- Overvew

- Table of Content

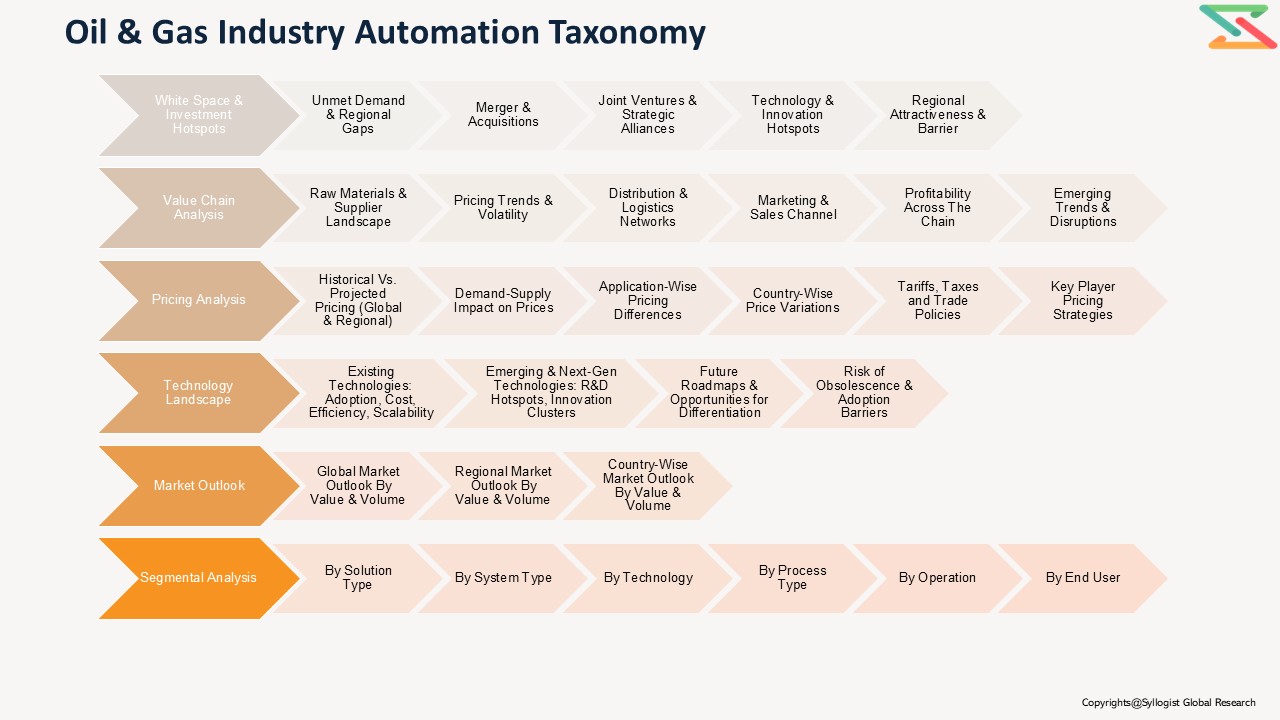

- Segmentation

- Request Sample

Market Definition

Oil & Gas Industry Automation refers to the deployment of advanced control systems, robotics, instrumentation, sensors, and data analytics technologies across upstream, midstream, and downstream processes to optimize operations, improve efficiency, enhance safety, and minimize environmental impact. Automation solutions, including distributed control systems (DCS), programmable logic controllers (PLC), supervisory control and data acquisition (SCADA) systems, industrial Internet of Things (IIoT) platforms, and artificial intelligence (AI), enable real-time monitoring, predictive maintenance, and data-driven decision-making. The oil and gas industry has historically relied on human-intensive processes; however, increasing operational complexity, energy transition goals, and the need to maintain profitability amid fluctuating crude prices have accelerated digital and automation adoption across global operations.

