- Overvew

- Table of Content

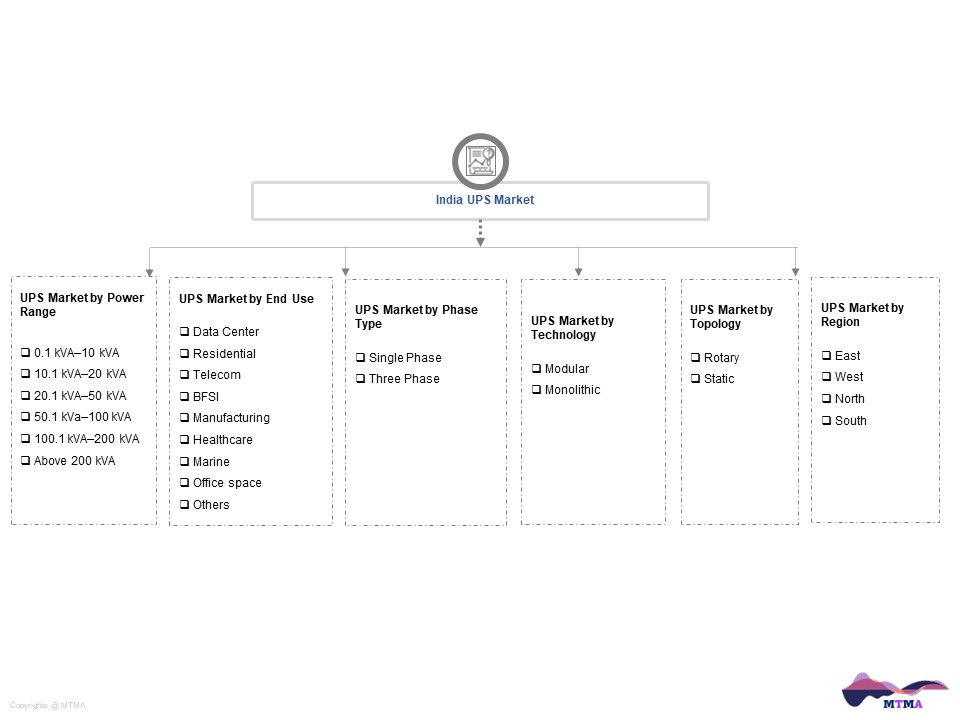

- Segmentation

- Request Sample

Market Definition

When the input power source or mains power fails, an uninterruptible power supply (UPS) or uninterruptible power source (UPS) supplies emergency power for a load. A UPS typically uses batteries, flywheels, or supercapacitors to store energy. The advantage of UPS over other instantaneous power supply systems is its tight protection against input power interruptions. It has a brief on-battery runtime, but it is enough to turn on a standby power source or securely shut down any connected equipment (computers, telecommunications equipment, etc.). To prevent harm to the gadgets, they can only be used temporarily for the delivery of electricity.

Market Insights

India The UPS market had a value of $390 million in 2022 and was expected to expand at a CAGR of more than 9% over the following five years. In the upcoming years, it is predicted that demand for UPS will increase as a result of India’s emergence as a significant global provider of cloud computing and data centre services. One of a data center’s most important parts, UPS keeps the system operational until reliable power is restored. Large data centres are also kept operational with the use of UPS systems, which also offer sensitive electronics facility-wide security. According to industry reports, the demand for UPS is anticipated to increase throughout the projected period due to rising investment in the development of data centres, driving the growth of the entire market.

Alternative power source technologies are a significant barrier to the expansion of the India UPS market. One of the most popular power sources that can replace a UPS is a sealed battery. Due to its many advantages, including its low physical space required and tolerable operating temperature that is greater than the batteries, a flywheel is also employed as an alternative to UPS systems. The commercial and industrial sectors, who are the most knowledgeable about these possibilities, favour using them. For instance, NxtGen’s data centre in Bidadi, Karnataka, uses solar energy for a portion of its power needs. It has stated that it will make all of its data centres solar-enabled within the next five years. The adoption of solar-powered data centres will affect the demand for UPS and generators in data centres.

The India UPS market is divided into four regions according to geography: North India, South India, East India, and West India. Due to its thriving economic and industrial sectors, the Western part of the country holds the biggest market share. Gujarat and several regions of Maharashtra, particularly Mumbai and Pune, are seeing rapid growth, which necessitates a steady supply of power to keep their businesses expanding. This is dramatically increasing demand for UPS and fueling the expansion of its business. On the other hand, because to the expanding IT and telecom sectors, Southern India also accounts for a sizeable portion of the market.

