- Overvew

- Table of Content

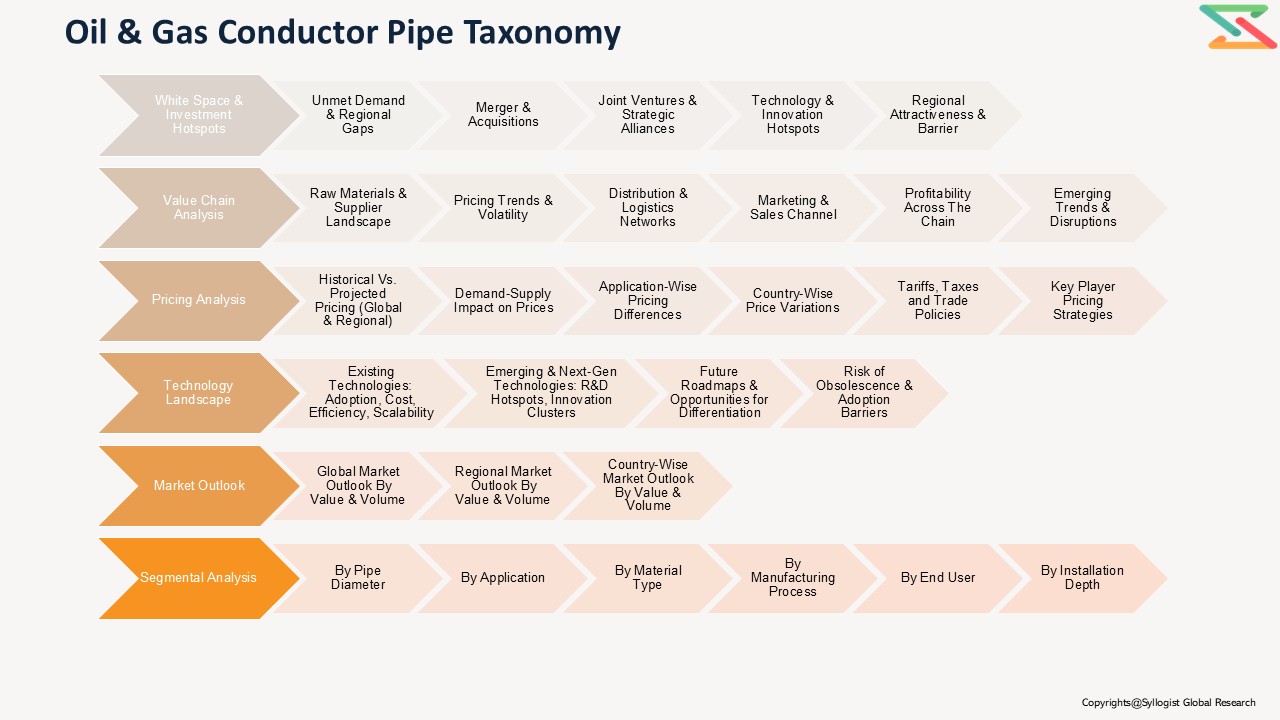

- Segmentation

- Request Sample

Market Definition

Oil and gas conductor pipes, typically the first and widest-diameter casing installed during the initial stages of drilling, serve as the foundational structural element of a well. Their primary role is to stabilize the upper section of the borehole, prevent collapse, isolate shallow water or loose formations, and support subsequent drilling operations. During this period, the global oil and gas conductor pipe market was shaped by fluctuating crude prices, evolving energy transition discussions, and varying levels of upstream activity across offshore and onshore assets.

Market Insights

In the years following earlier oil price declines, global upstream activity began showing signs of gradual recovery. Regions such as the Middle East, parts of Asia-Pacific, and the North Sea initiated new drilling programs as operators sought to rebuild production levels and strengthen domestic energy security. Offshore projects, particularly deepwater and ultra-deepwater developments, remained central to conductor pipe demand due to the technical necessity of large-diameter, high-strength casing in high-pressure marine environments.

