- Overvew

- Table of Content

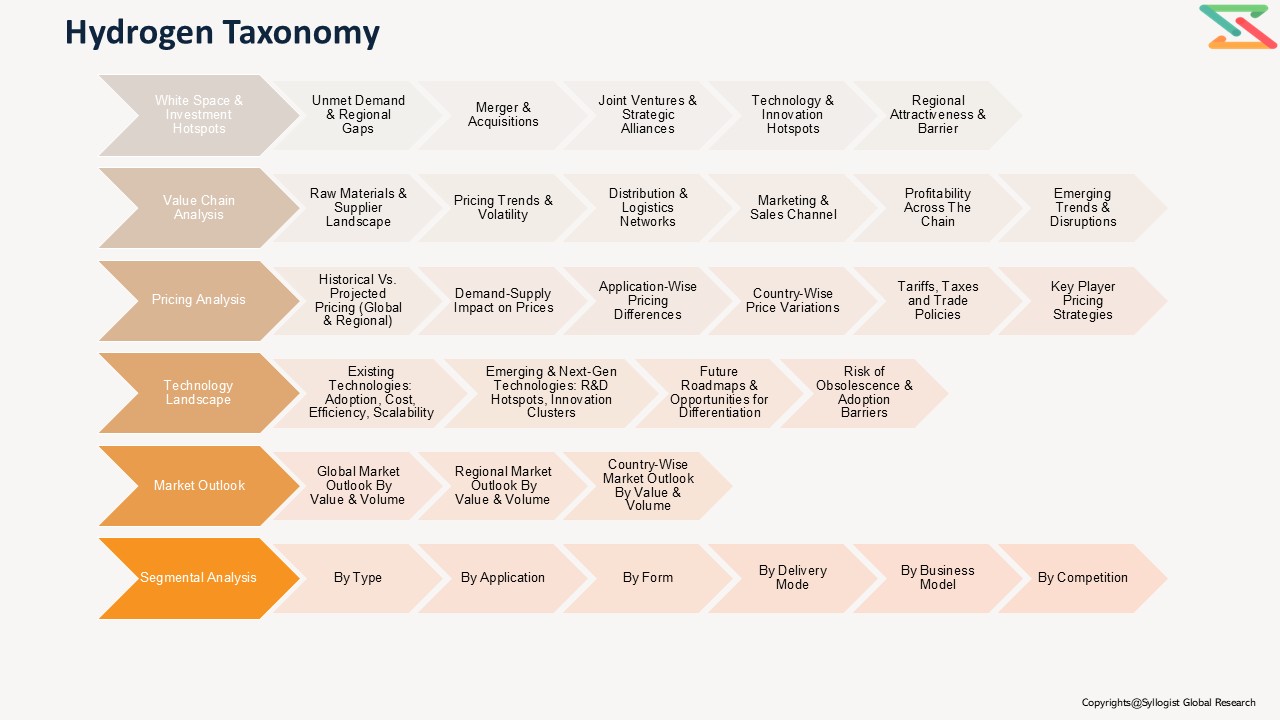

- Segmentation

- Request Sample

Market Definition

Hydrogen is a versatile energy carrier and industrial feedstock widely used in refining, chemicals, steel, and emerging clean energy applications. The global hydrogen market has undergone a significant transformation over the last two years, driven by energy transition goals, decarbonization policies, and fluctuating natural gas prices that directly affect hydrogen production economics.

Market Insights

Due to geopolitical tensions, rising natural gas costs, and supply chain disruptions, global hydrogen production faced pressure in 2021 and 2022. While grey hydrogen remained dominant, several projects shifted toward blue and green hydrogen, though adoption was limited by high production costs. The market began to stabilize in 2023, with renewed momentum from government subsidies and clean hydrogen roadmaps across major economies. However, demand growth remains uneven across regions due to infrastructure gaps and delayed investment decisions.

According to Syllogist Market Research estimates, global hydrogen demand was slightly lower in 2022 than in 2021, particularly in refining, owing to weaker fuel demand and high energy prices. Over the medium term, new applications in steelmaking, ammonia, methanol, and heavy transport are expected to drive recovery. Global hydrogen consumption is projected to grow at a CAGR of 7.5% from 2023 to 2030, with Asia-Pacific and Europe leading adoption due to aggressive decarbonization targets and industrial integration.

