- Overvew

- Table of Content

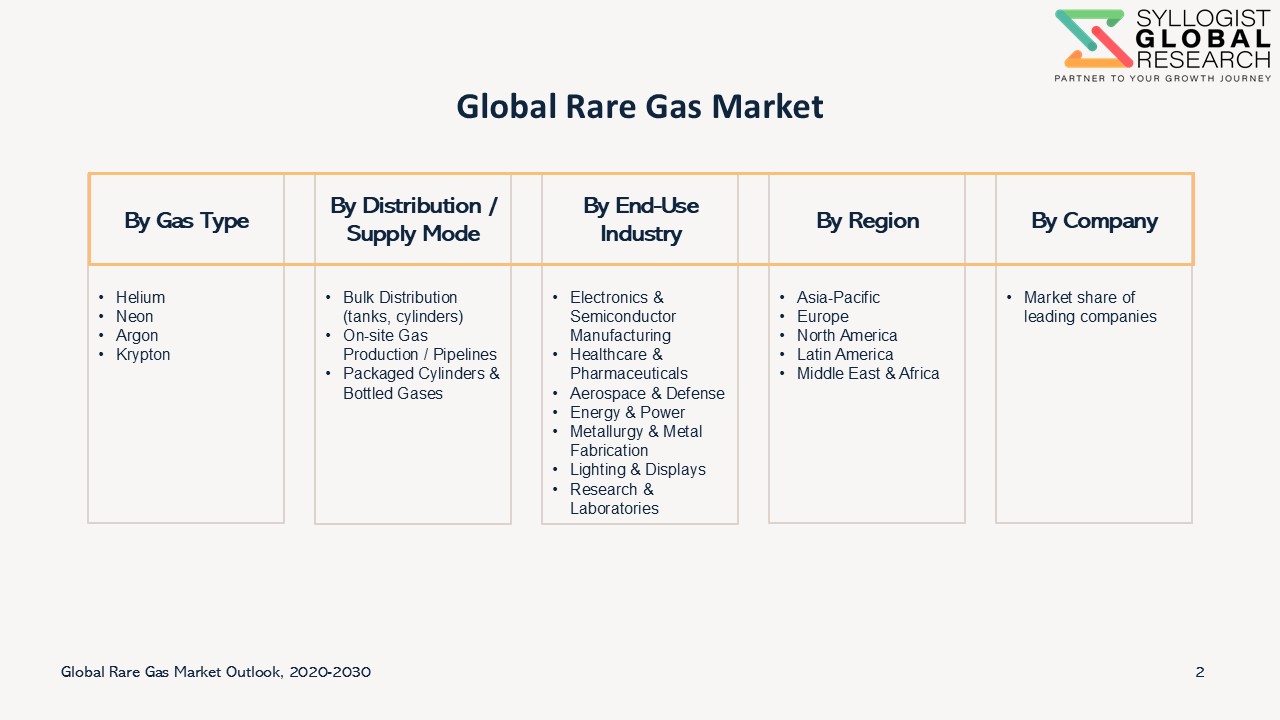

- Segmentation

- Request Sample

Market Definition

Rare gases, also known as noble gases, are a group of inert, non-reactive elements found in the periodic table, including helium (He), neon (Ne), argon (Ar), krypton (Kr), xenon (Xe), and radon (Rn). They are termed “rare” because of their relatively low natural abundance in the Earth’s atmosphere and limited terrestrial sources.

These gases are odorless, colorless, tasteless, and non-flammable, characterized by extremely low chemical reactivity due to their complete outer electron shells. This stability makes them valuable in a wide range of industries, including aerospace, electronics, lighting, healthcare, metallurgy, and energy.

In industrial applications, rare gases are extracted primarily from air separation processes or natural gas sources. Their unique physical and chemical properties make them critical for specialized uses such as semiconductor manufacturing, welding, cryogenics, medical imaging, lighting technologies, and propulsion systems.

Market Insights

The rare gas market, also known as the noble gas market, occupies a specialized yet strategically important niche within the global Rare Gases sector. Comprising gases such as helium, neon, argon, krypton, xenon, and radon, this market is characterized by low natural abundance, high purity requirements, and highly specialized applications. These gases are chemically inert and possess unique properties such as extremely low boiling points, high ionization potential, and stability under extreme conditions, making them indispensable in industries where precision and reliability are critical. Rare gases are typically produced as byproducts during cryogenic air separation, liquefied natural gas (LNG) processing, or fractional distillation of atmospheric air, making their supply closely tied to broader industrial production trends.

