- Overvew

- Table of Content

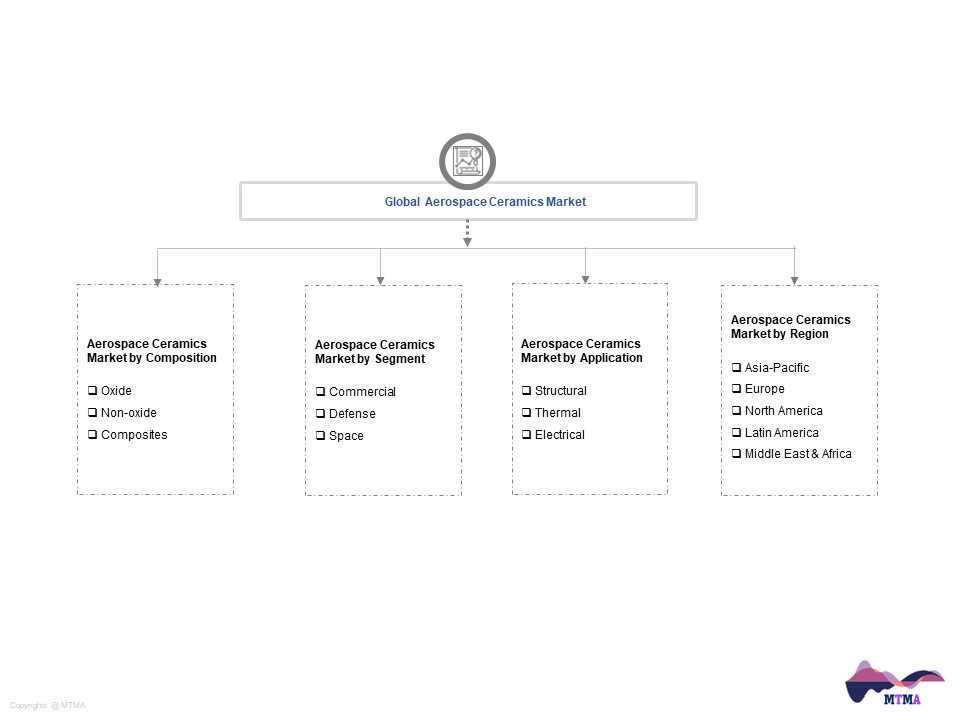

- Segmentation

- Request Sample

Market Definition

Due to their great temperature resistance, chemical stability, hardness, and vibration resistance, ceramics are employed in the aircraft sector. These materials offer superior electrical insulation and energy ablation while being lighter than metals. Thermal, electrical, and structural applications are the three main divisions of aerospace applications. Oxides, non-oxides, glass ceramics, and ceramic matrix composites (CMCs) are the different categories for the materials employed. These ceramics are employed in aviation parts like engines and exhaust systems that need to have a high compressive strength.

Market Insights

In 2022, the market for aerospace ceramics was estimated to be worth $5.1 billion, notwithstanding the COVID-19 pandemic’s year-long slowdown. From 2023 to 2030, the market is projected to expand at a compound annual growth rate (CAGR) of 11.87%. For structural applications in aerospace materials, composites like carbon-fiber reinforced polymer (CFRP) and glass-fiber reinforced polymer (GFRP) are in great demand. As a result, during the projected period, the ceramic composites segment will rule the market in terms of composition.

Due to the significant concentration of commercial and military aircraft manufacturers in these two continents, North America and Europe take the lead in the consumption of aerospace ceramics. The demand from Boeing and Airbus production facilities, respectively, is the main factor driving the aerospace ceramics market in these regions. North America is anticipated to continue to be the world’s largest market for aerospace ceramics throughout the projected period due to the constantly increasing demand for military aircraft and the burgeoning private space industry.

The expanding space sector is the main factor fueling growth in the aerospace ceramics market. An exponential rise in demand is being seen for small satellites (micro, nano satellites) for telecommunication, security, and entertainment. Additionally, the resurgence of the commercial aviation sector and stricter pollution regulations will have a big impact on the demand for ceramics in the future. The aerospace ceramics market is simultaneously confronted with issues such the production of thick, high volume components, brittleness, repair methods, and reproducibility. Additionally, the great heat, electricity, and chemical resistance of ceramics and composites makes it challenging to dispose of their waste.