Market Insights

The global Oil & Gas Industry Automation Market has undergone a significant transformation over the past few years. With growing energy demand, stricter environmental regulations, and pressure to reduce operational costs, automation technologies have become essential for maintaining competitiveness. The market was valued at around USD 20.5 billion in 2023 and is expected to reach approximately USD 32.4 billion by 2030, growing at a CAGR of 6.8% during the forecast period. The increasing integration of digital twins, predictive analytics, cloud computing, and AI-driven asset management solutions is redefining operational models across exploration, production, refining, and distribution. Upstream companies are leveraging automation for real-time drilling optimization, subsea monitoring, and well integrity management, while downstream operators are focusing on process control automation to enhance refining efficiency and reduce energy consumption.

The post-pandemic energy landscape and geopolitical disruptions, particularly the Russia-Ukraine conflict, have underscored the strategic importance of automation for supply chain resilience and operational continuity. As labor shortages, rising wages, and safety concerns persist, oil and gas companies are automating hazardous and repetitive tasks, deploying unmanned platforms, and using drones and robotics for pipeline and rig inspections. Moreover, with carbon neutrality targets gaining traction, automation plays a key role in achieving sustainability objectives by optimizing energy consumption, monitoring emissions, and enabling data transparency across operations. While North America and Europe lead in automation maturity due to early adoption and strong industrial bases, Asia-Pacific is emerging as a high-growth region driven by rapid industrialization, new refinery projects, and digital transformation initiatives in countries such as India, China, and Indonesia.

Nevertheless, automation deployment varies across the value chain. The upstream sector is seeing higher adoption of autonomous drilling rigs and reservoir management systems, while the midstream sector is implementing SCADA systems for real-time pipeline integrity and leak detection. The downstream segment continues to adopt advanced process control (APC) and manufacturing execution systems (MES) to boost refining efficiency and minimize downtime. Additionally, cybersecurity concerns and interoperability challenges among legacy systems remain key restraints, driving the need for standardization and secure integration frameworks. The shift toward cloud-based automation and AI-powered analytics platforms is further supporting remote operations, data centralization, and improved asset lifecycle management, particularly in offshore and remote facilities.

Market Dynamics: Drivers

The key drivers of the Oil & Gas Industry Automation Market include the growing need for operational efficiency, safety, and cost optimization. As global oil prices remain volatile, companies are focusing on maximizing asset utilization and minimizing unplanned downtime. Automation enables real-time visibility into production data, predictive maintenance, and better decision-making, which can improve productivity by up to 25%. The transition toward digital oilfields, enabled by IIoT sensors and machine learning algorithms, allows operators to manage assets remotely and reduce manpower requirements. Additionally, environmental compliance and carbon reduction commitments are driving adoption of automation systems that can monitor and control emissions, energy usage, and waste generation. The increasing availability of advanced analytics tools, combined with government incentives for digital transformation and energy efficiency, further supports market expansion.

Market Dynamics: Challenges

Despite strong growth potential, the automation market in the oil and gas sector faces challenges related to high initial investment costs, complex system integration, and cybersecurity risks. Many existing oil and gas facilities operate on outdated infrastructure, making retrofitting automation technologies expensive and technically challenging. The lack of interoperability among legacy control systems from multiple vendors often leads to integration inefficiencies and data silos. Furthermore, cyberattacks targeting industrial control systems (ICS) and SCADA networks have increased significantly, posing risks to operational continuity and safety. The shortage of skilled personnel capable of managing advanced digital and automation systems also acts as a restraint. Moreover, smaller operators, particularly in emerging economies, face budget constraints that limit their ability to invest in high-end automation solutions. However, falling hardware costs, the emergence of modular automation systems, and government initiatives supporting Industry 4.0 adoption are gradually mitigating these barriers.