The market has witnessed steady growth in recent years, largely driven by increasing demand from semiconductor manufacturing, space exploration, and medical applications. Rapid digitalization and the expansion of high-tech industries have significantly boosted the consumption of rare gases, particularly neon and helium, which are essential in the fabrication of integrated circuits and microchips. Moreover, global initiatives in aerospace and satellite launches, coupled with defense and commercial space missions, have spurred the use of xenon and helium in propulsion and cooling systems. On the medical side, rare gases such as helium and xenon are becoming increasingly important in MRI machines, imaging technologies, and anesthetics, reflecting the sector’s long-term demand outlook.

One of the strongest growth drivers is the semiconductor and electronics industry, where rare gases are vital to photolithography, etching, and wafer fabrication. Neon, for example, is critical in excimer lasers used for semiconductor lithography, while helium is used in cooling systems and leak detection. With the semiconductor supply chain expanding due to advances in AI, IoT, 5G, and electric vehicles, rare gas demand is poised to grow sharply. Asia-Pacific, particularly China, South Korea, Taiwan, and Japan, remains the dominant hub of rare gas consumption, but new semiconductor investments in the U.S. and Europe are diversifying demand geographically.

Another key growth area is aerospace and space exploration. Rare gases such as xenon are increasingly used in ion propulsion systems, which power satellites and spacecraft efficiently over long durations. Helium is also indispensable in rocket fuel pressurization and purging systems. With the rapid rise of satellite-based communications, Earth observation programs, and the emergence of commercial space travel, the aerospace industry is expected to remain a strong driver of rare gas consumption.

The medical and healthcare sector is also contributing to growth. Helium is critical in MRI machines due to its ability to maintain superconductivity at extremely low temperatures, while xenon is used in anesthesia and advanced imaging. As healthcare spending increases worldwide and diagnostic infrastructure expands, particularly in developing regions, rare gas applications in medicine are projected to grow consistently.

Despite these strong growth drivers, the market faces notable challenges. Supply constraints and price volatility remain major concerns, as rare gases are often produced as byproducts of unrelated industrial processes. For instance, the Russia–Ukraine conflict significantly disrupted the global supply of neon, which was concentrated in that region, creating bottlenecks for the semiconductor industry. Such supply chain dependencies make the rare gas market vulnerable to geopolitical and economic shocks. Furthermore, high production and recovery costs associated with cryogenic separation and purification processes limit scalability and create barriers to entry for new players. This is particularly challenging for high-value gases like xenon and krypton, which occur in extremely low concentrations in the atmosphere.

Looking ahead, the rare gas market is expected to see sustained growth, driven by its integration into high-tech, healthcare, and aerospace industries. Innovation in gas recovery, recycling, and alternative sourcing will play an important role in mitigating supply risks and addressing price fluctuations. Geographically, Asia-Pacific will remain the largest consumer region, but North America, Europe, and the Middle East are increasing their focus on securing rare gas supply chains to support strategic industries. Ultimately, the rare gas market will remain defined by its strategic importance, scarcity-driven pricing, and essential role in enabling the technologies of the future.

Market Dynamics: Drivers

Rising Demand from Semiconductor and Electronics Industry

One of the strongest drivers of the rare gas market is the surging demand from the semiconductor and electronics industry. Rare gases such as neon, helium, and argon are essential in wafer fabrication, photolithography, etching, and cooling processes. With the global boom in AI, IoT, 5G, electric vehicles, and cloud computing, the semiconductor supply chain is rapidly expanding, directly fueling rare gas consumption. Asia-Pacific, particularly China, South Korea, Taiwan, and Japan, dominates this demand, but new semiconductor fabs in the U.S. and Europe are also expected to drive consumption sharply upward.

