- Overvew

- Table of Content

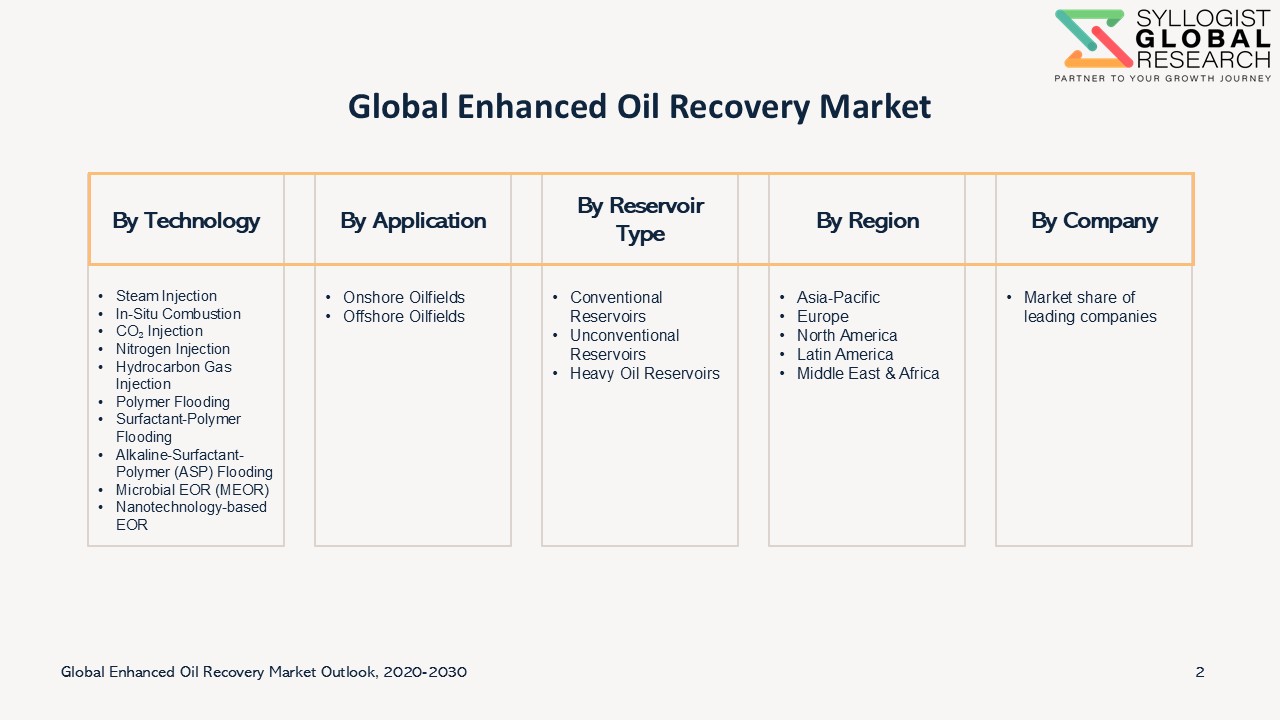

- Segmentation

- Request Sample

Market Definition

Enhanced Oil Recovery (EOR) refers to a set of advanced techniques used to increase the amount of crude oil that can be extracted from an oil reservoir beyond what is possible through primary (natural reservoir pressure) and secondary (water or gas injection) recovery methods. EOR methods, such as thermal injection, chemical flooding, and gas injection (including CO₂ and nitrogen), alter the physical and chemical properties of the oil, reduce its viscosity, or improve reservoir pressure, thereby enabling recovery of an additional 20–40% of the reservoir’s original oil in place.

Market Insights

The Enhanced Oil Recovery (EOR) market is becoming increasingly important as conventional oil production methods reach their limits. While primary and secondary recovery techniques typically extract only 30–40% of a reservoir’s oil, EOR technologies can boost recovery rates to 60–70%, extending the life of mature fields and maximizing returns on existing infrastructure. The market encompasses three main approaches, thermal, chemical, and gas injection methods, with gas-based CO₂ injection and steam-assisted techniques dominating adoption globally. Driven by rising global energy demand, the need to sustain oil production, and emerging opportunities in carbon capture, utilization, and storage (CCUS), the EOR market is expected to expand steadily in the coming years.

A key driver of the EOR market is the growing global demand for energy amid declining production from conventional fields. Despite accelerated investment in renewable energy, fossil fuels continue to account for a major share of global energy consumption, particularly in developing economies. With many oil fields maturing in North America, the Middle East, and Asia-Pacific, operators are increasingly turning to EOR technologies to sustain output. By enhancing recovery efficiency, EOR allows oil companies to delay field abandonment, optimize production infrastructure, and increase return on investment. This trend ensures that EOR remains strategically important even as the global energy transition gains momentum.

Another major growth factor is the rising adoption of CO₂-based EOR techniques, which serve the dual purpose of boosting oil recovery while supporting decarbonization goals. CO₂-EOR not only increases reservoir pressure but also permanently stores captured carbon underground, aligning with global carbon neutrality commitments. Governments and energy companies, especially in the U.S., Middle East, and China, are incentivizing large-scale CO₂-EOR projects through subsidies, tax credits, and partnerships. For example, the U.S. 45Q tax credit for carbon capture and storage has accelerated CO₂-EOR deployment, while Middle Eastern producers are integrating EOR into national energy strategies. This synergy between oil recovery and climate action is making CO₂-EOR one of the most promising growth areas within the sector.

