- Overvew

- Table of Content

- Segmentation

- Segmentation

- Request Sample

Market Definition

Conformal coatings are thin polymeric films applied to electronic assemblies to protect circuitry from moisture, dust, chemicals, and temperature extremes. These coatings—based on chemistries such as acrylics, silicones, polyurethane, and epoxy—provide electrical insulation and environmental protection for printed circuit boards (PCBs) across consumer electronics, automotive electronics, aerospace, and industrial applications. Over the last two years, the global supply chain disruptions and changing demand patterns have had a considerable impact on the production, pricing, and availability of key coating resins, solvents, and specialty additives used in conformal coating formulations.

Market Insights

Supply-side constraints and logistics challenges in 2021 and 2022—stemming from pandemic-induced factory slowdowns, container shortages, and raw material price spikes—temporarily disrupted conformal coating supply chains and increased costs for OEMs and EMS providers. Demand in some segments contracted as consumer electronics slowdown and production delays reduced short-term consumption of protective coatings. Though demand is predicted to recover in 2023 as component shortages ease and electronics manufacturing normalizes, total demand may remain below the pre-pandemic peak in specific end-use verticals. Other factors contributing to near-term volatility, beyond supply-chain issues, include semiconductor shortages that constrained PCB volumes, uneven recovery across geographies, and slower capital expenditure cycles in some industrial segments.

Environmental and regulatory trends are reshaping the conformal coatings market over the medium to long term. Stricter VOC regulations, restrictions on certain solvents and halogenated additives, and preference for low-emission, low-odour chemistries are pushing formulators toward water-based and UV-curable systems. While it is difficult to forecast exact adoption timing due to the fragmented regulatory landscape, global demand is expected to expand from 2023 onward as industries prioritize reliability and miniaturization-driven protection needs. The Asia-Pacific region and North America are forecast to drive growth because of strong electronics manufacturing bases and rising automotive electronics penetration (including EVs), which require advanced coating solutions.

Because many conformal coating resins rely on petrochemical-derived monomers and specialty additives, the market is vulnerable to fluctuations in feedstock prices and import dependencies. However, compared to some single-use commodity polymers, conformal coatings are driven more by performance requirements—such as thermal stability, dielectric strength, and chemical resistance—so demand is relatively resilient. In scenarios of supply or pricing shocks, OEMs tend to prioritize critical protective chemistries for mission-critical electronics over lower-priority applications. Demand for silicone- and polyurethane-based coatings, for example, fell less in 2021–2022 compared with some solvent-heavy acrylics due to their indispensable role in high-reliability sectors like aerospace and automotive.

Demand for conformal coatings is expected to rebound as manufacturers address supply bottlenecks and as electronics production for automotive, medical devices, and industrial automation accelerates. Adoption is being supported by design trends—such as higher PCB density, miniaturization, and increased use of electronics in harsh environments—that make conformal protection essential. Long-term growth will also be influenced by the industry’s shift toward greener chemistries and process innovations (selective automated dispensing, selective coating with robotic systems, and in-line UV curing), which improve throughput and reduce life-cycle environmental impact.

The competitive landscape remains a mix of large multinational chemical companies with broad specialty coatings portfolios and regional formulators addressing local EMS and OEM needs. Major global players dominate premium, high-performance segments, while smaller, agile manufacturers capture industrial and regional aftermarket demand. Geopolitical events such as trade restrictions and energy price shocks affected supply chains—raising raw material costs and compressing margins—yet many producers increased regional capacity or diversified suppliers to mitigate disruption. While sales volumes dipped in certain channels during 2021–2022, revenues held up due to higher average selling prices driven by raw material pass-throughs.

Market Dynamics: Drivers

Miniaturization of electronics, increased electronic content per vehicle (particularly in EVs), growth in industrial automation, and the expanding use of electronics in harsh-environment applications (oil & gas, marine, outdoor infrastructure) are major drivers of conformal coating adoption. The shift toward higher reliability and longer product lifecycles compels OEMs to specify advanced coating chemistries, while safety, performance and warranty considerations make conformal coatings a preferred protective solution in many regulated sectors.