Market Segmentation

- Based on System Type:

- Distributed Control System (DCS)

- Supervisory Control and Data Acquisition (SCADA)

- Programmable Logic Controller (PLC)

- Human Machine Interface (HMI)

- Safety Instrumented System (SIS)

- Manufacturing Execution System (MES)

- Industrial Internet of Things (IIoT) and Cloud Platforms

- Based on Application:

- Upstream (Exploration & Production)

- Midstream (Transportation & Storage)

- Downstream (Refining & Petrochemical Processing)

- Based on Component:

- Hardware (Sensors, Controllers, Actuators, Robots)

- Software (Analytics, Simulation, Monitoring)

- Services (Maintenance, Integration, Consulting, Training)

- Based on End User:

- National Oil Companies (NOCs)

- International Oil Companies (IOCs)

- Independent Operators and Contractors

- Based on Geography:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

All market revenue is presented in U.S. Dollars, while market volumes are measured in number of installations and control points.

Historical Year: 2021–2024 | Base Year: 2025 | Estimated Year: 2026 | Forecast Period: 2027–2031

Key Questions this Study Will Answer

- What are the key market statistics (market overview, market size by value and volume, forecast numbers, and segmentation) for the Global Oil & Gas Industry Automation Market?

- What are the major growth drivers, challenges, and emerging market trends shaping the automation landscape across upstream, midstream, and downstream segments?

- How are geopolitical and environmental factors influencing automation investments and technology choices in the oil and gas sector?

- What are the key innovations, opportunities, and policy developments impacting automation adoption globally?

- Who are the leading competitors, what are their technological strengths and weaknesses, and how do they perform based on a competitive benchmarking matrix?

- What insights can be derived from end-user surveys and interviews conducted during the study, and how can these inform investment and implementation strategies for automation vendors and oil companies?

- Market Foundations & Dynamics

- Introduction

1.1. Product Overview (Definition & Scope of Oil & Gas Automation)

1.1.2. Role of Automation Across the Oil & Gas Value Chain (Upstream → Midstream → Downstream)

1.1.3. Research Methodology

1.1.4. Executive Summary

1.1.5. Major Trends Shaping the Automation Market

1.1.6. Short-Term vs. Long-Term Opportunities

1.1.7. Comparison of Conventional vs. Smart Automation Architectures

1.1.8. Scenario Planning (Base, Optimistic, Conservative)

1.1.9. Sensitivity Analysis (Oil Price, CAPEX, Digital Adoption Rate)

1.1.10. Identification of Regional Investment Hotspots - Market Dynamics

- Introduction

- Market Drivers (Operational Efficiency, Workforce Safety, Digital Transformation)

- Market Restraints (Cybersecurity Concerns, High Initial Investment)

- Market Opportunities (AI Integration, Predictive Maintenance, Cloud SCADA)

- Market Challenges (Legacy System Integration, Skilled Workforce Gap)

