- Overvew

- Table of Content

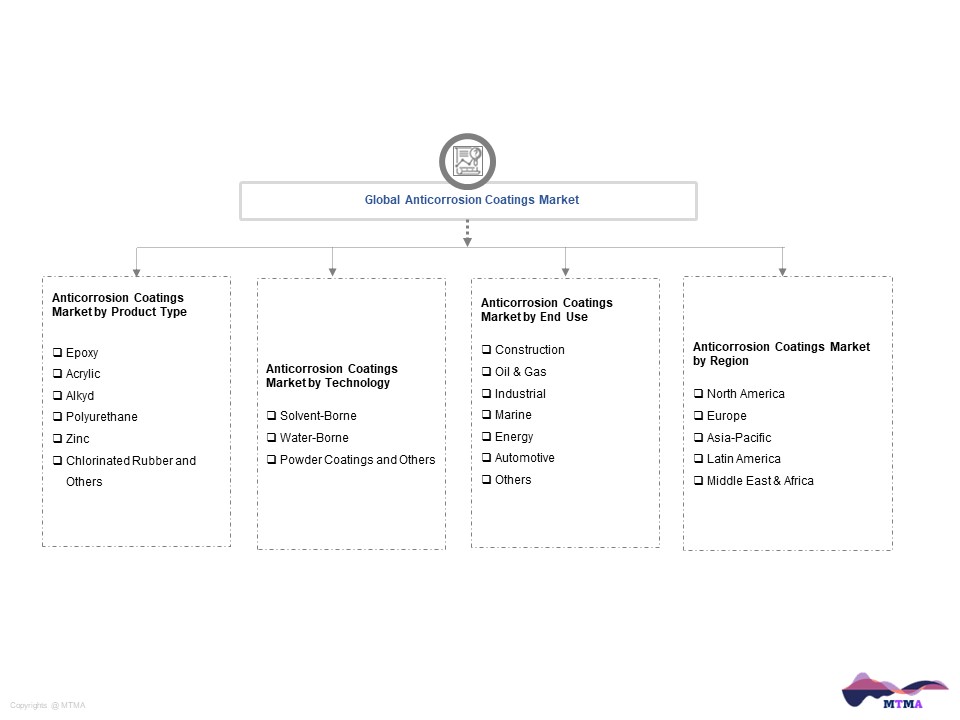

- Segmentation

- Request Sample

Market Definition

For components operating in severely corrosive environments, anti-corrosion coatings offer a strong level of corrosion protection. Although there are many alternatives for anti-corrosion coatings, they can be divided into three basic categories: barrier, inhibitive, and sacrificial.

Market Insights

Anticorrosion coatings are expected to have a $37.15 billion global market by 2030, up from $25.3 billion in 2022.Because anticorrosion coatings are widely used in the construction, marine, aerospace, and automotive industries, among others, the global market for them is predicted to expand significantly throughout the forecast period. In addition, increased maintenance-driven demand for corrosion protection in the oil & gas and industrial manufacturing sectors is anticipated to drive up demand for anticorrosion coatings throughout the forecast period.

Water-borne anticorrosion coatings are increasingly being used in the construction sector, which can be due to their widespread availability, environmental friendliness, and low VOC features. Critical applications in the construction sector include harsh and corrosive environments seen in industrial buildings and public infrastructure. Therefore, it is anticipated that the expanding construction industry in developing nations and massive infrastructure projects in emerging economies will boost the expansion of the anticorrosion coatings market throughout the course of the forecast year.

Due to growing knowledge of the negative effects of solvent-based coatings and different restrictions pertaining to volatile organic compounds (VOCs) and air pollutants that are damaging to the environment, the demand for water-based coatings is anticipated to increase over the course of the projected period. Due to the solvents’ carcinogenic and combustible characteristics, regulatory agencies’ rules for coatings producers are strict. As a result of their VOC-free qualities, powder- and water-based coatings are anticipated to become more common during the projection period.

Due to the strength of its manufacturing base, Asia is anticipated to continue being the major consumer of coatings and to experience the quickest growth in the future years. Additionally, over the projected period, it is anticipated that the specific industrial output of individual countries will be driven by the rising competitiveness of regional end-user demand supported by government actions to secure the local economy.

In rising economies including Turkey, China, India, Brazil, Indonesia, Thailand, and the Philippines, demand for anticorrosion coatings is anticipated to increase as a result of increasing industrial investment and supportive governmental policies encouraging infrastructure development. Governments are making enormous investments to support an industrial environment in their nations. These factors are anticipated to fuel the expansion of metal-based structures and equipment, which will in turn fuel demand for anticorrosion coatings.

The anticorrosion coatings market has grown over the past ten years in tandem with global economic expansion, but there are conflicting signals due to industry-wide issues that have an impact on project investments and expansion projects. These issues include the COVID pandemic crisis, sluggish economic growth, the geopolitical environment, the availability or affordability of technology, regulatory compliance, and rising costs.