The hydrogen market’s evolution is being shaped by several trends: diversification of production technologies (electrolysis, SMR with CCS, and biomass gasification), rapid development of hydrogen hubs, and increased cross-border collaboration. However, the market continues to face structural challenges, namely, insufficient transport and storage infrastructure, limited renewable capacity for green hydrogen, and uncertainty in carbon pricing frameworks. While many countries are investing in large-scale electrolyzer installations, cost competitiveness remains a concern, especially against conventional fossil-based hydrogen.

Despite these constraints, government-led initiatives such as the U.S. Hydrogen Hub program, EU Hydrogen Strategy, and Japan’s Basic Hydrogen Roadmap have accelerated pilot projects and off-take agreements. As natural gas price volatility eases and renewable power costs decline, hydrogen production and consumption are expected to scale up rapidly from 2025 onward. Over the long term, hydrogen is projected to become a critical pillar of global energy transition, supporting net-zero ambitions and industrial decarbonization.

Market Dynamics: Drivers

Decarbonization of hard-to-abate industries such as steel, cement, and chemicals, coupled with growing emphasis on clean energy security, continues to be a major driver of hydrogen market expansion. Supportive policy frameworks, carbon credits, and international trade partnerships are further stimulating investment in production and distribution infrastructure.

Market Dynamics: Challenges

High capital costs of electrolyzers and CCS-equipped reformers, coupled with insufficient hydrogen transport and storage networks, remain major obstacles to scaling production. The current lack of global standardization, uncertain carbon pricing, and limited end-user readiness also restrict near-term growth. Furthermore, the competitiveness of hydrogen against fossil fuels remains dependent on subsidies and renewable electricity costs.

Market Segmentation

Based on Production Type, the Global Hydrogen Market is segmented into:

- Grey Hydrogen

- Blue Hydrogen

- Green Hydrogen

- Turquoise Hydrogen

Based on Technology, the Market is segmented into:

- Steam Methane Reforming (SMR)

- Coal Gasification

- Water Electrolysis

- Partial Oxidation

- Others

Based on Application, the Market is segmented into:

- Refining

- Ammonia Production

- Methanol Production

- Steel Manufacturing

- Transportation Fuel

- Power Generation

- Others

Based on End Use Industry, the Market is segmented into:

- Chemical

- Petrochemical

- Steel and Metallurgy

- Energy and Power

- Mobility

- Others

Based on Distribution Method, the Market is segmented into:

- Pipeline

- Compressed Gas

- Liquid Hydrogen

- Ammonia and LOHC (Liquid Organic Hydrogen Carriers)

Based on Geography, the Global Hydrogen Market is segmented into:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

All market revenue has been given in US Dollar, while the market volumes are represented in tons.

Historical Year: 2021–2024 | Base Year: 2025 | Estimated Year: 2026 | Forecast Period: 2027–2031

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size by Value and Volume, Forecast Numbers, Market Segmentation, Market Shares) of the Global Hydrogen Market?

- What are the region-wise growth drivers, challenges, and key market trends?

- What are the latest innovations, policy developments, and future opportunities in the Global Hydrogen Market?

- Who are the key competitors, what are their core strengths and weaknesses, and how do they perform based on competitive benchmarking?

- What key results and insights were derived from primary and secondary research conducted during the Global Hydrogen Market study?

