- Overvew

- Table of Content

- Segmentation

- Segmentation

- Request Sample

Market Definition

Aerosols are pressurized products that dispense active ingredients as fine sprays, foams, mists, or streams using a propellant-driven system. Each aerosol product consists of three essential components: the container (typically aluminum, steel, or plastic), the formulation (active ingredients + solvents or water-based solutions), and the propellant (liquefied or compressed gases). Aerosols deliver precise, hygienic, and controlled dispensing, making them highly effective for personal care, household, automotive, industrial, pharmaceutical, and food applications.

The industry is undergoing a structural shift toward low-VOC, low-GWP propellants, recyclable packaging, water-based formulations, and advanced dispensing technologies such as bag-on-valve systems. This transition positions aerosols as a modern, performance-driven, and increasingly sustainable packaging format aligned with global environmental and safety regulations.

Market Insights

The aerosol industry represents a large, multi-billion-dollar global market driven by rising consumption across personal care, household cleaning, healthcare, and industrial maintenance. The market was valued at around USD 93 billion in 2024 and is projected to expand at a healthy mid-single to high-single-digit CAGR through 2035, supported by strong demand in developed economies and accelerated adoption in Asia-Pacific and Latin America.

Personal care remains the largest application category, dominated by deodorants, hair sprays, body mists, and shaving foams, driven by urban lifestyles, grooming habits, and product premiumization. Household aerosols such as air fresheners, surface cleaners, disinfectants, and insecticides have also gained momentum, particularly with rising hygiene awareness. Medical and industrial aerosols add further depth to the market, with respiratory inhalers, wound care sprays, lubricants, industrial cleaners, and spray paints expanding non-consumer demand.

Sustainability trends, such as the shift to hydrocarbon and compressed gas propellants, adoption of recyclable metal cans, and introduction of eco-dispensing systems, are transforming the value chain. Brand owners are redesigning formulations, reducing VOC levels, and transitioning to low-GWP propellants, while fillers are investing in modern, flexible, and automated production lines. As environmental regulations tighten, aerosols are evolving from conventional “spray cans” into a technology-led, compliance-driven, high-value packaging ecosystem.

Market Dynamics: Drivers

Rising Demand for Convenient, Hygienic & On-the-Go Products

Aerosols offer unique advantages such as touch-free dispensing, precise dosing, even spray patterns, and sealed packaging that prevents contamination. These attributes make them ideal for personal care, surface cleaning, disinfection, odor control, automotive maintenance, and industrial lubrication. Increasing consumer preference for convenience and fast-acting solutions continues to push aerosol penetration across categories.

Expansion of Personal Care, Grooming & Household Categories

Growing disposable incomes, urban lifestyles, and grooming awareness, especially among younger consumers, are accelerating demand for deodorants, dry shampoos, body sprays, and hair styling products. Meanwhile, household products such as air care sprays, fabric refreshers, kitchen cleaners, and insect repellents are witnessing strong volume growth as modern retail and e-commerce expand globally.

Technological Innovation in Formulations, Propellants & Packaging

The industry is innovating rapidly across the value chain. Water-based and low-VOC formulations are becoming mainstream; propellant technologies are shifting toward hydrocarbons, dimethyl ether, compressed gases, and next-generation low-GWP gases; and packaging innovations include lightweight aluminum cans, recyclable steel cans, and advanced bag-on-valve systems. These developments improve sustainability, enhance performance, and open new application opportunities.

Market Dynamics: Challenges

Stringent and Diverse Environmental Regulations

Regulations related to VOC emissions, greenhouse gases, propellant restrictions, and product safety differ significantly across regions. Manufacturers face ongoing pressure to reformulate products, redesign propellant systems, and requalify packaging to remain compliant. Smaller players often struggle with the cost and technical expertise required to meet evolving standards.

Higher Costs & Technical Barriers for Next-Generation Technologies

Transitioning to eco-friendly propellants, recyclable cans, and advanced dispensing systems often increases production costs. Adoption of new formulations requires investment in specialized filling equipment, testing protocols, and safety systems. Ensuring consistent spray performance, stability, and consumer acceptance also presents technical challenges, especially for complex or high-viscosity formulations.

Market Segmentation

- By Product Type

- Personal Care (Deodorants, Hair Care Sprays, Shaving Foams, Body Sprays, etc.)