Market Dynamics: Challenges

Rising raw material and energy prices, coupled with pandemic-related logistics constraints, continue to affect conformal coating availability and pricing in the near term. Regulatory pressures to reduce VOCs and eliminate certain hazardous solvents force reformulation and capital investment in new production lines. Additionally, the fragmented nature of electronics manufacturing—varying application methods, quality standards, and inspection requirements—complicates standardization and scale-up for new coating chemistries. Finally, the shortage of trained application engineers and the capital cost of automated selective coating systems can hinder adoption among smaller EMS providers.

Market Segmentation

Based on Product Type, the Global Conformal Coatings market is segmented into

- Acrylic Coatings

- Silicone Coatings

- Urethane/Polyurethane Coatings

- Epoxy Coatings

- Parylene Coatings

- UV-Curable Coatings

- Water-Based Coatings

- Others

Based on Application, the Global Conformal Coatings market is segmented into

- Automotive Electronics

- Consumer Electronics

- Industrial & Automation

- Aerospace & Defense

- Medical Devices

- Renewable Energy (e.g., PV inverters)

- Others

Based on Application Method, the Global Conformal Coatings market is segmented into

- Dip Coating

- Spray Coating

- Selective Coating (Dispensing/Robotic)

- Brush Coating

- Vapor Deposition (Parylene)

Based on End User, the Global Conformal Coatings market is segmented into

- OEMs (Electronics, Automotive, Aerospace)

- EMS Providers

- Aftermarket & Repair Shops

Based on Geography, the Global Conformal Coatings market is segmented into

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

All market revenue has been given in US Dollar, while the market volumes are given in tons.

Historical Year: 2021–2024

Base Year: 2025

Estimated: 2026

Forecast: 2027–2031

Key Questions this Study will Answer

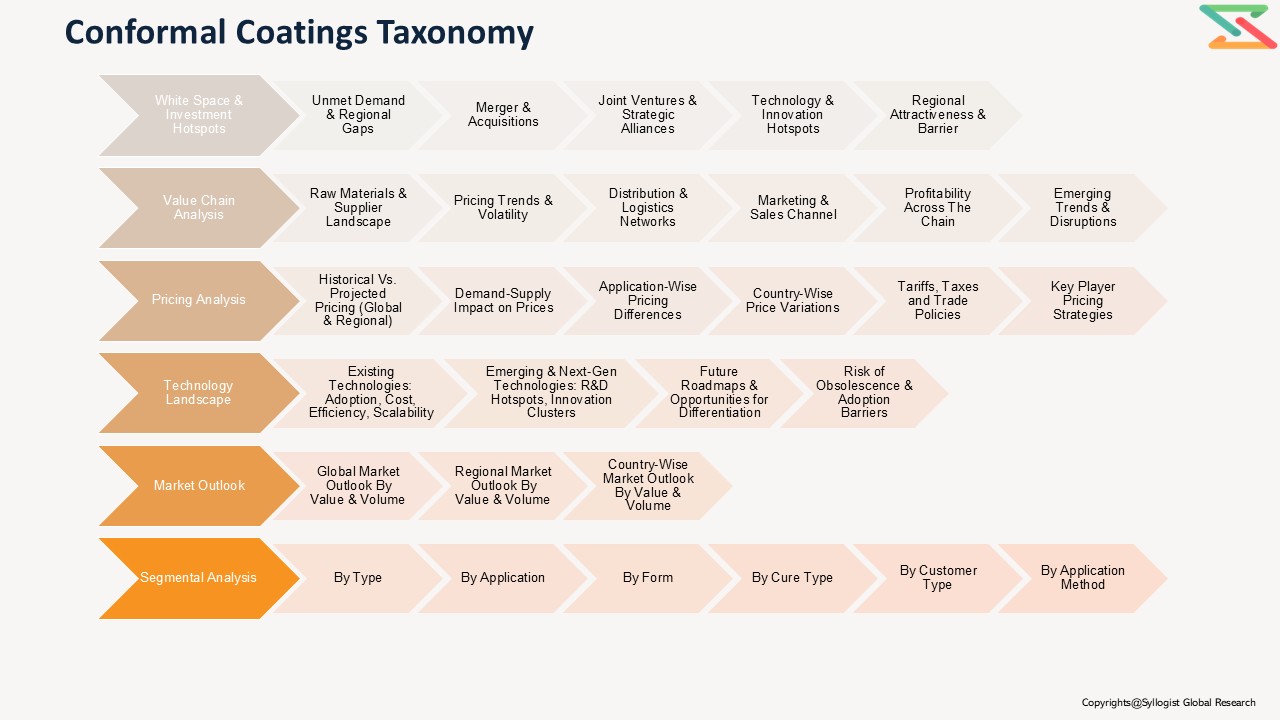

- What are the key overall market statistics or market estimates (Market Overview, Market Size-By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of Global Conformal Coatings Market?

