- Overvew

- Table of Content

- Segmentation

- Request Sample

Market Definition

In order to create a material having qualities that are a blend of the component material properties, composite materials are created by combining at least two different materials on a macroscopic scale. Although the term “composites” can refer to a wide variety of materials, it is used in this article to refer to fiber-reinforced polymer composites, specifically those made of epoxy and carbon, fiberglass, and aramid fibres.

Market Insights

In 2022, the market for aircraft composites was valued at $1.5 billion and was anticipated to expand at a CAGR of 8.95% during the following five years. One of the main end-use industries for material innovation is the aircraft industry. The industry has traditionally been the first to use high-performance, lightweight materials like titanium, improved aluminium alloys, sandwich structures made of composite materials, carbon fibre composites, and forged carbon composites. The greatest market for aerospace composites is commercial aviation. Airbus and Boeing are the market leaders in this area. These OEMs are competing to develop new models with the highest potential composite percentages because they are the biggest consumers of composites in commercial aviation. Stricter regulations against carbon emissions, declining CFRP pricing, and growing sustainability commitments from key players in the value chain are further primary drivers for the expansion of composites. The only 2 models with a weight percentage of 50% or higher composites are the Boeing 787 and Airbus A350 series. The Boeing 777X, scheduled for delivery in 2024, will have a weight percentage of 50% composites. These aircraft will set the standard for future designs; by 2030, weights of 40%–50% composites will be commonplace.

The aerospace industry was negatively impacted by the COVID-19 epidemic. In comparison to 2019, the demand for new aircraft was significantly lower in 2020 and 2021. Wide-body aircraft, which have the biggest volume share of composites in contrast to other materials and include the Boeing 787 and Airbus A350 XWB, saw a sharp fall in demand. Due to these issues, demand for composites decreased by 40.5% between 2019 and 2021. The recovery of wide-body aircraft demands as well as the introduction of fresh narrow-body designs like the Airbus A220 will fuel composites’ rise during the course of the forecast. The penetration of composites in the airframe and engine sectors will be the main growth drivers. The penetration of thermoset CFRPs in big composite parts (such wings and fuselages) will rise as their average price drops. According to estimates, 46% to 50% of all CFRPs used in commercial aircraft will be epoxy-based. More than 90% of commercial aircraft produced worldwide are made by Boeing, Embraer, and Airbus. The production of composite parts is dominated by the Americas and Europe because these locations are where their products are manufactured. Nevertheless, during the projected period, this is anticipated to alter as the Middle East aircraft fleet grows as a result of rising indigenous aircraft production in RoW. Manufacturing of aircraft composite components in the region will receive a significant boost from investments in composite manufacturing in Saudi Arabia. The average price of aerospace composites will decrease during the forecast period because of the falling prices of carbon fiber and HPPs.

The market for composite aircraft resin is dominated by epoxy resin. Because it can produce big continuous components without compromising structural integrity, there is a significant demand for it. The most popular composite in fuselage applications is thermoset pre-preg made of carbon fibre tape and epoxy. The rising need for epoxy is a result of the dry textile carbon fibre layup method, which allows for a high fibre and low void content. The HPP market is the second-largest resin market. PEEK-based composites are now competitive with titanium and other metal-based components in engine and structural applications thanks to price reductions over the past five years.

Market Dynamics: Drivers

- Manufacturers will use more composite materials to produce engine and airframe components

- Demand for lightweight materials will increase as regulatory pressure to cut carbon emissions grows

- Greater design freedom will be possible with the use of composites. Smaller parts will no longer be required, allowing for weight reduction and a decrease in non-routine maintenance tasks

- Aerospace propulsion in the future will be powered by electricity and a combination of hydrogen fuel cells and batteries. High composite penetration will make aircraft lighter and smaller, which will fuel composite growth

Market Dynamics: Challenges

- Between 12% and 25% of airline passengers are business travelers. After the pandemic, this number will significantly decline as virtual reality and digital conferences become more widespread

- The regulatory policy of the sector imposes testing and permission at many levels, delaying the use of composites. Additionally, material, and technological upheavals happen too quickly for the bureaucracy of aircraft testing

