- Overvew

- Table of Content

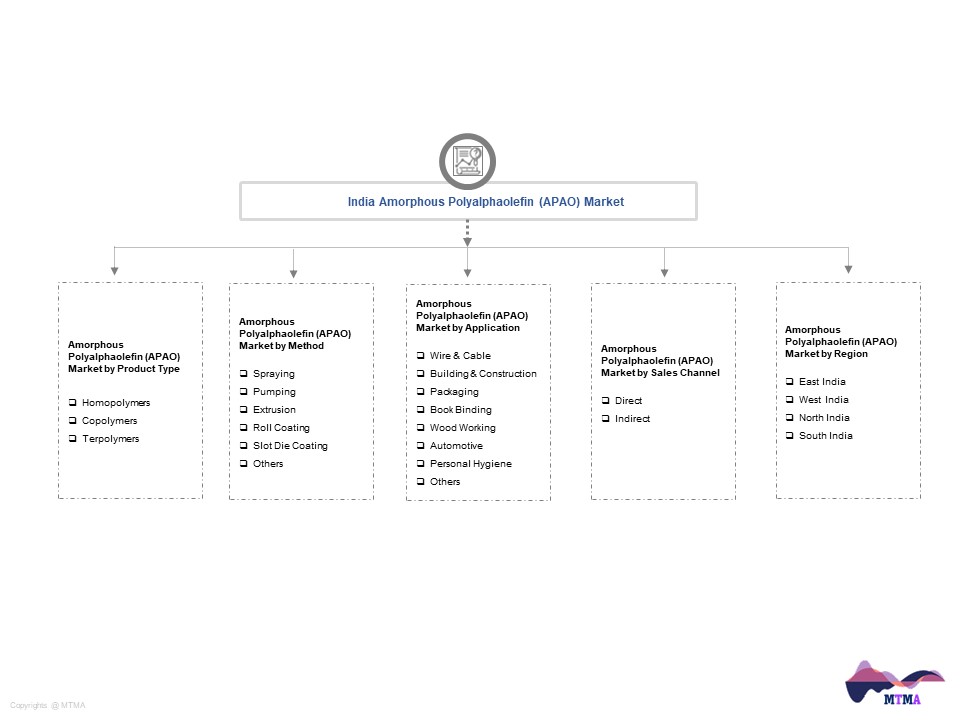

- Segmentation

- Request Sample

Market Definition

Isotactic polypropylene (iPP) produces a byproduct called APAO. Propylene and ethylene may currently be polymerized to produce APAO, and the development of the Ziegler-Natta (Z-N) catalyst has shown successful results when used in the polymerization process. An especially created catalyst system based on a Z-N supported catalyst and an alkyl aluminium cocatalyst produces AmAOs (enzyme 4-amorphen-11-ol synthase). The melting point of APAO is neither clearly defined or acute like that of other polymers. Instead, as its temperature rises, it becomes softer, transitioning across a large temperature range from a solid to a high viscosity fluid.

Market Insights

Hot-melt adhesives, which have a wide range of uses due to their adaptability, include APAO. In general, extrusion, rolling, pumping, slot coating, spraying, and other techniques can be used to apply hot melts. Due to their high viscosity, hot-melt adhesives work best on porous and permeable materials. A variety of substrates, including rubber, ceramic, metal, plastic, glass, and wood, can be bonded with hot-melt adhesives.

India is anticipated to contribute to the growth of APAO-based adhesive demand. These adhesives are widely used in many industries, including the packaging, automotive, and construction sectors. A sizeable component of the Indian APAO market is made up of feminine hygiene products. The use of adhesives based on APAO will rise in response to the high demand for feminine hygiene products. Additionally, it is anticipated that rising disposable income will lower the cost of sanitary napkins for consumers, which will increase sanitary napkin usage. The rural female population still does not use sanitary napkins, despite the upper-class female population’s demand for more superior hygiene goods.

India, a developing nation without the means to produce APAO, imports a significant quantity of the substance from nations including Germany, Italy, and the U.S. The import of APAO is crucial since it is widely used in numerous industries. Additionally, importing can lower manufacturing costs, making APAO more inexpensive than local production. Large importations of APAO can reduce the cost of the commodity. The table below lists a few APAO imports into India.

Market Dynamics: Drivers

Strong Demand from Automotive Sector

For more than a century, the automotive and transportation sectors have experienced constant expansion. Numerous reasons, including escalating urbanization, have been linked to this rise. The expansion of the automobile industry has paved the path for advancements in amorphous polyalphaolefin-based hot-melt adhesives. These adhesives can be used for many different things, including panel lamination, installing automobile seats over the phone, attaching trim, and attaching headlamp assemblies. Across the country, the number of automobile sales has been significantly increasing.