- Household (Air Fresheners, Surface Cleaners, Insecticides, Fabric Fresheners)

- Industrial & Automotive (Lubricants, Cleaners, Anti-corrosion Sprays)

- Paints & Coatings (Spray Paints, Protective Coatings)

- Medical & Pharmaceutical (Inhalers, Wound Care, Topical Sprays)

- Food (Whipped Cream, Cooking Oils)

- Others (Pet Care, Specialty Applications)

- By Propellant Type

- Hydrocarbons (Propane, Butane, Isobutane)

- Compressed Gases (Nitrogen, CO₂, Air)

- Dimethyl Ether (DME)

- Low-GWP Propellants (e.g., newer alternatives)

- Others (Blends and specialty systems)

- By End Use

- Consumer

- Industrial

- Commercial/Institutional

- By Geography

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

Revenue: USD Billion

Volume: Kilotons

Historical Years: 2020–2024

Base Year: 2025

Estimated: 2026

Forecast: 2027–2035

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of Global Aerosol Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the Global Aerosol Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in Global Aerosol Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during Global Aerosol Market study?

- Strategic Introduction

- Definition & Scope of the Global Aerosol Market

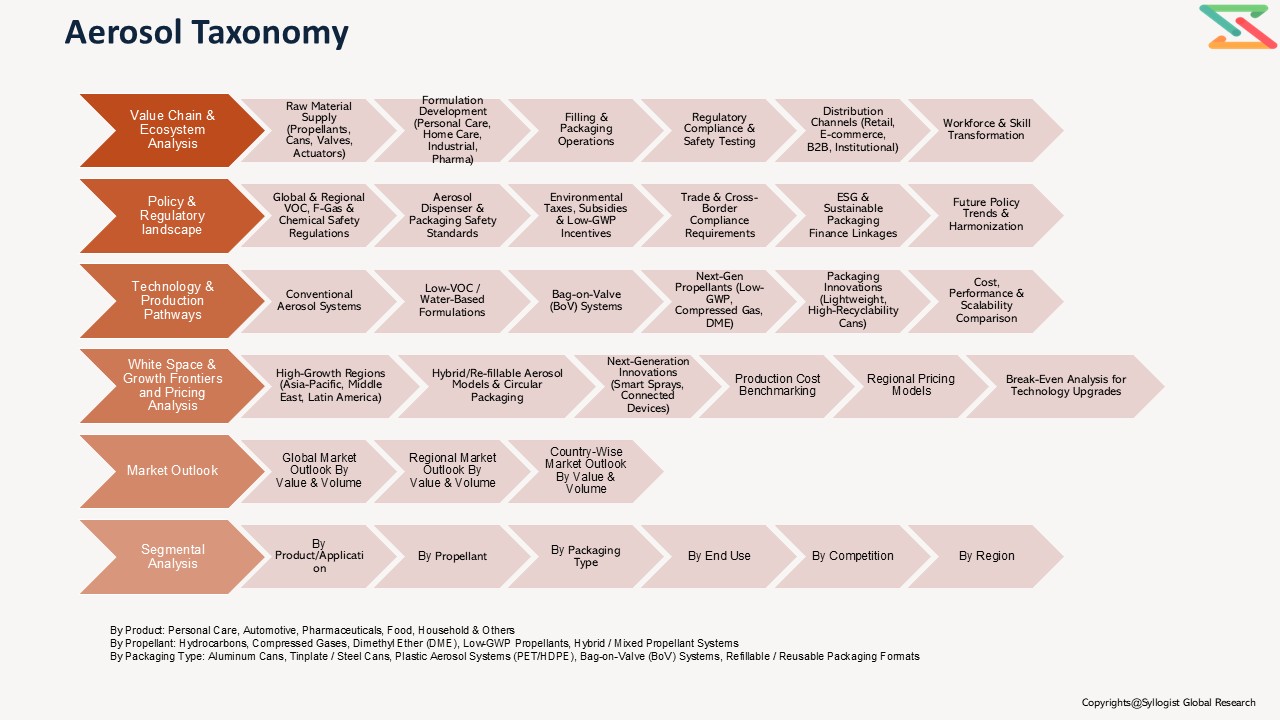

- Market Architecture & Taxonomy (Product Type, Propellant Type, Application, End Use, Channel)

- Research Framework & Methodology

- Data Mining, Secondary & Primary Research

- Market Sizing & Validation (top-down, bottom-up, demand/supply analysis)