While the broader oil and gas sector navigated uncertainties associated with energy transition policies, conductor pipes retained steady demand because drilling fundamentals remained unchanged. The market was also experiencing the beginning of cost pressures resulting from tightening OCTG supply chains, rising steel input costs, and geopolitical tensions. Manufacturers of large-diameter pipes faced capacity constraints, contributing to longer lead times and pricing volatility.

Industry forecasts at that time suggested moderate growth, with global conductor pipe demand expected to rise at a CAGR of around 4% through the latter half of the decade. Asia-Pacific and the Middle East were projected to lead consumption, supported by offshore exploration, national oil company (NOC) investments, and efforts to expand local manufacturing capacities to reduce import reliance. Early-stage opportunities also started emerging in adjacent applications such as geothermal wells and pilot carbon storage projects, laying groundwork for future diversification.

Technological progress during this period focused on enhancing pipe performance through improved steel metallurgy, corrosion-resistant materials, and more efficient welding and fabrication techniques. These advancements were aimed at enabling safer and more durable well construction, particularly in challenging subsea environments.

Market Dynamics: Drivers

- Increasing offshore exploration and deepwater drilling activity

- Strengthening national focus on domestic energy production

- Improvements in high-strength steels and welding practices enhancing conductor reliability

- Expansion of upstream CAPEX among NOCs in Asia-Pacific and the Middle East

Market Dynamics: Challenges

- Volatility in steel prices affecting OCTG product costs

- Supply-side constraints due to limited global capacity for large-diameter pipe manufacturing

- Regulatory and environmental pressures slowing project approvals in Europe and North America

- Emerging ESG frameworks influencing investment decision-making in upstream oil and gas

Market Segmentation

Based on Type, the Global Oil and Gas Conductor Pipe Market is segmented into:

- Welded Pipes

- Seamless Pipes

Based on Material, the Market is segmented into:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Composite Materials

Based on Outer Diameter, the Market is segmented into:

- Below 20 inches

- 20–30 inches

- Above 30 inches

Based on Application, the Market is segmented into:

- Offshore Drilling

- Onshore Drilling

- Others (Geothermal, CCS, etc.)

Based on End User, the Market is segmented into:

- National Oil Companies (NOCs)

- International Oil Companies (IOCs)

- Drilling Contractors

- EPC Companies

Based on Geography, the Global Oil and Gas Conductor Pipe Market is segmented into:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

All market revenues are provided in US Dollars (USD), while market volumes are represented in meters.

Historical Year: 2017–2020

Base Year: 2021

Estimated Year: 2022

Forecast Period: 2023–2027

Key Questions this Study will Answer

- What are the key overall market statistics (market size by value and volume, forecast numbers, market shares) for the Global Oil and Gas Conductor Pipe Market?

- What are the regional trends, growth drivers, and challenges shaping the conductor pipe demand across key markets?

- What are the key technological innovations, regulatory trends, and upcoming opportunities in the global conductor pipe industry?

- Who are the major competitors, and how do they compare in terms of capacity, cost efficiency, and global reach?

- What are the key results derived from primary and secondary research conducted during the Global Oil and Gas Conductor Pipe Market study?

- Market Foundations & Dynamics

- Introduction

1.1. Product Overview (Definition & Scope of Conductor Pipes)

1.1.2. Role of Conductor Pipes in Drilling and Well Construction

1.1.3. Research Methodology

1.1.4. Executive Summary

1.1.5. Major Trends Shaping the Conductor Pipe Market

1.1.6. Short-Term vs. Long-Term Market Opportunities

1.1.7. Comparison: Conductor Pipes vs. Surface Casing

1.1.8. Scenario Planning (Base, Optimistic, Conservative)

1.1.9. Sensitivity Analysis (Oil Price, CAPEX, Rig Count)

1.1.10. Identification of Regional Investment Hotspots - Market Dynamics

- Introduction

- Drivers (E&P Drilling Activity, Offshore Developments, Rig Modernization)

- Restraints (Volatility in Oil Prices, Steel Cost Fluctuations, Environmental Regulations)

- Opportunities (Deepwater Projects, Pipe Material Innovation)

- Challenges (Supply Chain Constraints, Corrosion Management)