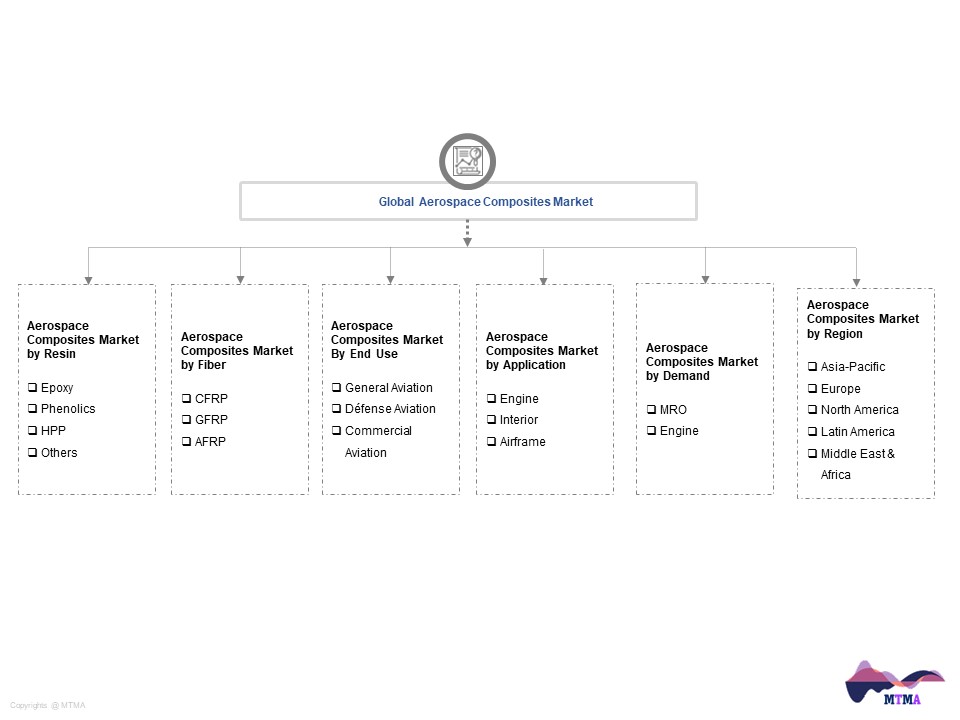

Market Segmentation

- Based on Resin, the Global Aerospace Composites market is segmented into

- Epoxy

- Phenolics

- HPP

- Others

- Based on Fiber, the Global Aerospace Composites market is segmented into

- CFRP

- GFRP

- AFRP

- Based on End Use, the Global Aerospace Composites market is segmented into

- General Aviation

- Défense Aviation

- Commercial Aviation

- Based on Application, the Global Aerospace Composites market is segmented into

- Engine

- Interior

- Airframe

- Based on Demand, the Global Aerospace Composites market is segmented into

- Engine

- MRO

- Based on Geography, the Global Aerospace Composites market is segmented into

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- All market revenue has been given in US Dollar.

Historical Year: 2020-2021

Base Year: 2022

Estimated: 2023

Forecast- 2024-2030

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of Global Aerospace Composites Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the Global Aerospace Composites Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in Global Aerospace Composites Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during Global Aerospace Composites Market study?

- Introduction

- Product Definition

- Market Taxonomy

- Research Process

- Brief on Secondary Sources Used

- Primary Research

- Sample Size

- List of Companies Interviewed

- Market Sizing Model

- Assumptions Used

- Model Description

- Forecast Model

- Executive Summary

- Impact of COVID-19 on Global Aerospace Composites Market

- Global Aerospace Composites Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Resin

- Epoxy

- Phenolics

- HPP

- Others

- By Fiber

- CFRP

- GFRP

- AFRP

- By End Use

- General Aviation

- Défense Aviation

- Commercial Aviation

- By Application

- Engine

- Interior

- Airframe

- By Demand

- Engine

- MRO

- By Region

- Asia-Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

- By Competition

- By Resin

- Market Size & Forecast

- North America Aerospace Composites Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Resin

- Epoxy

- Phenolics

- HPP

- Others

- By Fiber

- CFRP

- GFRP

- AFRP

- By End Use

- General Aviation

- Défense Aviation

- Commercial Aviation

- By Application

- Engine

- Interior

- Airframe

- By Demand

- Engine

- MRO

- By Country

- United States

- Canada

- By Resin

- Market Size & Forecast

- Asia-Pacific Aerospace Composites Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Resin

- Epoxy

- Phenolics

- HPP

- Others

- By Fiber

- CFRP

- GFRP

- AFRP

- By End Use

- General Aviation

- Défense Aviation

- Commercial Aviation

- By Application

- Engine

- Interior

- Airframe

- By Demand

- Engine

- MRO

- By Country

- Singapore

- Australia

- South Korea

- Hong Kong

- China

- By Resin

- Market Size & Forecast

- Europe Aerospace Composites Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Resin

- Epoxy

- Phenolics

- HPP

- Others

- By Fiber

- CFRP

- GFRP

- AFRP

- By End Use

- General Aviation

- Défense Aviation

- Commercial Aviation

- By Application

- Engine

- Interior

- Airframe

- By Demand

- Engine

- MRO

- By Country

- United Kingdom

- Switzerland

- Germany

- The Netherlands

- By Resin

- Market Size & Forecast

- Latin America Aerospace Composites Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Resin

- Epoxy

- Phenolics

- HPP

- Others

- By Fiber

- CFRP

- GFRP

- AFRP

- By End Use

- General Aviation

- Défense Aviation

- Commercial Aviation

- By Application

- Engine

- Interior

- Airframe

- By Demand

- Engine

- MRO

- By Country

- Argentina

- Brazil

- Chile

- Colombia

- By Resin

- Market Size & Forecast

- Middle East & Africa Aerospace Composites Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Resin

- Epoxy

- Phenolics

- HPP

- Others

- By Fiber

- CFRP

- GFRP

- AFRP

- By End Use

- General Aviation

- Défense Aviation

- Commercial Aviation

- By Application

- Engine

- Interior

- Airframe

- By Demand

- Engine

- MRO

- By Country

- Saudi Arabia

- UAE

- Qatar

- South Africa

- By Resin

- Market Size & Forecast

- Global Aerospace Composites Market Policies & Regulatory Landscape

- Global Aerospace Composites Market Trends

- Global Aerospace Composites Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- Global Aerospace Composites White Market Space

- Global Aerospace Composites Pricing Analysis

- Competition Outlook

- Competition Matrix

- Target Markets

- Research & Development

- Collaborations & Strategic Alliances and Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs and Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Key Customers, Strategic Alliances/ Partnerships, Future Plans)

- Competition Matrix

- Disclaimer