- Scenario Calibration (consumption trends, VOC/F-Gas regulations, input cost volatility, and sustainability shifts)

- Executive Insights

- Strategic snapshot of the Global Aerosol market landscape, highlighting consumption drivers, regulatory inflection points, and scale-up readiness across key applications

- Key findings and actionable insights to guide boardroom decision-making, innovation strategy, and category expansion

- Future Outlook & Opportunity Mapping (2025–2035)

- Scenario Planning (Base, Optimistic, Conservative)

- Sensitivity Analysis (propellant mix, packaging costs, regulatory tightening)

- Identification of regional investment hotspots and high-growth application clusters

- Aerosols’ Positioning in the Next-Generation Packaging & Dispensing Ecosystem (hygiene, convenience, sustainability)

- Value Chain & Ecosystem Analysis

- Aerosols’ Role Across Consumer, Healthcare, Automotive, Industrial & Food Value Chains

- Digitalization in the Aerosol Value Chain (smart filling lines, quality analytics, track-and-trace)

- Supply Chain Logistics for Propellants, Cans, and Formulation Components

- Stakeholder Mapping

- Brand Owners (FMCG, Personal Care, Home Care, Pharma, Industrial)

- Aerosol Contract Fillers & System Integrators

- Can & Valve Manufacturers

- Propellant Suppliers (Hydrocarbons, DME, Compressed Gases, Low-GWP Gases)

- Distributors, Retailers & E-commerce Platforms

- Regulators & Standards Bodies

- Packaging & Sustainability Certification Agencies

- Ecosystem Interlinkages with Sustainable Packaging, Green Chemistry, VOC Management, And Circular Economy Programs to Accelerate Adoption and Portfolio Transformation

- Workforce and Skills Transformation Across R&D, Formulation, Regulatory, and Operations

- Global Market Outlook (2020–2035)

- Market size and forecast by value and volume (million units / kilotons)

- Product Type, Propellant Type, Application, End Use, Regional, and Company Segmentation

- Regional Deep-Dive Analysis (2020–2035)

- Asia-Pacific (China, India, Japan, South Korea, Australia, ASEAN)

- Europe (Germany, France, United Kingdom, Italy, Spain, Poland, Nordics)

- North America (U.S., Canada)

- South America (Brazil, Mexico, Chile, Argentina)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Egypt, Rest of MEA)

- Each region includes:

- Market size & forecast

- Adoption by Product Type, Propellant, Application & End Use

- Key brand owners, fillers, and manufacturing hubs

- Country-specific regulatory & labeling landscape

- Each region includes:

- Policy & Regulatory Landscape

- Global & Regional Regulatory Frameworks

- VOC and Air Quality Regulations Impacting Aerosol Formulations (e.g., EU VOC Directives, US EPA Air Regulations)

- F-Gas, Ozone-Depleting Substances, and Low-GWP Propellant Regulations (phase-down schedules, bans, and substitution timelines)

- Country-Specific Roadmaps for Sustainable Packaging, Chemical Safety, and Circular Economy (EU Green Deal, US Sustainability Initiatives, Extended Producer Responsibility Schemes, Plastic & Packaging Directives)

- Product Safety, Labeling & Packaging Standards

- Global Standards: GHS Labeling, Aerosol Dispensers Directive (ADD), ISO Standards

- Regional Standards: CLP (EU), TSCA (US), REACH, local chemical and packaging regulations

- How Safety & Labeling Schemes are Increasingly Mandating/Encouraging Low-VOC, Low-GWP, and Recyclable Aerosol Solutions

- Impact on Procurement by Retailers, E-commerce Platforms, and Multinational Brand Owners

- Environmental Taxes, Incentives & Subsidies

- National and Regional Frameworks for VOC Fees, GHG Taxes, and Eco-Modulation of Packaging Fees

- Incentives for Low-GWP Propellants, Recyclable Packaging, and Sustainable Formulations

- Subsidies and Grants for Line Upgrades, Eco-Design, and Waste Collection/Recycling Infrastructure

- Green Procurement Policies (Retail and Government Contracts Favoring Sustainable Aerosols)

- Public-Private Funding for R&D and Scale-Up in Low-Impact Aerosol Technologies

- Trade & Cross-Border Measures

- Impact of Trade Agreements, Import Duties, and Non-Tariff Barriers on Aerosol Components and Finished Products