Due to growing knowledge of the negative effects of solvent-based coatings and various regulations pertaining to volatile organic compounds (VOCs) and air pollutants that are harmful to the environment, the demand for water-based coatings is anticipated to increase over the course of the forecast period. Due to the solvents’ carcinogenic and combustible characteristics, regulatory agencies’ rules for coatings producers are strict. As a result of their VOC-free qualities, powder- and water-based coatings are anticipated to become more common during the projection period.

The growing infrastructure and development activities in the Asia-Pacific and Middle East regions are likely to fuel growth in the architectural application segment. The market is anticipated to be further driven by an expanding range of applications in the architectural sector, including for interior and external walls, doors, trimmings, and facades. In the architectural sector, severe government rules limiting VOC emissions and solvent content are anticipated to increase demand for water-borne anticorrosion coatings. Demand for high-performance coatings is anticipated to increase as maintenance tasks and specialised primers for concrete and metal structures become more popular.

Market Dynamics: Drivers

Growing Industrial Applications’ Need for Water as a Strategic Resource

Worldwide demand for industrial water has increased because to the rising requirement for feed water brought on by the quickening globalisation of trade, technical advancements, and infrastructure expansion. Water is now a necessary process input for practically any product’s preparation, processing, and production. The majority of process water used by manufacturing industries is obtained from surrounding bodies of water or is directly imported from desalination plants in some nations. The specifications for process water are different from those for drinking water. Mechanical filtration was the first step in the wastewater treatment industry’s development, which has since advanced with new technology. Companies have been able to increase R&D spending and customer-centric technology development due to the growing need for process optimisation and flexibility in the process control technology side of the systems. From the perspective of how much more material is being used, these technological advancements have been made. Rigidity, longevity, corrosion resistance, wear resistance, and chemical abrasion resistance are all included in the material specification. One of the most important elements in wastewater treatment plants is the growing emphasis on energy conservation. It is essential that the total cost of ownership be greatly decreased to permit ROI and to achieve breakeven in a short period of time given the significant increase in the cost of energy per unit and to achieve economy of scale in the development of water treatment projects.

Market Dynamics: Challenges

Concerns about rising operational expenditures (OPEX)

Industrial production facilities are being compelled to use technology to run agile operations more and more. The goal of these technologies is to align all major cost centres, from transportation and handling to processing, HVAC, and waste disposal, in order to achieve the necessary performance metrics. In the assembly of each of these applications, anticorrosion-coated components are used. Technology has changed recently, focusing more on the digital side of business and less on the footprint of machinery, prompting organisations to use predictive analytics to determine the likelihood of failure.

Price variations for consumable maintenance items, such as anticorrosion coatings, as a result of volatility in the upstream oil markets, are another cost factor. Given that many coatings are made using petroleum derivatives, this directly affects chemical pricing. Over the past five years, prices for amines, polymers, and phosphonates have all increased similarly. The cost of operations of water handling facilities in large capital expenditure (CAPEX) sectors is similarly impacted by energy costs.

The high level of technical expertise needed and the lack of qualified maintenance staff and operators present additional problem with technology adoption. These operations also need a consistent energy source, a supply of chemicals, and a particular set of services. Due to the large initial CAPEX required, the affordability of sustainable advanced solutions is a big challenge for many plant owners.

Operation costs include costs associated with the upkeep, running, and monitoring of the plant through the use of tools and preventative measures like analytics, artificial intelligence, and other machine-learning methods. The price of maintenance, energy use, and pollution can all have a big impact on operating expenses. The budget could also increase due to increased wages and the outsourcing of some services. Treatment for corrosion is an ongoing OPEX expense. However, because it is inescapable and regarded as an investment in and of itself, it could add to the cost element.

The size of the plant, the number of staff, the location, the kind of effluent treated, the choice of technologies and chemicals, and the level of automation integration are other factors that affect the initial setup cost. The cost of OPEX is expected to rise as regulations governing treatment practises are increasingly enforced.

An unavoidable cost issue in a manufacturing setting is the ROI on such support facilities. Few businesses choose to install partially automated or semi-mechanized systems for wastewater treatment plants. These significant investments must be protected from corrosion, which reduces productivity.

India, Indonesia, Vietnam, the Philippines, Malaysia, Taiwan, Brazil, and South Africa are examples of emerging economies that lag behind technologically advanced developed nations. A handful of these countries have established strategy programmes for the growth of long-term industry clusters focused on exports, taking into account the economic value generated and job creation. However, it is anticipated that the issue of growing OPEX worries among project developers will persist in the short term and fade in the long run.