- Porter’s Five Forces Analysis

- PESTLE Analysis

- Market Ecosystem & Value Chain

3.1. Overview of Value Chain Participants

1.3.1.1. Raw Material Suppliers (Steel Mills, Seamless Pipe Manufacturers)

1.3.1.2. Pipe Fabricators and Coating Companies

1.3.1.3. Oilfield Equipment Suppliers

1.3.1.4. EPC Contractors and Drilling Service Providers

1.3.1.5. Oil & Gas Operators (Upstream Companies)

1.3.1.6. Distributors and Traders

- Market Ecosystem & Value Chain

- 3.2. Flow of Value and Material Through the Chain

1.3.3. Value Addition and Margins at Each Stage

1.3.3.1. Steel Procurement

1.3.3.2. Manufacturing / Forming / Heat Treatment

1.3.3.3. Coating & Inspection

1.3.3.4. Distribution / Sales - 3.4. Integration Trends (Vertical Integration by Pipe Manufacturers)

1.3.5. Impact of Supply Chain Localization- Mapping of Roles and Interdependencies

- Market Trends & Developments

5.1. White Space Analysis (Emerging Offshore Basins, New Materials)

1.5.2. Demand–Supply Gaps (Steel Availability, Capacity Constraints)

1.5.3. Investment Hotspots (Middle East, Subsea Developments)

1.5.4. Unmet Needs (Lightweight, Corrosion-Resistant Alloys) - Risk Assessment Framework

6.1. Political / Geopolitical Risk

1.6.2. Operational Risk (Rig Delays, Equipment Failure)

1.6.3. Environmental & Safety Risk

1.6.4. Financial Risk (Oil Price Volatility, CAPEX Cycle Risk)

- Regulatory Framework & Standards

- Global Standards Overview

1.1. API 5L, API 10A, ISO 11960 Standards

2.1.2. Regional Oilfield Material Regulations (US, EU, Middle East, Asia)

2.2. Certification & Inspection Requirements (NDT, Hydrostatic Testing)

2.3. Transportation and Storage Regulations

2.4. Health, Safety, and Environmental Compliance (HSE)

2.5. Offshore Safety and Quality Regulations

2.6. Impact of Local Content Laws (Saudi Arabia IKTVA, Nigeria Content Law)

- Global Standards Overview

- Technology Landscape

- Manufacturing Processes (Seamless, Welded, ERW, LSAW)

2. Material Advancements (Carbon Steel, Duplex, Alloy Steel)

3.3. Corrosion-Resistant Coatings and Linings

3.4. Automation and Digital Inspection in Pipe Manufacturing

3.5. Advances in Heat Treatment and Forming

3.6. Innovations to Reduce Weight and Enhance Durability

- Manufacturing Processes (Seamless, Welded, ERW, LSAW)

- Global, Regional & Country Forecasts (2017–2027)

- Global Market Outlook (Value, Volume)

- Market Share by Segment:

2.1. By Application: Onshore vs. Offshore

4.2.2. By Pipe Diameter (≤20″, 20–36″, >36″)

4.2.3. By Material Type (Carbon Steel, Stainless Steel, Alloy Steel)

4.2.4. By Manufacturing Process (Seamless, Welded)

4.2.5. By End-User (National Oil Companies, IOCs, Drilling Contractors)

4.2.6. By Installation Depth (Shallow, Deepwater, Ultra-deepwater)

4.2.7. By Region - Regional & Country Outlook (2017–2027)

3.1. North America (U.S., Canada, Mexico)

4.3.2. Middle East (Saudi Arabia, UAE, Qatar, Kuwait)

4.3.3. Asia-Pacific (China, India, Indonesia, Malaysia, Australia)

4.3.4. Europe (UK, Norway, Russia)

4.3.5. Latin America (Brazil, Argentina)

4.3.6. Africa (Nigeria, Angola, South Africa)

- Pricing Analysis

- Overview of Pricing Structure (per ton / per meter basis)