Market Dynamics: Drivers

Growth in Military Markets

The international military aerospace equipment markets are driven by government budgets. These may alter as a result of changing leadership, changed leadership priorities, and shifting situations related to international security. The amount spent on military jets in the United States, which by far contributes the most to global defence spending, remained stable from 2013 to 2016, increasing or decreasing by 1% to 3% year. Then, spending exploded under the Trump administration. Other nations, especially China, have boosted their military spending, although a large portion of this has not involved the aerospace sector. Under Trump, the U.S. budget’s military spending increased. In the long run, it is anticipated that U.S. spending will decrease as a share of overall global military spending. This will be a result of increased military spending abroad, especially by China, which has already boosted its military budget significantly and is likely to do so again in the near- to medium-term, along with possibly greatly increasing it. Although large adjustments are not anticipated during the five-year prediction period based on current development rates and public planning, this could push military jet engine markets towards China. The effect of such investment on external markets is still unknown, though.

Market Segmentation

- Based on Composition, the Global Aerospace Ceramics market is segmented into

- Oxide

- Non-Oxide

- Composites

- Based on Segment, the Global Aerospace Ceramics market is segmented into

- Commercial

- Défense

- Space

- Based on Application, the Global Aerospace Ceramics market is segmented into

- Structural

- Thermal

- Electrical

- Based on Geography, the Global Aerospace Ceramics market is segmented into

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- All market revenue has been given in US Dollar.

Historical Year: 2020-2021

Base Year: 2022

Estimated: 2023

Forecast- 2024-2030

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of Global Aerospace Ceramics Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the Global Aerospace Ceramics Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in Global Aerospace Ceramics Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during Global Aerospace Ceramics Market study?

- Introduction

- Product Definition

- Market Taxonomy

- Research Process

- Brief on Secondary Sources Used

- Primary Research

- Sample Size

- List of Companies Interviewed

- Market Sizing Model

- Assumptions Used

- Model Description

- Forecast Model

- Executive Summary

- Impact of COVID-19 on Global Aerospace Ceramics Market

- Global Aerospace Ceramics Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Composition

- Oxide

- Non-Oxide

- Composites

- By Segment

- Commercial

- Défense

- Space

- By Application

- Structural

- Thermal

- Electrical

- By Region

- Asia-Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

- By Competition

- By Composition

- Market Size & Forecast

- North America Aerospace Ceramics Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Composition

- Oxide

- Non-Oxide

- Composites

- By Segment

- Commercial

- Défense

- Space

- By Application

- Structural

- Thermal

- Electrical

- By Country

- United States

- Canada

- By Composition

- Market Size & Forecast

- Asia-Pacific Aerospace Ceramics Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Composition

- Oxide

- Non-Oxide

- Composites

- By Segment

- Commercial

- Défense

- Space

- By Application

- Structural

- Thermal

- Electrical

- By Country

- Singapore

- Australia

- South Korea

- Hong Kong

- China

- By Composition

- Market Size & Forecast

- Europe Aerospace Ceramics Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Composition

- Oxide

- Non-Oxide

- Composites

- By Segment

- Commercial

- Défense

- Space

- By Application

- Structural

- Thermal

- Electrical

- By Country

- United Kingdom

- Switzerland

- Germany

- The Netherlands

- By Composition

- Market Size & Forecast

- Latin America Aerospace Ceramics Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Composition

- Oxide

- Non-Oxide

- Composites

- By Segment

- Commercial

- Défense

- Space

- By Application

- Structural

- Thermal

- Electrical

- By Country

- Argentina

- Brazil

- Chile

- Colombia

- By Composition

- Market Size & Forecast

- Middle East & Africa Aerospace Ceramics Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Composition

- Oxide

- Non-Oxide

- Composites

- By Segment

- Commercial

- Défense

- Space

- By Application

- Structural

- Thermal

- Electrical

- By Country

- Saudi Arabia

- UAE

- Qatar

- South Africa

- By Composition

- Market Size & Forecast

- Global Aerospace Ceramics Market Policies & Regulatory Landscape

- Global Aerospace Ceramics Market Trends

- Global Aerospace Ceramics Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- Global Aerospace Ceramics White Market Space

- Global Aerospace Ceramics Pricing Analysis

- Competition Outlook

- Competition Matrix

- Target Markets

- Research & Development

- Collaborations & Strategic Alliances and Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs and Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Key Customers, Strategic Alliances/ Partnerships, Future Plans)

- Competition Matrix

- Disclaimer