- What is the region-wise industry size, growth drivers and challenges, and key market trends?

What are the key innovations, opportunities, current and future trends, and regulations in the Global Conformal Coatings Market? - Who are the key competitors, what are their key strengths and weaknesses, and how do they perform in the Global Conformal Coatings Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during the Global Conformal Coatings Market study?

- Market Foundations & Dynamics

- Introduction

1.1. Product Overview (Definition & Scope of Conformal Coatings — acrylics, silicones, urethanes, Parylene, epoxy, UV-cure)

1.1.2. Coating Lifecycle Overview (Formulation → Application → Curing → Service → Removal/Repair)

1.1.3. Research Methodology

1.1.4. Executive Summary

1.1.5. Major Trends Shaping the Market (miniaturization, IoT, automotive electrification, RoHS/REACH impact)

1.1.6. Short-Term vs. Long-Term Opportunities (consumer electronics vs. automotive & aerospace adoption)

1.1.7. Comparison of Reworkable vs. Permanent Coatings; Liquid vs. Vapor Deposition (Parylene)

1.1.8. Scenario Planning (Base, Optimistic, Conservative)

1.1.9. Sensitivity Analysis (PCB volumes, electronics outsourcing trends, raw material costs)

1.1.10. Identification of Regional Investment Hotspots - Market Dynamics

- Introduction

- Drivers (growing electronics reliability requirements, harsh-environment protection needs, increased conformal coating specifications)

- Restraints (stringent flammability & VOC regulations, repairability concerns)

- Opportunities (automotive ADAS/EVs, 5G equipment, medical devices, industrial IoT)

- Challenges (process control for miniaturized assemblies, material compatibility)

- Porter’s Five Forces Analysis

- PESTLE Analysis

- Market Ecosystem & Value Chain

3.1. Overview of Value Chain Participants

1.3.1.1. Raw Material Suppliers (resins, solvents, monomers, additives)

1.3.1.2. Coating Manufacturers (global, regional, specialty formulators)

1.3.1.3. Application Equipment Suppliers (spray, selective coating, dip, vapor deposition)

1.3.1.4. EMS / PCB Assembly Houses (in-house vs. outsourced coating)

1.3.1.5. Test Laboratories & Certification Bodies

1.3.1.6. End-Use Sectors (Consumer Electronics, Automotive, Aerospace, Industrial, Medical, Telecom)

1.3.2. Flow of Value and Material Through the Chain

1.3.3. Value Addition and Margins at Each Stage

1.3.3.1. Resin & Additive Procurement

1.3.3.2. Formulation & R&D

1.3.3.3. Application & Process Control

1.3.3.4. Testing, Certification & Aftermarket Services

1.3.4. Integration Trends (OEM vs. EMS-controlled coating operations)

1.3.5. Impact of Vertical Integration (formulator + applicator, captive supply) - Mapping of Roles and Interdependencies

- Market Trends & Developments

5.1. White Market Space Analysis (selective coating for 3D-printed electronics, high-temp electronics)

1.5.2. Demand–Supply Gaps (low-VOC, low-outgassing, high-reliability grades)

1.5.3. Investment Hotspots (Asia-Pacific contract coating capacity, automotive hubs)

1.5.4. Unmet Needs (repair-friendly coatings, faster cure, better adhesion on new substrates) - Risk Assessment Framework