2. Average Selling Price Trends by Material Type and Region

5.3. Cost Benchmark:

5.3.1. Seamless vs. Welded Conductor Pipes

5.3.2. Offshore vs. Onshore Installed Cost Comparison ($/m)

5.4. Price Sensitivity to Steel Prices and Oil Price Index

5.5. Historical Price Evolution (2017–2022)

5.6. Forecast Pricing Curve (2023–2027)

5.7. Factors Influencing Price (Raw Material, Energy, Logistics, Labor)

5.8. Regional Pricing Differentiation (China vs. Middle East vs. U.S.)

5.9. Impact of Global Steel Market Dynamics

- Overview of Pricing Structure (per ton / per meter basis)

- Competition Outlook

- Market Concentration and Fragmentation Level

2. Market Shares of Leading Players (Top 10 Manufacturers)

6.3. Competitive Strategies (Capacity Expansion, Localization, Partnerships)

6.4. Benchmarking Matrix (Technology vs. Cost vs. Supply Reach)

6.5. Recent Developments (M&A, Strategic Alliances, New Facilities)

- Market Concentration and Fragmentation Level

- Cost Structure & Margin Analysis

- Detailed Cost Breakdown (Raw Material, Forming, Coating, Transport)

2. Average Cost per Stage (in $/ton or $/meter)

7.3. Profitability and Margin Distribution Along Value Chain

7.3.1. Steel Supplier Margin

7.3.2. Pipe Manufacturer Margin

7.3.3. EPC Contractor Margin

7.3.4. Distributor Margin

7.4. Sensitivity Analysis (Oil Price and Steel Price Impact on Margins)

7.5. Cost Reduction Opportunities (Automation, Sourcing, Localization)

- Detailed Cost Breakdown (Raw Material, Forming, Coating, Transport)

- Business Models & Strategic Insights

- OEM-Owned Pipe Manufacturing Models

2. EPC-Integrated Supply Models

8.3. Third-Party Distribution & Trading Models

8.4. Strategic Partnerships with Oilfield Service Providers

8.5. Economic Viability of Local vs. Imported Pipes

8.6. SWOT Analysis of Leading Business Models

- OEM-Owned Pipe Manufacturing Models

- Investment & Financial Analysis

- CAPEX and OPEX Benchmarks for Conductor Pipe Manufacturing Units

2. Payback Period and IRR Sensitivity (by Region, Application)

9.3. Financial Modeling Assumptions (Steel Cost, Capacity Utilization)

9.4. Investment Case Studies (Onshore vs. Offshore Projects)

9.5. Funding Landscape (EPC Contracts, Local Joint Ventures, FDI)

- CAPEX and OPEX Benchmarks for Conductor Pipe Manufacturing Units

- Sales & Distribution Channel Analysis

- Overview of Go-to-Market Channels

1.1. Direct Sales to Oil Companies

10.1.2. Indirect Sales via EPCs / Distributors

10.1.3. Strategic Alliances (Pipe Mill + Oilfield Supplier)

10.2. Channel Share by Region

10.3. Typical Supply Chain Flow Diagram

10.4. Distribution Strategies by Leading Players

10.5. Emerging Trends (Digital Procurement, E-Marketplaces)

- Overview of Go-to-Market Channels

- Strategic Recommendations & Roadmap

11.2. Future Outlook (Next 5–10 Years, Emerging Manufacturers, Success Factors)

11.3. Strategic Recommendations

11.3.1. Technology Advancements to Watch (Advanced Coating, Non-corrosive Materials)

11.3.2. Localization and Capacity Expansion Strategies

11.3.3. Partnership & Collaboration Opportunities

11.4. Market Acceleration Roadmap

11.4.1. Short-term (2017–2019)

– Focus on capacity expansion and material efficiency

11.4.2. Mid-term (2020–2023)

– Integration of digital manufacturing and traceability

11.4.3. Long-term (2024–2027)

– Transition to low-carbon steel and circular supply chains

11.5. Tailored Recommendations for:

11.5.1. Pipe Manufacturers

11.5.2. EPC & Oilfield Service Providers

11.5.3. Oil & Gas Operators

11.6. Key Success Factors

11.6.1. Cost Efficiency & Supply Chain Optimization

11.6.2. Local Content & Compliance

11.6.3. Technological Differentiation

11.6.4. Strategic Partnerships & Financing- Market Foundations & Dynamics