Market Segmentation

- Based on Product Type, the Global Anticorrosion Coatings market is segmented into

- Epoxy

- Acrylic

- Alkyd

- Polyurethane

- Zinc

- Chlorinated Rubber and Others

- Based on Technology, the Global Anticorrosion Coatings market is segmented into

- Solvent-Borne

- Water-Borne

- Powder Coatings and Others

- Based on End Use, the Global Anticorrosion Coatings market is segmented into

- Construction

- Oil & Gas

- Industrial

- Marine

- Energy

- Automotive

- Others

- Based on Geography, the Global Anticorrosion Coatings market is segmented into

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- All market revenue has been given in US Dollar.

Historical Year: 2020-2021

Base Year: 2022

Estimated: 2023

Forecast- 2024-2030

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of Global Anticorrosion Coatings Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the Global Anticorrosion Coatings Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in Global Anticorrosion Coatings Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during Global Anticorrosion Coatings Market study?

- Introduction

- Product Definition

- Market Taxonomy

- Research Process

- Brief on Secondary Sources Used

- Primary Research

- Sample Size

- List of Companies Interviewed

- Market Sizing Model

- Assumptions Used

- Model Description

- Forecast Model

- Executive Summary

- Impact of COVID-19 on Global Anticorrosion Coatings Market

- Standards and Certifications in Global Anticorrosion Coatings Market

- Trade Dynamics

- Imports

- Exports

- Global Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- Epoxy

- Acrylic

- Alkyd

- Polyurethane

- Zinc

- Chlorinated Rubber and Others

- By Technology

- Solvent-Borne

- Water-Borne

- Powder Coatings and Others

- By End User Industry

- Construction

- Oil & Gas

- Industrial

- Marine

- Energy

- Automotive

- Others

- By Region

- Asia-Pacific

- North America

- Latin America

- Europe

- Middle East & Africa

- By Competition

- By Product Type

- Market Size & Forecast

- North America Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- Epoxy

- Acrylic

- Alkyd

- Polyurethane

- Zinc

- Chlorinated Rubber and Others

- Non- Biodegradable

- By Technology

- Solvent-Borne

- Water-Borne

- Powder Coatings and Others

- By End User Industry

- Construction

- Oil & Gas

- Industrial

- Marine

- Energy

- Automotive

- Others

- By Country

- United States

- Canada

- Mexico

- By Product Type

- Market Size & Forecast

- Europe Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- Epoxy

- Acrylic

- Alkyd

- Polyurethane

- Zinc

- Chlorinated Rubber and Others

- Non- Biodegradable

- By Technology

- Solvent-Borne

- Water-Borne

- Powder Coatings and Others

- By End User Industry

- Construction

- Oil & Gas

- Industrial

- Marine

- Energy

- Automotive

- Others

- By Country

- Germany

- United Kingdom

- France

- Italy

- Spain

- By Product Type

- Market Size & Forecast

- Asia-Pacific Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- Epoxy

- Acrylic

- Alkyd

- Polyurethane

- Zinc

- Chlorinated Rubber and Others

- Non- Biodegradable

- By Technology

- Solvent-Borne

- Water-Borne

- Powder Coatings and Others

- By End User Industry

- Construction

- Oil & Gas

- Industrial

- Marine

- Energy

- Automotive

- Others

- By Country

- China

- India

- Japan

- South Korea

- By Product Type

- Market Size & Forecast

- Latin America Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- Epoxy

- Acrylic

- Alkyd

- Polyurethane

- Zinc

- Chlorinated Rubber and Others

- Non- Biodegradable

- By Technology

- Solvent-Borne

- Water-Borne

- Powder Coatings and Others

- By End User Industry

- Construction

- Oil & Gas

- Industrial

- Marine

- Energy

- Automotive

- Others

- By Country

- Brazil

- Argentina

- Chile

- By Product Type

- Market Size & Forecast

- Middle East & Africa Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- Epoxy

- Acrylic

- Alkyd

- Polyurethane

- Zinc

- Chlorinated Rubber and Others

- Non- Biodegradable

- By Technology

- Solvent-Borne

- Water-Borne

- Powder Coatings and Others

- By End User Industry

- Construction

- Oil & Gas

- Industrial

- Marine

- Energy

- Automotive

- Others

- By Country

- GCC

- South Africa

- By Product Type

- Market Size & Forecast

- China Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- India Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- Japan Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- South Korea Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- Australia & New Zealand Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- Germany Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- United Kingdom Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- France Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- Italy Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- Spain Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- Russia Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- United States Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- Brazil Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- Canada Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- Mexico Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- Argentina Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- Saudi Arabia Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- UAE Anticorrosion Coatings Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Product Type

- By Technology

- By End User Industry

- Market Size & Forecast

- Global Anticorrosion Coatings Market Trends

- Global Anticorrosion Coatings Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- Global Anticorrosion Coatings White Market Space

- Global Anticorrosion Coatings Pricing Analysis

- Competition Outlook

- Competition Matrix

- Target Markets

- Research & Development

- Collaborations & Strategic Alliances and Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs and Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Key Customers, Strategic Alliances/ Partnerships, Future Plans)

- Competition Matrix

- Disclaimer