6.1. Political / Geopolitical Risk (trade tariffs, supply-chain concentration)

1.6.2. Operational Risk (process variability, solvent handling)

1.6.3. Environmental Risk (VOC emissions, solvent recovery)

1.6.4. Financial Risk (raw material price volatility, capital intensity of coating lines)

- Market Ecosystem & Value Chain

- Regulatory Framework & Standards

- Global Regulatory Overview

1.1. RoHS / REACH / TSCA implications for coating chemistries

2.1.2. UL flammability and safety standards for electronic materials

2.1.3. Aerospace & Defense specifications (e.g., NASA, military standards)

2.2. Compliance & Certification Requirements (IPC-CC-830, IPC-A-610 guidance, MIL specs)

2.3. Transportation and Storage Regulations (hazardous solvent shipping, UN classifications)

2.4. Safety & Quality Standards (outgassing, corrosion resistance, dielectric strength)

2.5. Environmental & Liability Considerations (VOC limits, solvent recovery, waste handling)

2.6. Traceability & Material Declaration (RoHS/REACH reporting, material declarations for OEMs)

- Global Regulatory Overview

- Technology Landscape

- Coating Chemistries & Properties

1.1. Acrylics — advantages, limitations, typical uses

3.1.2. Silicones — high-temp, flexibility, electrical insulation

3.1.3. Urethanes/Polyurethanes — chemical resistance, durability

3.1.4. Epoxies — mechanical protection, hardness

3.1.5. Parylene (vapor deposition) — pinhole-free thin films, conformality

3.1.6. UV-Curable & Low-VOC Formulations

3.2. Application Methods & Equipment

3.2.1. Spray Coating (robotic and manual)

3.2.2. Selective/Precision Coating (needle/jet, selective dispensers)

3.2.3. Dip and Flood Coating

3.2.4. Vapor Deposition (Parylene)

3.2.5. Cure Processes (thermal, UV, moisture)

3.3. Process Control, Inline Inspection & Automation (vision systems, thickness measurement)

3.4. Testing & Qualification Technologies (salt spray, thermal cycling, insulation resistance, dielectric breakdown)

3.5. Materials Science Advances (nano-additives, adhesion promoters, hydrophobic/hydrophilic tuning)

3.6. Innovations to Reduce Cure Time, VOCs & Improve Repairability

- Coating Chemistries & Properties

- Global, Regional & Country Forecasts (2020–2035)

- Global Conformal Coatings Market Outlook (value, volume)

- Market Share by:

2.1. By Product Type (Acrylic, Silicone, Urethane, Epoxy, Parylene, UV-Cure)

4.2.2. By Application/End-Use (Consumer Electronics, Automotive Electronics, Industrial Controls, Aerospace & Defense, Medical Devices, Telecom & Datacom, Renewable Energy Inverters)

4.2.3. By Form (Solvent-borne, Water-borne, Solvent-free, Vapor)

4.2.4. By Application Method (Selective, Spray, Dip, Vapor Deposition)

4.2.5. By Cure Type (Thermal, UV, Moisture-Cure)

4.2.6. By Customer Type (OEM, EMS, Aftermarket)

4.2.7. By Company - Regional & Country Outlook (2020–2035)

3.1. Asia-Pacific (China, Taiwan, South Korea, Japan, India, Vietnam)

4.3.2. North America (U.S., Canada, Mexico)

4.3.3. Europe (Germany, UK, France, Italy)

4.3.4. Latin America (Brazil, Mexico)

4.3.5. Middle East & Africa (UAE, South Africa)

- Pricing Analysis

- Overview of Pricing Structures (per litre / per kg; pricing by grade & form)

2. Average Selling Price (ASP) Trends by Chemistry and Region

5.3. Cost Benchmark: Specialty Low-VOC / Parylene vs. Commodity Acrylics

5.4. Price Sensitivity by Application (high-reliability aerospace vs. consumer electronics)

5.5. Historical Price Evolution (2015–2025)

5.6. Forecast Pricing Curve (2025–2035)

5.7. Factors Influencing Price: Raw materials (resins, solvents, monomers), energy, compliance costs, equipment amortization

5.8. Regional Pricing Differentiation (Asia manufacturing cost advantage vs. Western premium grades)

5.9. Impact of Regulatory Shifts & Raw Material Availability on Pricing

- Overview of Pricing Structures (per litre / per kg; pricing by grade & form)

- Competition Outlook

- Market Concentration and Fragmentation Level

2. Company Market Shares (Top 10 Global & Regional Players)

6.3. Competitive Strategies (new low-VOC formulations, service & application capabilities, regional footprint)

6.4. Benchmarking Matrix (Chemistry Portfolio vs. Application Expertise vs. Service Presence)

6.5. Recent Developments (M&A, joint ventures, new product launches, capacity expansions)

- Market Concentration and Fragmentation Level

- Cost Structure & Margin Analysis

- Detailed Cost Breakdown (resins, solvents, additives, packaging, QA/QC)