Growth in Space Exploration and Aerospace Applications

Rare gases are playing a pivotal role in the aerospace and space exploration sector, particularly as propellants and coolants. Xenon is increasingly used in ion propulsion systems for satellites and deep-space missions due to its efficiency and stability, while helium is vital in pressurizing and purging rocket fuel systems. With growing satellite launches, commercial space programs, and defense-related aerospace projects, rare gas demand in this sector is expected to accelerate in the coming years.

Medical and Healthcare Applications

The healthcare sector is another important growth driver, where rare gases are used in medical imaging, anesthesia, and cryogenics. For instance, helium is critical in MRI machines due to its superconducting cooling properties, while xenon has applications in diagnostic imaging and anesthesia. Rising global healthcare spending, the expansion of advanced diagnostic facilities, and the growing incidence of chronic diseases are boosting demand for rare gases in the medical field.

Market Challenges

Limited Supply and Price Volatility

One of the biggest challenges in the rare gas market is supply scarcity and price fluctuations. Rare gases are often recovered as byproducts of steelmaking or natural gas processing, making their production volumes dependent on unrelated industries. For example, the Russia-Ukraine conflict severely impacted neon gas supply, which was heavily concentrated in that region, creating bottlenecks for the semiconductor industry. Such supply chain vulnerabilities contribute to high volatility in pricing and procurement risks for end-users.

High Production and Recovery Costs

Extracting, purifying, and storing rare gases requires complex cryogenic processes and specialized infrastructure, resulting in high production costs. This creates barriers for smaller players and limits scalability in emerging markets. Moreover, rare gases such as xenon and krypton are extremely limited in concentration in the atmosphere, further raising extraction costs. Developing recycling and recovery technologies is emerging as a partial solution, but large-scale adoption remains limited due to cost constraints.

Market Segmentation

- Based on Gas Type, the Global Rare Gas market is segmented into

- Helium

- Neon

- Argon

- Krypton

- Based on Distribution / Supply Mode, the Global Rare Gas market is segmented into

- Bulk Distribution (tanks, cylinders)

- On-site Gas Production / Pipelines

- Packaged Cylinders & Bottled Gases

- Based on By End Use Industry, the Global Rare Gas market is segmented into

- Electronics & Semiconductor Manufacturing

- Healthcare & Pharmaceuticals

- Aerospace & Defense

- Energy & Power

- Metallurgy & Metal Fabrication

- Lighting & Displays

- Research & Laboratories

- Based on Geography, the Global Rare Gas market is segmented into

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

- All market revenue has been given in US Dollar

Historical Year: 2020-2024

Base Year: 2025

Estimated: 2026

Forecast- 2027-2030

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of Global Rare Gas Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the Global Rare Gas Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in Global Rare Gas Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during Global Rare Gas Market study?

- Strategic Introduction

- Definition & Scope of Rare Gas

- Market Architecture & Taxonomy

- Research Framework & Methodology

- Data Mining, Secondary & Primary Research

- Market Sizing & Validation (Top-Down, Bottom-Up, Demand/Supply Analysis)

- Scenario Calibration (Supply-Side Factors, Demand-Side Factors, Price & Cost Drivers, Policy & Regulatory Shocks, Technology & Substitution Dynamics, Macro & Scenario Variables)

- Executive Insights

- Strategic Snapshot of Market Landscape

- Key Investment Priorities

- Competitive & Supply Chain Dynamics

- Policy, ESG & Strategic Risk Considerations

- Boardroom-Level Key Findings

- Future Outlook & Opportunity Mapping (2025–2035)

- Scenario Planning (Base, Optimistic, Conservative)

- Sensitivity Analysis

- Identification of regional investment hotspots

- Value Chain & Ecosystem Analysis

- Introduction to Rare Gas Value Chain

- Upstream: Feedstock & Extraction

- Midstream: Processing & Refining

- Storage & Logistics

- Downstream Applications

- Stakeholder Mapping Across Ecosystem

- Policy & ESG Dimensions in the Value Chain

- Ecosystem Interlinkages & Partnerships

- Future Evolution of Rare Gas Value Chain

- Global Market Outlook (2020–2035)

- Market size and forecast by value

- Type, Distribution / Supply Mode and End-Use, Regional, and Company Segmentation

- Regional Deep-Dive Analysis (2020–2035)

- Asia-Pacific (China, Japan, South Korea, Taiwan and India)

- Europe (Germany, France, United Kingdom, Spain, Italy)