- Compliance Requirements, Testing, and Certification for Cross-Border Aerosol Shipments

- ESG & Sustainable Finance Linkages

- Role of Green Bonds, Sustainability-Linked Loans, and Climate Funds for Packaging & Product Reformulation Projects

- Disclosure Frameworks (TCFD, ISSB, EU Taxonomy) Requiring Consumer and Industrial Companies to Demonstrate Progress on Sustainable Packaging and VOC/GHG Reduction

- Future Policy Trends & Harmonization

- Global Convergence on VOC, F-Gas, and Chemical Safety Standards by 2030–2035

- Integration with National Net-Zero, Circular Economy, and Waste Management Roadmaps

- anticipated Shift Toward Mandatory Packaging Footprint & Product-Carbon-Intensity Reporting in Consumer and Industrial Categories

- Global & Regional Regulatory Frameworks

- Technology & Production Pathways

- Conventional Aerosol Systems (Standard Cans, Hydrocarbon Propellants)

- Low-VOC and Water-Based Formulation Pathways

- Bag-on-Valve (BoV) and Advanced Dispensing Systems

- Next-Generation Propellant Technologies (Compressed Gases, DME Blends, Low-GWP Gases)

- Emerging Technologies

- Refillable & Reusable Aerosol and “Aerosol-Like” Systems

- Digital & Smart Aerosol Devices (Connected/Measured Dosing, IoT-Enabled)

- Lightweight, High-Recyclability Can Innovations (Aluminum & Steel)

- Novel Valves, Actuators & Spray-Pattern Engineering

- Cost, Performance, and Scalability Comparison

- Cost Analysis (formulation, propellant, can, valve, filling, logistics)

- Performance Metrics (spray quality, stability, safety, consumer/user experience)

- Scalability Assessment Across Technologies and Regions

- Commercial Readiness Levels (CRL/TRL) for Key Aerosol Technologies

- Market Dynamics

- Growth drivers, restraints, challenges, opportunities

- Impact of VOC/F-Gas Regulations, Retail & Brand Sustainability Mandates, and ESG Compliance on Aerosol Adoption, Reformulation, and Portfolio Realignment

- White Space & Growth Frontiers

- Unexplored Regional Markets and Untapped Opportunities in Emerging Economies with Rising Urbanization, Hygiene Awareness, and Modern Retail Penetration

- Hybrid Business Models Integrating Aerosols with Refill Systems, Concentrates, and Circular Packaging Solutions

- Next-Generation Innovations Such as Smart Dosing Devices, Eco-Propellant Platforms, And Fully Recyclable/Reusable Aerosol Systems

- Pricing & Economics

- Production Cost Benchmarking Across Aerosol Technologies (Conventional vs. Low-VOC, BoV, Advanced Propellants)

- Regional Pricing Models Factoring Raw Material Availability, Propellant Costs, Energy Prices, and Logistics

- Break-Even Analysis for Different Technology Pathways, Line Upgrade Scenarios, and Sustainability Investments

- Competition & Benchmarking

- Competition Matrix: Global Brand Majors vs. Regional Players vs. Contract Fillers and Component Suppliers

- Comparative positioning of multinational FMCG/personal care/home care companies, regional brand owners, and private-label players in aerosol usage and innovation.

- Market share analysis by product category (personal care, household, industrial, pharma) and technology adoption (BoV, low-VOC, low-GWP).

- Competitive edge in formulation IP, scale, distribution, sustainability credentials, and speed-to-market.

- Player Strategies

- Reformulation and portfolio decarbonization roadmaps (VOC reduction, low-GWP propellants, recyclable packaging)

- Investments in advanced filling capacities, flexible packaging formats, and collaborative R&D with suppliers

- Vertical and horizontal integration strategies with contract fillers, can/valve manufacturers, and propellant suppliers

- Case Comparisons of Early Adopters vs. Laggards

- Regional leaders (e.g., Europe’s rapid transition to low-VOC/low-GWP systems) vs. slower adopters in markets with weaker policy push

- Lessons from early demonstration projects, eco-label launches, and first-mover advantages in securing retail shelf space and green finance

- Competitive Benchmarking: Leaders, Challengers, Innovators

- Leaders: Global brand owners and system suppliers scaling sustainable aerosols across multiple geographies

- Challengers: Regional players and contract fillers upgrading technology and sustainability credentials