Lithium-ion batteries, which have many benefits over conventional lead-acid batteries, including a better energy density, a longer lifespan, and quicker charging periods, are becoming more and more popular in UPS systems in India. As the price of lithium-ion batteries continued to drop, it was anticipated that this trend would persist over the following years. In addition, the cloud-based UPS system market in India is growing rapidly. These systems offer real-time monitoring and remote administration capabilities, allowing organisations to optimise their power use and lower their energy expenditures. Additionally, there is a strong demand for dependable power supply solutions in India due to the expanding use of electronic devices and growing reliance on technology across a number of industries, including IT, healthcare, and BFSI (banking, financial services, and insurance). Due to this, demand for UPS systems has significantly increased across the nation. Utilising eco-friendly UPS systems that are low-carbon-footprint and energy-efficient is becoming more popular in India. The necessity to lower energy use and running expenses, while also keeping in mind environmental sustainability, is what motivates this. In India, the use of cloud computing and data centres is growing, which has increased demand for high-performance UPS systems that can supply these vital infrastructural facilities with uninterrupted power. Additionally, due to their high energy density, longer lifespan, and little maintenance needs, lithium-ion batteries are growing in popularity in the Indian UPS industry. As a result, several UPS manufacturers are converting their equipment to use lithium-ion batteries. The growing use of modular UPS systems, which make it simple for companies to scale up or down their power capacity as required without having to replace their entire UPS system, was another trend.

Market Dynamics: Drivers

Strong Demand from Data Centers

Data centres are places where a lot of private information is kept. These facilities are required for round-the-clock operation, data security, and downtime minimization. They are furnished with a constant power source. Additionally, the data centres are linked to the internet, and thanks to an uninterruptible power supply, they function without any hiccups in terms of internet access. An uninterruptible power supply features multiple bus capability and redundancy configurations. As a result, it needs less uptime and can protect delicate devices throughout the entire building. Additionally, an uninterruptible power supply delivers power devoid of brownouts, sags, surges, noise interference, and blackouts. India has seen a steady increase in the number of data centres around the nation in recent years, which can be attributed to a considerable increase in digitalization. India will have about 127 data centres as of May 2022.

Furthermore, cloud-based networks are becoming more prevalent. Higher integration as a result of businesses globally switching to cloud-based networks rather than maintaining their infrastructure might be attributed to this. Additionally, industry 4.0, financial technology, global cities, digital infrastructure, and communications are among the industries that are changing as a result of growing investment in and deployment of artificial intelligence, the Internet of Things (IoT), and machine learning.

Significant businesses are expressing interest in building data centres. For instance, Cisco opened its first data centre in India in May 2022. The business strives to meet growing client expectations for data localization and cyber-defense. As a result, India is now the location of Cisco’s Duo’s first data centre. Additionally, Cisco hopes to develop a data-compliant security infrastructure in India with this investment. Additionally, a number of businesses would be served by this data centre, including the public sector, healthcare, banking, financial services, and insurance. The new data centre is a component of Duo’s strategy for international expansion, which aims to extend its network throughout APAC, Europe, and the US.

The diverse Adani Group committed over USD 55.72 million to two data centre projects in Uttar Pradesh, India, in January 2022. The two data centres are planned to be constructed in Noida sectors 62 and 80, respectively, according to the Uttar Pradesh government. Adani-EdgeConneX Indian Joint Venture, a subsidiary of the Adani Group, was also established to build a data centre in Mumbai, India. In addition, the corporation plans to build 1 GW worth of data centre capacity over the following ten years. These projects are anticipated to be located in a number of Indian cities, including Hyderabad, Chennai, Navi Mumbai, Noida, and Vizag.All of these investments in the construction of data centres will increase demand for uninterruptible power supplies, propelling the uninterruptible power supply market in India from 2023 to 2030.

Market Dynamics: Challenges

High Capital Cost and Operational Expenditure of UPS

The uninterruptible power supply (UPS) system’s cost is the main worry, despite the fact that it is a dependable and highly responsive system that ensures an immediate power supply in the case of a power breakdown. The initial setup cost for UPS is high. For instance, from 628 the year before to 858 in 2021, private equity and venture capital deals in startups in India. For household use, even a single device can run into the hundreds of dollars. On the other hand, large-scale business systems cost tens of thousands of dollars for the equipment alone. These large installations necessitate infrastructure setup, which can substantially raise the overall setup cost. As a result, not all customers could afford them, which restricted the market’s expansion.

Because of their complex designs, uninterruptible power sources, such Online Double Conversion systems, produce more heat and operate at a lower efficiency, which raises operating expenses. Additionally, UPS batteries have a limited lifespan. A UPS’s ability to retain a charge decreases over time, just like other rechargeable batteries do. A UPS battery has a lifespan of between five and ten years, depending on the model. The old battery must then be properly disposed of after which a new battery must be obtained. Businesses must pay for the secure disposal of their equipment, despite the fact that many UPS manufacturers and retail establishments recycle the UPS batteries used in residences for no cost.

Due to system maintenance, there are additional considerations when employing a UPS system. The cost of maintenance is substantially higher, especially for businesses and corporations, as it necessitates several UPS connections and calls for the hiring of a qualified electrician to oversee wiring systems and guarantee error-free operations. Additionally, because the UPS system frequently releases fumes, adequate ventilation is necessary for the system to function properly. These elements are anticipated to push up the price of a UPS, which would in turn limit market expansion during the projection period.