- Market Foundations & Dynamics

- Introduction

1.1. Product Overview (Definition & Scope of Hydrogen — gray / blue / green / turquoise / pink hydrogen; forms: compressed, liquefied, ammonia, LOHC)

1.1.2. Hydrogen Life-Cycle Overview (Production → Purification → Storage → Transport → Distribution → End-use → Recycling/Emission accounting)

1.1.3. Research Methodology

1.1.4. Executive Summary

1.1.5. Major Trends Shaping the Market (electrolyzer scale-up, decarbonization targets, hydrogen hubs, cross-border trade)

1.1.6. Short-Term vs. Long-Term Opportunities (pilot projects, industrial clusters → wide deployment & export markets)

1.1.7. Comparison of Production Pathways (SMR/ATR ± CCS, electrolysis (alkaline, PEM, AEM, SOEC), pyrolysis, plasma/turquoise)

1.1.8. Scenario Planning (Base, Optimistic, Conservative — technology cost trajectories, policy support)

1.1.9. Sensitivity Analysis (electricity price, natural gas price, carbon price, electrolyzer CAPEX)

1.1.10. Identification of Regional Investment Hotspots (industrial clusters, renewables + electrolysis co-location, import/export corridors) - Market Dynamics

- Introduction

- Drivers (decarbonization mandates, industry hard-to-abate demand, transport & shipping pilots, energy security)

- Restraints (cost gap to fossil alternatives, infrastructure gaps, safety/regulatory complexity)

- Opportunities (green hydrogen for chemicals, heavy transport, steel, seasonal energy storage, ammonia export)

- Challenges (water availability, supply chain for electrolyzers, critical minerals)

- Porter’s Five Forces Analysis

- PESTLE Analysis

- Market Ecosystem & Value Chain

3.1. Overview of Value Chain Participants

1.3.1.1. Producers (electrolyzer manufacturers, SMR/ATR + CCS operators, pyrolysis firms)

1.3.1.2. Power & Renewable Developers (integrated renewable + electrolysis projects)

1.3.1.3. Purification & Compression Providers (PSA, membrane, compressors, liquefaction)

1.3.1.4. Storage Solutions (compressed gas, liquid hydrogen, LOHC, ammonia, salt cavern)

1.3.1.5. Transport & Distribution (pipelines, tanker, tube trailers, maritime carriers)

1.3.1.6. End-Users (refineries, chemical feedstock, steel, heavy transport, power generation)

1.3.1.7. Services (project developers, EPC, offtake aggregators, certifiers)

1.3.2. Flow of Value and Material Through the Chain

1.3.3. Value Addition and Margins at Each Stage

1.3.3.1. Production (CAPEX/OPEX drivers)

1.3.3.2. Purification & Compression/Liquefaction

1.3.3.3. Storage & Distribution

1.3.3.4. End-use Conversion (fuel cells, burners, feedstock)

1.3.4. Integration Trends (producer + offtaker integrated projects, utility-led hydrogen)

1.3.5. Impact of Vertical Integration (renewable + electrolyzer + storage + offtake) - Mapping of Roles and Interdependencies