- Innovators: Startups and niche players commercializing novel propellants, smart devices, or circular-packaging-based aerosol solutions

- Comparison on cost structure, scalability, TRL, market adoption, and sustainability alignment

- Key Company Profiles and Strategies

- M&A activity in aerosol contract filling, can/valve manufacturing, and innovative propellant/formulation companies

- Strategic alliances with research institutes, chemical companies, and packaging innovators

- Partnerships with retailers, e-commerce platforms, and brand owners to launch sustainable aerosol ranges

- Supply chain integration: securing propellant sources, metal/can supply, and specialized valve/actuator technologies

- Startups and Disruptors in Next-Gen Aerosols

- Startups developing eco-propellant technologies, concentrated/refill models, and smart dispensing systems

- Pilot-scale disruptors in reusable and circular-packaging aerosols

- Role of VC funding, climate-tech and packaging-tech accelerators, and corporate venture arms

- Sustainability Benchmarking & Certifications

- Benchmarking of companies based on VOC emissions, GHG footprint, recyclability, and circular economy practices

- Certification and eco-label landscape (environmental seals, retailer scorecards, packaging taxonomies) as a differentiator

- Regional Competition Dynamics

- Europe: Policy-driven leadership via VOC/F-Gas regulations and circular packaging mandates

- Asia-Pacific: High-volume growth region with expanding manufacturing base and rising domestic brands

- North America: Strong focus on regulatory compliance, product innovation, and retail-driven sustainability commitments

- Middle East & Africa: Early-stage but growing adoption, driven by hygiene, insect control, and modern trade expansion

- Competitive Risks & Barriers (additional)

- Technology lock-ins and high CAPEX for line conversion and safety systems

- Feedstock availability (propellants, metal, specialty chemicals) and supply volatility

- Regulatory and certification delays slowing commercialization of new formats and formulations

- Competition Matrix: Global Brand Majors vs. Regional Players vs. Contract Fillers and Component Suppliers

- Project Case Studies (Global Best Practices)

- Successful Aerosol Reformulation, Packaging Upgrade, and Scale-Up Programs Across Regions

- Lessons Learned from Technology Challenges, Failed Reformulations, and Market Adoption Barriers

- Benchmarking of Project Economics (CAPEX, OPEX, payback, ROI for sustainable aerosol transitions)

- Technology Adoption Roadmaps for Low-VOC Formulations, Low-GWP Propellants, BoV, and Recyclable/Reusable Packaging Models

- ESG & Sustainability Dimensions

- VOC and GHG reduction through propellant substitution, low-solvent and water-based formulations, and packaging optimization

- ESG compliance and access to sustainable financing via green bonds, climate funds, and ESG-linked loans

- Resource efficiency and waste management innovations in aerosol filling, packaging, and end-of-life handling

- Circular economy integration (collection, recycling, reuse, and refill models)

- Transparent environmental footprint accounting and MRV (monitoring, reporting, verification) aligned with international frameworks

- Investment & Financing Models

- CAPEX & OPEX Structures Across Conventional and Next-Generation Aerosol Technologies

- Risk-Return Models Under Regulatory Tightening, Retail Requirements, and Sustainability Commitments

- Financing Incentives Linked to ESG Performance, Sustainable Packaging Targets, and Taxonomy Alignment

- Public–Private Partnerships (PPPs) for Recycling Infrastructure, Technology Pilots, and Sustainable Propellant/Formulation Scale-Up

- Talent, Skills & Workforce Transformation

- Human Capital Challenges in Scaling Next-Generation Aerosol Technologies

- Reskilling Needs in Formulation Science, Regulatory Affairs, Process Safety, and Automation

- Training for Safety, Regulatory Compliance, ESG Reporting, and Operational Excellence in Modern Filling Plants

- Building Interdisciplinary Teams Bridging Chemistry, Packaging Engineering, Data Science, and Marketing

- Risk Assessment Framework

- Political/Regulatory Risk

- Operational Risk

- Environmental Risk

- Financial Risk

- Market Risk

- Strategic Roadmap & Recommendations

- Short-term (2025–2027)

- Mid-term (2028–2030)

- Long-term (2031–2035)

- Tailored recommendations for:

- For Brand Owners (FMCG, Personal Care, Home Care, Healthcare, Industrial)

- For Contract Fillers & System Suppliers

- For Regulators & Standards Bodies

- For Investors & Strategic Partners