When compared to a solo device, the UPS system uses more energy. As UPS needs to maintain its batteries constantly charged, the amount needed is substantially larger than the amount actually used by the devices. Due to this circumstance, there is an inevitable power waste that is directly related to the system’s electricity consumption. This higher power usage comes at a significant additional cost in large-scale applications. When analysing the environmental practises of businesses, this squandered energy should also be taken into account.

As a result, it is anticipated that the system’s high capital and operating costs will restrain the market’s expansion over the projection period.

Market Segmentation

- Based on Power Range, the India UPS market is segmented into

- 1 kVA–10 kVA

- 1 kVA–20 kVA

- 1 kVA–50 kVA

- 1 kVa–100 kVA

- 1 kVA–200 kVA

- Above 200 kVA

- Based on End Use, the India UPS market is segmented into

- Data Center

- Residential

- Telecom

- BFSI

- Manufacturing

- Healthcare

- Marine

- Office space

- Others

- Based on Type, the India UPS market is segmented into

- Standby UPS System

- Online UPS System

- Line-interactive UPS System

- Based on Phase Type, the India UPS market is segmented into

- Single Phase

- Three Phase

- Based on Technology, the India UPS market is segmented into

- Modular

- Monolithic

- Based on Topology, the India UPS market is segmented into

- Rotary

- Static

- Based on Geography, the India UPS market is segmented into

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- All market revenue has been given in US Dollar and volume in Units.

Historical Year: 2020-2021

Base Year: 2022

Estimated: 2023

Forecast- 2024-2030

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of India UPS Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the India UPS Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in India UPS Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during India UPS Market study?

- Introduction

- Product Definition

- Market Taxonomy

- Research Process

- Brief on Secondary Sources Used

- Primary Research

- Sample Size

- List of Companies Interviewed

- Market Sizing Model

- Assumptions Used

- Model Description

- Forecast Model

- Executive Summary

- Impact of COVID-19 on India UPS Market

- Trade Dynamics

- India UPS Market Value Chain Analysis

- India UPS Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Power Range

- 1 kVA–10 kVA

- 1 kVA–20 kVA

- 1 kVA–50 kVA

- 1 kVa–100 kVA

- 1 kVA–200 kVA

- Above 200 kVA

- By Type

- Standby UPS System

- Online UPS System

- Line-interactive UPS System

- By End Use

- Data Center

- Residential

- Telecom

- BFSI

- Manufacturing

- Healthcare

- Marine

- Office space

- Others

- By Phase Type

- Single Phase

- Three Phase

- By Technology

- Modular

- Monolithic

- By Topology

- Rotary

- Static

- By Region

- East India

- West India

- North India

- South India

- By Competition

- By Power Range

- Market Size & Forecast

- India Standby UPS System Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Power Range

- 1 kVA–10 kVA

- 1 kVA–20 kVA

- 1 kVA–50 kVA

- 1 kVa–100 kVA

- 1 kVA–200 kVA

- Above 200 kVA

- By End Use

- Data Center

- Residential

- Telecom

- BFSI

- Manufacturing

- Healthcare

- Marine

- Office space

- Others

- By Phase Type

- Single Phase

- Three Phase

- By Technology

- Modular

- Monolithic

- By Topology

- Rotary

- Static

- By Region

- East India

- West India

- North India

- South India

- By Power Range

- Market Size & Forecast

- India Online UPS Systems Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Power Range

- 1 kVA–10 kVA

- 1 kVA–20 kVA

- 1 kVA–50 kVA

- 1 kVa–100 kVA

- 1 kVA–200 kVA

- Above 200 kVA

- By End Use

- Data Center

- Residential

- Telecom

- BFSI

- Manufacturing

- Healthcare

- Marine

- Office space

- Others

- By Phase Type

- Single Phase

- Three Phase

- By Technology

- Modular

- Monolithic

- By Topology

- Rotary

- Static

- By Region

- East India

- West India

- North India

- South India

- By Power Range

- Market Size & Forecast

- India Line-interactive UPS System Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Power Range

- 1 kVA–10 kVA

- 1 kVA–20 kVA

- 1 kVA–50 kVA

- 1 kVa–100 kVA

- 1 kVA–200 kVA

- Above 200 kVA

- By End Use

- Data Center

- Residential

- Telecom

- BFSI

- Manufacturing

- Healthcare

- Marine

- Office space

- Others

- By Phase Type

- Single Phase

- Three Phase

- By Technology

- Modular

- Monolithic

- By Topology

- Rotary

- Static

- By Region

- East India

- West India

- North India

- South India

- By Power Range

- Market Size & Forecast

- India UPS Market Policies & Regulatory Landscape

- India UPS Market Trends

- India UPS Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- India UPS White Market Space

- Competition Outlook

- Competition Matrix

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Key Customers, Strategic Alliances/ Partnerships, Future Plans)

- Disclaimer