- Market Trends & Developments

5.1. White Market Space Analysis (refuelling corridors, seasonal storage, maritime bunkering, hydrogen trading hubs)

1.5.2. Demand–Supply Gaps (short-term projects vs. long-term industrial demand)

1.5.3. Investment Hotspots (coastal electrolysis export clusters, industrial decarbonization hubs)

1.5.4. Unmet Needs (standards, certification, skilled workforce, supply chain scale) - Risk Assessment Framework

6.1. Political / Geopolitical Risk (export/import dependencies, trade policy)

1.6.2. Operational Risk (plant reliability, water sourcing, grid integration)

1.6.3. Environmental Risk (water use, land use, lifecycle emissions accounting)

1.6.4. Financial Risk (project financing, merchant market liquidity, subsidy dependency)

- Market Ecosystem & Value Chain

- Regulatory Framework & Standards

- Global Regulatory Overview

1.1. National Hydrogen Strategies & Targets (EU, US, China, Japan, India, Australia, GCC)

2.1.2. International Trade & Certification Initiatives (certified low-carbon hydrogen, guarantees of origin)

2.2. Compliance & Certification Requirements (ISO TC 197, GHG accounting, hydrogen certificates)

2.3. Transportation and Storage Regulations (pipeline codes, hydrogen embrittlement, road/maritime tanker regs)

2.4. Safety & Quality Standards (purity specs for different end uses, ISO/ANSI standards)

2.5. Environmental & Liability Considerations (water sourcing permits, CCS liability frameworks)

2.6. Market Mechanisms & Incentives (contracts for difference, production tax credits, concessional financing)

- Global Regulatory Overview

- Technology Landscape

- Production Technologies

1.1. Low-Carbon Thermal Routes (SMR/ATR + CCS)

3.1.2. Electrolysis Technologies (Alkaline, PEM, AEM, Solid Oxide)

3.1.3. Emerging Routes (pyrolysis/turquoise, biomass gasification)

3.2. Electrolyzer Scale-up, Stack Lifetimes & Degradation Mechanisms

3.3. Hydrogen Purification, Compression, Liquefaction Technologies

3.4. Storage Technologies (compressed, liquid, LOHC, ammonia, salt cavern)

3.5. Transport Technologies (pipelines, tube trailers, LH₂ ships, ammonia carriers, LOHC carriers)

3.6. End-use Technologies (fuel cells — PEM/HT, hydrogen boilers, direct firing, feedstock processes)

3.7. Digital & Operational Technologies (hydrogen plant optimization, trading platforms, digital twins)

3.8. Innovations to Reduce LCOH (cheap renewables, flexible electrolysis, co-location synergies)

- Production Technologies

- Global, Regional & Country Forecasts (2020–2035)

- Global Hydrogen Market Outlook (value, volume; production by color & use)

- Market Share by:

2.1. By Production Type (Green, Blue, Gray, Turquoise, Pink)

4.2.2. By Application/End-Use (Refining, Ammonia & Fertilizer, Methanol, Steel, Heavy Transport — trucking/rail/aviation/ shipping, Power & Grid Services, Residential/Commercial heating)

4.2.3. By Form (Gaseous H₂, Liquid H₂, Ammonia, LOHC)

4.2.4. By Delivery Mode (Pipelines, Trucking, Shipping)

4.2.5. By Business Model (Merchant H₂, Long-term offtake, CCfD/Contracts)

4.2.6. By Company / Project Portfolio - Regional & Country Outlook (2020–2035)

3.1. North America (U.S., Canada, Mexico)

4.3.2. Europe (EU member states, UK, Norway)

4.3.3. Asia-Pacific (China, Japan, South Korea, India, Australia)

4.3.4. Middle East & Africa (GCC exporters, South Africa)

4.3.5. Latin America (Chile, Brazil — renewable export potential)

- Pricing Analysis

- Overview of Pricing Structures (production cost LCOH $/kg, delivered price by mode)

2. Historical & Current Price Benchmarks (industrial hydrogen, merchant H₂ spot)

5.3. Cost Benchmark: Electrolytic vs. SMR+CCS (sensitivity to electricity, gas, carbon price)

5.4. Price Sensitivity by Application (feedstock vs. fuel vs. power balancing)

5.5. Historical Price Evolution (2015–2025)

5.6. Forecast Pricing Curve (2025–2035)

5.7. Factors Influencing Price:

5.7.1. Electricity Cost & Availability (renewables)

5.7.2. Electrolyzer CAPEX & Utilization

5.7.3. Carbon Price & CCS Costs

5.7.4. Transport & Liquefaction Costs

5.8. Regional Pricing Differentiation (local production vs. import parity)

5.9. Impact of Policy Mechanisms (subsidies, CfDs, green premium)

- Overview of Pricing Structures (production cost LCOH $/kg, delivered price by mode)

- Competition Outlook

- Market Concentration and Fragmentation Level

2. Company & Project Portfolios (leading electrolyzer OEMs, producers, integrated players)

6.3. Competitive Strategies (vertical integration, low-cost renewable pairings, export hubs)

6.4. Benchmarking Matrix (Technology vs. Scale vs. Cost vs. offtake diversity)

6.5. Recent Developments (major projects, alliances, electrolyzer scale announcements, financing deals)

- Market Concentration and Fragmentation Level

- Cost Structure & Margin Analysis

- Detailed Cost Breakdown (CAPEX, OPEX, electricity/gas feedstock, water, operations, CCS)