2. Average Cost per Stage (R&D/formulation, manufacturing, packaging, application equipment)

7.3. Profitability and Margin Distribution Along Value Chain

7.3.1. Raw Material Supplier Margin

7.3.2. Formulator / Manufacturer Margin

7.3.3. Application Service (EMS) Margin

7.3.4. Distributor / Trader Margin

7.4. Sensitivity Analysis: How Raw Material Prices & Process Efficiency Impact Margin

7.5. Cost Reduction Opportunities (waterborne shift, solvent recovery, process automation)

- Detailed Cost Breakdown (resins, solvents, additives, packaging, QA/QC)

- Business Models & Strategic Insights

- Formulator & Manufacturer Models (global formulators vs. regional specialists)

2. EMS / OEM In-House Application Models

8.3. Contract Coating & Turnkey Application Services

8.4. Coating-as-a-Service / Managed Application Models (outsourced coating lines)

8.5. Integrated Supply (coating + application equipment + process control)

8.6. Economic Viability Comparison of Models

8.7. SWOT Analysis of Leading Models

- Formulator & Manufacturer Models (global formulators vs. regional specialists)

- Investment & Financial Analysis

- CAPEX and OPEX Benchmarks for Coating Plants & Application Lines

2. Payback Period and IRR Sensitivity (by region, equipment automation level)

9.3. Financial Modeling Assumptions (capacity utilization, yield loss, service revenues)

9.4. Revenue Streams: Product Sales, Contract Coating Services, Equipment & Consumables

9.5. Investment Case Studies (greenfield coating plant, Parylene deposition facility, EMS line retrofits)

9.6. Funding Landscape: Strategic Investors, PE, government incentives for low-VOC tech

- CAPEX and OPEX Benchmarks for Coating Plants & Application Lines

- Sales & Distribution Channel Analysis

- Overview of Go-to-Market Channels

1.1. Direct Sales (to OEMs & EMS)

10.1.2. Indirect Sales via Distributors & Chemical Traders

10.1.3. Service Contracts & Application Partnerships

10.2. Channel Share by Region

10.3. Typical Channel Flow Diagram (manufacturer → distributor → EMS/OEM → end-user)

10.4. Sales Process (specification, qualification, samples, process trials)

10.5. Distribution Strategies by Leading Players (local stocking, technical support centers)

10.6. Emerging Trends:

10.6.1. Digital Spec Platforms & Technical Portals

10.6.2. On-site Mobile Coating Services

10.6.3. Consumable & Replenishment Subscriptions

- Overview of Go-to-Market Channels

- Strategic Recommendations & Roadmap

- Competitors’ Strategic Initiatives (sustainability claims, digital services, regional expansions)

2. Future Outlook (next 5–10 years — electrification, miniaturization, more stringent VOC/flammability rules)

11.3. Strategic Recommendations

11.3.1. Technology & Product Advancements to Watch (low-VOC chemistries, UV/rapid cure, Parylene alternatives)

11.3.2. Process & Quality Roadmap (inline inspection, digital traceability, repairable coatings)

11.3.3. Strategic Recommendations for Stakeholders (formulators, EMS, OEMs, investors)

11.4. Conformal Coatings Market Acceleration Roadmap

11.4.1. Short-term (2025–2027): Pilot low-VOC lines, strengthen supply-chain resilience

11.4.2. Mid-term (2028–2030): Scale selective automated application, target automotive & telecom sectors

11.4.3. Long-term (2031–2035): Move toward solvent-free/vapor deposition alternatives, full digital process control

11.5. Tailored recommendations for:

11.5.1. Coating Manufacturers & Formulators

11.5.2. EMS & OEM Coating Operations

11.5.3. Application Equipment Vendors

11.6. Recommendations on Key Success Factors

11.6.1. Partnerships & Alliances (equipment + material + EMS)

11.6.2. Digitalization & Quality Traceability (inline metrology, COA dashboards)

11.6.3. Regulatory Alignment & Low-Emission Certifications

11.6.4. Investor Confidence & Capital Availability

- Competitors’ Strategic Initiatives (sustainability claims, digital services, regional expansions)