- North America (U.S., Canada)

- South America (Brazil, Argentina, Colombia, Chile, Peru)

- Middle East & Africa (UAE, South Africa, Saudi Arabia, Egypt, Qatar)

- Each region includes:

- Market size & forecast

- Adoption by Type, Distribution / Supply Mode, End Use

- Country-specific regulatory landscape

- Each region includes:

- Policy & Regulatory Landscape

- Introduction to Policy & Regulatory Frameworks

- Global Frameworks & Standards

- Regional & Country-Level Policies

- Safety & Environmental Regulations

- Trade & Export-Import Controls

- Incentives & Support Mechanisms

- ESG & Compliance Dimensions

- Comparative Policy Analysis

- Future Policy Outlook (2025–2035)

- Technology & Production Pathways

- Introduction to Rare Gas Technologies

- Extraction Pathways by Gas Type

- Refining & Purification Technologies

- Storage & Distribution Technologies

- Recycling & Recovery Technologies

- Cost, Scalability & Performance Comparison

- Technology Providers & Licensors

- Emerging & Next-Gen Pathways (2025–2035)

- Technology Adoption Roadmaps

- Market Dynamics

- Growth drivers, restraints, challenges, opportunities

- Future Outlook & Structural Shifts (2025–2035)

- White Space & Growth Frontiers

- Regional White Space Opportunities

- Supply-Side Growth Frontiers

- Demand-Side Growth Frontiers

- Hybrid & Integrated Models

- Policy & Strategic Growth Opportunities

- Sustainability & ESG-Linked White Spaces

- Technology & Innovation Frontiers

- Long-Term Growth Outlook (2030–2040)

- Pricing & Economics

- Introduction to Rare Gas Pricing Dynamics

- Production Cost Benchmarking Across Gases

- Cost Contribution Breakdown

- Regional Pricing Models

- Break-even & Competitiveness Analysis

- Pricing Trends (2020–2035)

- Policy, Incentives & Carbon Pricing Impacts

- Market Mechanisms & Trading Models

- Investment Economics & Financial Metrics

- Future Pricing Outlook

- Project Case Studies (Global Best Practices)

- Introduction to Case Studies

- Successful Implementations Across Regions

- Lessons Learned from Supply Disruptions & Failures

- Benchmarking of Project Economics

- Technology Adoption Roadmaps

- Partnerships & Collaborations

- ESG & Sustainability Dimensions in Case Studies

- Replication & Scalability Potential

- Future Outlook Based on Case Studies

- ESG & Sustainability Dimensions

- Introduction: ESG in Rare Gases

- Environmental Dimensions

- Social Dimensions

- Governance Dimensions

- ESG-Linked Financing & Investment

- Risks & Challenges in ESG Adoption

- ESG Best Practices & Global Benchmarks

- Future Outlook

- Investment & Financing Models

- Introduction to Investment Landscape

- CapEx & OpEx Structures

- Sources of Capital & Financing Instruments

- Incentives & Policy-Linked Financing

- Risk–Return Models

- ESG & Sustainable Finance

- Strategic Investor Participation

- Regional Investment Trends

- Future Outlook (2025–2035)

- Talent, Skills & Workforce Transformation

- Introduction: Workforce in Rare Gas Ecosystem

- Workforce Requirements Across the Value Chain

- Skills Gaps & Reskilling Needs

- Emerging Digital & Technical Skills

- Policy & Institutional Support for Workforce Development

- Regional Workforce Implications

- Social & ESG Dimensions of Workforce

- Future Outlook (2025–2035)

- Risk Assessment Framework

- Political/Regulatory Risk

- Operational Risk

- Environmental & Social Risks

- Financial Risk

- Market & Competitive Risks

- Technology Risks

- Risk Mitigation Strategies

- Future Outlook

- Strategic Roadmap & Recommendations

- Short-Term Roadmap (2025–2027)

- Mid-Term Roadmap (2028–2030)

- Long-Term Roadmap (2031–2035)

- Tailored Recommendations by Stakeholder

- For Producers

- For End-Users (Semiconductors, Healthcare, Aerospace)

- For Policymakers & Regulators

- For Investors & Lenders

- For Technology Providers

- Key Success Factors

- Future Outlook & Strategic Priorities