-Reactive

- By Country

- Saudi Arabia

- UAE

- Qatar

- South Africa

- By Resin Type

- Market Size & Forecast

- Global Aerospace Adhesives Market Policies & Regulatory Landscape

- Global Aerospace Adhesives Market Trends

- Global Aerospace Adhesives Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- Global Aerospace Adhesives White Market Space

- Global Aerospace Adhesives Pricing Analysis

- Competition Outlook

- Competition Matrix

- Target Markets

- Research & Development

- Collaborations & Strategic Alliances and Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs and Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Key Customers, Strategic Alliances/ Partnerships, Future Plans)

- Competition Matrix

- Disclaimer