- Porter’s Five Forces Analysis

- PESTLE Analysis

- Market Ecosystem & Value Chain

3.1. Overview of Value Chain Participants

1.3.1.1. Hardware Manufacturers (Sensors, Controllers, Field Devices)

1.3.1.2. Automation Software & Platform Providers

1.3.1.3. System Integrators & EPCs

1.3.1.4. Cloud and Edge Computing Providers

1.3.1.5. Oil & Gas Operators and End Users

1.3.1.6. Service Providers (O&M, Remote Monitoring)

1.3.2. Flow of Value and Information Through the Chain

1.3.3. Value Addition and Margins at Each Stage

1.3.3.1. Design & Engineering

1.3.3.2. Hardware Manufacturing

1.3.3.3. Software Integration & Commissioning

1.3.3.4. Service & Maintenance

1.3.4. Integration Trends (EPC-Controlled vs. OEM-Controlled Systems)

1.3.5. Impact of Vertical Integration (End-to-End Digital Platforms) - Mapping of Roles and Interdependencies

- Market Trends & Developments

5.1. White Space Analysis (Automation Opportunities in Unmanned Operations)

1.5.2. Demand–Supply Gaps in Industrial Automation Expertise

1.5.3. Investment Hotspots (Digital Oilfields, Refinery Upgrades, LNG Terminals)

1.5.4. Unmet Needs (Standardized Communication Protocols, Interoperability) - Risk Assessment Framework

6.1. Political / Geopolitical Risk

1.6.2. Operational Risk (System Failures, Downtime)

1.6.3. Environmental Risk (Emission Compliance, Process Safety)

1.6.4. Financial Risk (Oil Price Volatility, CAPEX Delays)

- Market Ecosystem & Value Chain

- Regulatory Framework & Standards

- Global Regulatory Overview

1.1. IEC, ISO, API, and ISA Standards for Automation & Control Systems

2.1.2. Regional Digitalization & Cybersecurity Policies (US, EU, Middle East, Asia)

2.2. Compliance & Certification Requirements (Functional Safety, SIL, ATEX, IECEx)

2.3. Data Protection, Network & Communication Protocol Standards (OPC-UA, Modbus, Ethernet/IP)

2.4. Environmental & Safety Regulations (Emission Monitoring, HSE Compliance)

2.5. Cybersecurity Frameworks (NIST, ISA/IEC 62443)

2.6. Digital Twin & Data Traceability Regulations

- Global Regulatory Overview

- Technology Landscape

- Process Control & Automation Systems

1.1. Distributed Control Systems (DCS)

3.1.2. Programmable Logic Controllers (PLC)

3.1.3. SCADA Systems

3.2. Industrial IoT (IIoT) and Edge Computing Integration

3.3. AI & Machine Learning in Predictive Maintenance and Production Optimization

3.4. Robotics and Autonomous Systems for Oil & Gas Operations

3.5. Cloud-Based Automation and Data Analytics Platforms

3.6. Digital Twin, Simulation, and Asset Performance Management (APM)

3.7. Communication Technologies (5G, LPWAN, Satellite Connectivity)

3.8. Future Outlook: Smart Field Devices, Wireless Sensors, AI-Driven Control Loops

- Process Control & Automation Systems

- Global, Regional & Country Forecasts (2020–2035)

- Global Oil & Gas Automation Market Outlook (Value, Volume)

- Market Share by Segment:

2.1. By Solution Type (Hardware, Software, Services)

4.2.2. By System Type (SCADA, DCS, PLC, MES, Safety Systems)

4.2.3. By Technology (AI/ML, IIoT, Robotics, Cloud, Digital Twin)

4.2.4. By Process Type (Upstream, Midstream, Downstream)

4.2.5. By Operation (Onshore, Offshore)

4.2.6. By End-User Type (National Oil Companies, IOCs, Independents)

4.2.7. By Business Model (Turnkey, Subscription, Managed Services, Hybrid) - Regional & Country Outlook (2020–2035)

3.1. North America (U.S., Canada, Mexico)

4.3.2. Middle East (Saudi Arabia, UAE, Qatar, Kuwait)

4.3.3. Asia-Pacific (China, India, Japan, South Korea, Australia)

4.3.4. Europe (UK, Norway, Germany, Italy, France)

4.3.5. Latin America (Brazil, Argentina)

4.3.6. Africa (Nigeria, Angola, South Africa)

- Pricing Analysis

- Overview of Pricing Structures (System-Level, Software License, Service Models)

2. Average Selling Price (ASP) Trends by System and Region

5.3. Cost Benchmarking:

5.3.1. Legacy Control Systems vs. Smart Automation Platforms

5.3.2. On-Premise vs. Cloud-Based Automation Cost per Unit

5.4. Price Sensitivity by Application (Upstream, Refining, LNG, Pipelines)

5.5. Historical Price Evolution (2015–2025)

5.6. Forecast Pricing Curve (2025–2035)

5.7. Factors Influencing Price (Hardware, Software, Connectivity, Integration)

5.8. Regional Pricing Differentiation (Middle East vs. North America vs. Asia)

5.9. Impact of Digital Transformation on Automation Costs

- Overview of Pricing Structures (System-Level, Software License, Service Models)