Rising Demand in Packaging Industries

The fifth-largest economic industry in India is packaging. Over the previous few years, steady progress has been noted, and there is a great deal of room for growth. Additionally, due to reduced labour costs in India, which makes it a desirable location for investment, the cost of processing and packaging food is roughly 40% lower there than it is in some regions of Europe. Additionally, industries like hard and soft drinks, particularly processed foods, fruit, and marine items, have a lot of promise. Additionally, the packaging sector in India has become well-known for its exports of printed sheets and components, flattened cans, crown corks, craft paper, lug caps, laminated plastic film, paper board, and packaging equipment. The fastest-growing packaging markets in the nation include laminates and flexible packaging, more specifically PET and woven sacks. It is clear that the packaging sector is a significant one that has been boosting innovation and technology growth over the past few years in the nation and enhancing a number of manufacturing industries, including agriculture and the fast-moving consumer goods sector. Adoption of APAO-based adhesives will be fueled by the packaging industry’s rapid growth, which will also serve as a major market driver.

Market Dynamics: Challenges

Raw Material Prices

The fluctuating cost of the raw materials needed to make polyolefins is one of the main factors impeding the growth of the APAO market. By (co-) polymerizing -olefins, such as propylene or 1-butene, using Ziegler-Natta catalysts, amorphous polyalphaolefins (APAOs) are created. The copolymers’ amorphous nature makes them suitable for making hot-melt adhesives. Crude oil is used to create APAO by turning it into propylene and other alpha olefins. The supply and demand, weather, geopolitics, and technological advancements in a market all affect oil prices. Oil supply is drained by depleted reserves in major oil-consuming countries, which may lead to an increase in oil prices. In addition, rising economies and rising consumption have driven up costs. When any major firms, like BP or Esso, have production volatility, prices rise. In a similar vein, cutting back on exploratory spending will usually result in higher prices. The large-scale manufacturing of APAO is directly impacted by all these varying circumstances. A sudden increase in oil prices makes it more expensive to produce APAO, which makes the security of its supply unpredictable and restrains market expansion.

Market Segmentation

- Based on Product Type, the India Amorphous Polyalphaolefin (APAO) market is segmented into

- Homopolymers

- Copolymers

- Terpolymers

- Based on Method, the India Amorphous Polyalphaolefin (APAO) market is segmented into

- Spraying

- Pumping

- Extrusion

- Roll Coating

- Slot Die Coating

- Others

- Based on Application, the India Amorphous Polyalphaolefin (APAO) market is segmented into

- Wire & Cable

- Building & Construction

- Packaging

- Book Binding

- Wood Working

- Automotive

- Personal Hygiene

- Others

- Based on Sales Channel, the India Amorphous Polyalphaolefin (APAO) market is segmented into

- Direct Sales

- Indirect Sales

- Based on Geography, the India Amorphous Polyalphaolefin (APAO) market is segmented into

- East India

- West India

- North India

- South India

- All market revenue has been given in US Dollar, while the market volumes are given in tons.

Historical Year: 2020-2021

Base Year: 2022

Estimated: 2023

Forecast- 2024-2030

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of India Amorphous Polyalphaolefin (APAO) Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the India Amorphous Polyalphaolefin (APAO) Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in India Amorphous Polyalphaolefin (APAO) Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during India Amorphous Polyalphaolefin (APAO) Market study?

- Introduction

- Product Definition

- Market Taxonomy

- Research Process

- Brief on Secondary Sources Used

- Primary Research (Sample Size; List of Companies Interviewed)

- Market Sizing Model (Assumptions Used, Model Description)

- Executive Summary

- Impact of COVID-19 on India Amorphous Polyalphaolefin (APAO) Market

- Trade Dynamics

- India Amorphous Polyalphaolefin (APAO) Market Value Chain Analysis

- India Amorphous Polyalphaolefin (APAO) Demand Supply Analysis

- Production

- Imports

- Exports

- Sales

- Demand-Supply Analysis

- India Amorphous Polyalphaolefin (APAO) Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Product Type

- Homopolymers

- Copolymers

- Terpolymers

- By Method

- Spraying

- Pumping

- Extrusion

- Roll Coating

- Slot Die Coating

- Others

- By Application

- Wire and Cable

- Building & Construction

- Packaging

- Book Binding

- Wood Working

- Automotive

- Personal Hygiene

- Others

- By Region

- By Company

- By Product Type

- Market Size & Forecast

- India Amorphous Polyalphaolefin (APAO) Market Policies & Regulatory Landscape

- India Amorphous Polyalphaolefin (APAO) Market Trends

- India Amorphous Polyalphaolefin (APAO) Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- India Amorphous Polyalphaolefin (APAO) White Market Space

- India Amorphous Polyalphaolefin (APAO) Pricing Analysis

- Competition Outlook

- Competition Matrix

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Key Customers, Strategic Alliances/ Partnerships, Future Plans)