2. Average Cost per Stage (production, purification, storage, transport)

7.3. Profitability and Margin Distribution Along Value Chain

7.3.1. Producer Margin (differentiate green vs. blue)

7.3.2. Transporter / Liquefaction Margin

7.3.3. Distributor / Pipeline Operator Margin

7.3.4. End-user Margin / Cost Avoidance (substitution benefits)

7.4. Sensitivity Analysis: How Electricity Price, Electrolyzer CAPEX & Utilization Affect LCOH

7.5. Cost Reduction Opportunities (stack learning, manufacturing scale, demand aggregation)

- Detailed Cost Breakdown (CAPEX, OPEX, electricity/gas feedstock, water, operations, CCS)

- Business Models & Strategic Insights

- Producer Models (utility-owned, independent merchant, captive for industry)

2. Offtake & Trading Models (fixed offtake, merchant spot, green certificates)

8.3. Integrated Exporter Models (ammonia/LOHC conversion & shipping)

8.4. Service & O&M Models (managed hydrogen services, retrofit services)

8.5. Economic Viability Comparison of Models (project financing profiles)

8.6. SWOT Analysis of Leading Models

- Producer Models (utility-owned, independent merchant, captive for industry)

- Investment & Financial Analysis

- CAPEX and OPEX Benchmarks for Hydrogen Projects (electrolysis, SMR+CCS, liquefaction, storage)

2. Payback Period and IRR Sensitivity (by region, technology, policy support)

9.3. Financial Modeling Assumptions (electricity price scenarios, electrolyzer degradation, carbon price)

9.4. Revenue Streams: Production sales, services, certificate/GO sales, energy arbitrage, capacity payments

9.5. Investment Case Studies (hub projects, export corridors, industrial decarbonization clusters)

9.6. Funding Landscape: Gov grants, concessional debt, project bonds, green financing, private equity

- CAPEX and OPEX Benchmarks for Hydrogen Projects (electrolysis, SMR+CCS, liquefaction, storage)

- Sales & Distribution Channel Analysis

- Overview of Go-to-Market Channels (direct long-term contracts, merchant sales, spot, hubs)

2. Channel Share by Region & Application

10.3. Typical Channel Flow Diagrams (producer → pipeline / truck / ship → terminal → offtaker)

10.4. Sales Process (certification, procurement, purity spec matching, logistics)

10.5. Distribution Strategies (strategic pipeline corridors, hub-and-spoke export models)

10.6. Emerging Trends:

10.6.1. Hydrogen Hubs & Cluster Aggregation Models

10.6.2. Hydrogen Trading Platforms & Exchange Development

10.6.3. Cross-border Long-Term Supply Agreements

- Overview of Go-to-Market Channels (direct long-term contracts, merchant sales, spot, hubs)

- Strategic Recommendations & Roadmap

- Competitors’ Strategic Initiatives (vertical integration, electrolyzer manufacturing scale, joint ventures)

2. Future Outlook (next 5–10 years — scaling, trade frameworks, role in net-zero economies)

11.3. Strategic Recommendations

11.3.1. Technology & Policy Priorities to Watch (electrolyzer cost decline, CCS deployment, certification)

11.3.2. Hydrogen Market Development Roadmap (2030–2035)

11.3.3. Strategic Recommendations for Stakeholders (producers, utilities, governments, investors)

11.4. Hydrogen Market Acceleration Roadmap

11.4.1. Short-term (2025–2027): build first-mover hubs, de-risk projects, enable certification systems

11.4.2. Mid-term (2028–2030): scale electrolyzer manufacturing, regional pipelines, merchant markets

11.4.3. Long-term (2031–2035): cross-border trade, mature trading hubs, deep decarbonization of industry & transport

11.5. Tailored Recommendations for:

11.5.1. Electrolyzer & Equipment Manufacturers

11.5.2. Project Developers & Utilities

11.5.3. End Users (steel, chemicals, shipping, heavy transport)

11.6. Recommendations on Key Success Factors

11.6.1. Partnerships & Alliances (offtake, finance, technology)

11.6.2. Standardization, Certification & Traceability (low-carbon attribution)

11.6.3. Infrastructure Planning & Policy Alignment

11.6.4. Investor Confidence & De-risking Instruments

- Competitors’ Strategic Initiatives (vertical integration, electrolyzer manufacturing scale, joint ventures)