- Competition Outlook

- Market Concentration and Fragmentation Level

2. Company Market Shares (Top 10 Automation Players)

6.3. Competitive Strategies (Localization, Digital Service Expansion, Partnerships)

6.4. Benchmarking Matrix (Technology vs. Integration vs. Customer Reach)

6.5. Recent Developments (M&A, Product Launches, Platform Upgrades, Partnerships)

- Market Concentration and Fragmentation Level

- Cost Structure & Margin Analysis

- Detailed Cost Breakdown (Hardware, Software, Integration, Training)

2. Average Cost per Stage (Design, Commissioning, O&M)

7.3. Profitability and Margin Distribution Along Value Chain

7.3.1. Hardware Vendor Margin

7.3.2. System Integrator Margin

7.3.3. Software Provider Margin

7.3.4. Service Margin

7.4. Sensitivity Analysis: How Oil Price & Project Pipeline Impact Margins

7.5. Cost Reduction Opportunities via Cloud, Remote Monitoring, and AI

- Detailed Cost Breakdown (Hardware, Software, Integration, Training)

- Business Models & Strategic Insights

- OEM-Controlled Automation Platforms

2. Independent Integrator & EPC Models

8.3. Software-as-a-Service (SaaS) and Subscription Models

8.4. Managed Operations and Remote Monitoring Models

8.5. Integrated Digital Oilfield Models

8.6. Economic Viability Comparison of Business Models

8.7. SWOT Analysis of Leading Automation Models

- OEM-Controlled Automation Platforms

- Investment & Financial Analysis

- CAPEX and OPEX Benchmarks for Automation Projects

2. Payback Period and IRR Sensitivity (by Segment & Region)

9.3. Financial Modeling Assumptions (Digital Adoption Rate, Downtime Reduction)

9.4. Revenue Streams:

9.4.1. Equipment Sales

9.4.2. Software Licensing

9.4.3. Maintenance & Managed Services

9.4.4. Data Monetization / Analytics Services

9.5. Investment Case Studies (Digital Oilfield, Refinery Automation, Offshore Platform)

9.6. Funding Landscape: Venture Capital & Strategic Partnerships

- CAPEX and OPEX Benchmarks for Automation Projects

- Sales & Distribution Channel Analysis

- Overview of Go-to-Market Channels

1.1. Direct Sales (OEM to Oil Company)

10.1.2. Indirect Sales via System Integrators / EPCs

10.1.3. Strategic Partnerships (OEM + Cloud Provider + EPC)

10.2. Channel Share by Region

10.3. Typical Channel Flow Diagram (Design → Integration → Commissioning → O&M)

10.4. Distribution Strategies by Leading Players

10.5. Emerging Trends:

10.5.1. Platform-as-a-Service (PaaS)

10.5.2. Remote and Autonomous Operations Centers

10.5.3. Marketplace Models for Software and Analytics Tools

- Overview of Go-to-Market Channels

- Strategic Recommendations & Roadmap

- Competitors’ Strategic Initiatives

2. Future Outlook (Next 5–10 Years, Emerging Players, Success Factors)

11.3. Strategic Recommendations

11.3.1. Key Technology Advancements to Watch (AI, Edge, Digital Twin)

11.3.2. Integration Roadmap for Fully Digital Oilfields (2030–2035)

11.3.3. Strategic Recommendations for Stakeholders

11.4. Oil & Gas Automation Acceleration Roadmap

11.4.1. Short-Term (2025–2027): Standardization, Cybersecurity, Pilot Projects

11.4.2. Mid-Term (2028–2030): Widespread Cloud and Edge Deployment

11.4.3. Long-Term (2031–2035): Autonomous and Self-Optimizing Assets

11.5. Tailored Recommendations for:

11.5.1. Automation OEMs & Software Providers

11.5.2. EPC Contractors and System Integrators

11.5.3. Oil & Gas Operators and End Users

11.6. Recommendations on Key Success Factors

11.6.1. Partnerships & Ecosystem Collaboration

11.6.2. Cybersecurity & Data Governance

11.6.3. AI and Digitalization Adoption

11.6.4. Investor Confidence & Policy Support

- Competitors’ Strategic Initiatives