Technological advancements in chemical and thermal EOR methods are also broadening the market’s potential. Innovations in polymer and surfactant flooding, as well as Alkaline-Surfactant-Polymer (ASP) techniques, are improving cost efficiency and enabling recovery from complex reservoirs, particularly in Asia-Pacific and Latin America. Thermal methods like steam-assisted gravity drainage (SAGD) remain dominant in Canada’s oil sands, while emerging microbial and nanotechnology-based EOR techniques are attracting attention for their ability to reduce costs and environmental impact. Continuous R&D and digital integration are making EOR more adaptable, helping oil producers overcome challenges in unconventional and deepwater reservoirs.

However, the market faces challenges that could limit its pace of adoption. High capital intensity and operational costs remain major hurdles, as EOR projects require significant investment in injection facilities, steam generators, chemical plants, and CO₂ pipelines. Fluctuating crude oil prices also affect the economic viability of projects, with companies often delaying or scaling back EOR initiatives during periods of low prices. Furthermore, environmental and regulatory concerns around water usage, emissions, and chemical handling create additional barriers. As regulators and investors demand lower-carbon practices, companies must balance energy security with sustainability, making the adoption of cleaner and more efficient EOR technologies essential.

Regionally, North America leads the global EOR market, driven by the U.S.’s strong deployment of CO₂-EOR and technological innovation. The Middle East is emerging as a major growth hub, with countries like Oman, Saudi Arabia, and the UAE investing heavily in thermal and chemical EOR to maximize recovery from giant reservoirs. Asia-Pacific, led by China and India, is seeing increased adoption of chemical and thermal EOR to reduce reliance on imports, while Latin America, particularly Brazil and Venezuela, is focusing on offshore and heavy oil reserves.

Looking ahead, the global EOR market will continue to expand, shaped by the interplay of energy demand, sustainability, and technology. While challenges around costs and environmental concerns persist, innovations in CO₂ utilization, digital oilfield integration, and next-generation EOR methods will unlock new opportunities. As oil producers seek to balance profitability with climate commitments, EOR will remain a critical enabler of efficient, sustainable oil production.

Market Dynamics: Drivers

Rising Global Energy Demand and Declining Conventional Oil Fields

The continuous rise in global energy demand, driven by population growth, industrialization, and transportation needs, is pushing oil producers to maximize extraction from existing reservoirs. Conventional oil fields are gradually maturing, and primary as well as secondary recovery methods often leave more than half of the original oil in place. Enhanced Oil Recovery (EOR) techniques, such as thermal injection, chemical flooding, and gas injection, provide a viable solution to extend the productive life of these aging reservoirs. As energy security becomes a priority for both developed and emerging economies, EOR is increasingly seen as a strategic approach to boost production without relying solely on costly exploration of new reserves.

Technological Advancements in EOR Methods

Continuous innovations in EOR technologies are significantly improving efficiency, cost-effectiveness, and environmental performance. Advances such as carbon dioxide (CO₂) injection for both oil recovery and carbon sequestration, novel chemical formulations for flooding, and improved thermal methods are enabling higher recovery rates and making previously uneconomical reservoirs viable. Additionally, digital technologies like reservoir simulation, artificial intelligence, and real-time monitoring are optimizing EOR project performance. These advancements not only enhance production but also align with sustainability goals by reducing carbon footprints, thereby accelerating the adoption of EOR across various oil-producing regions.

Market Challenges

High Capital and Operational Costs

One of the major challenges restraining the growth of the EOR market is the significant capital investment required for implementing these advanced recovery methods. From installing CO₂ pipelines to deploying specialized equipment for thermal or chemical flooding, the upfront costs are much higher compared to conventional recovery techniques. Operational expenses, including the continuous supply of chemicals or gases, also add to the overall financial burden. For smaller oil companies or projects in regions with volatile oil prices, these high costs often make EOR less attractive and financially risky.

Environmental and Logistical Concerns

While EOR can support carbon sequestration in the case of CO₂ injection, the process still raises environmental and logistical challenges. Chemical flooding can lead to groundwater contamination if not managed properly, and thermal recovery methods require large amounts of energy and water, raising concerns about resource consumption. Additionally, sourcing and transporting CO₂ or chemicals at scale presents logistical hurdles, especially in regions lacking robust infrastructure. These environmental and supply chain issues not only increase project complexity but also attract regulatory scrutiny, slowing down adoption in some markets.

Market Segmentation

- Based on Technology, the Global Enhanced Oil Recovery market is segmented into

- Steam Injection

- In-Situ Combustion

- CO₂ Injection

- Nitrogen Injection

- Hydrocarbon Gas Injection

- Polymer Flooding

- Surfactant-Polymer Flooding

- Alkaline-Surfactant-Polymer (ASP) Flooding

- Microbial EOR (MEOR)

- Nanotechnology-based EOR

- Based on Application, the Global Enhanced Oil Recovery market is segmented into

- Onshore Oilfields

- Offshore Oilfields

- Based on Reservoir Type, the Global Enhanced Oil Recovery market is segmented into

- Conventional Reservoirs

- Unconventional Reservoirs

- Heavy Oil Reservoirs

- Based on Geography, the Global Enhanced Oil Recovery market is segmented into

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

- All market revenue has been given in US Dollar

Historical Year: 2020-2024

Base Year: 2025

Estimated: 2026

Forecast- 2027-2030

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of Global Enhanced Oil Recovery Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the Global Enhanced Oil Recovery Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in Global Enhanced Oil Recovery Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during Global Enhanced Oil Recovery Market study?

- Strategic Introduction

- Definition & Scope of Enhanced Oil Recovery

- Market Architecture & Taxonomy

- Research Framework & Methodology

- Data Mining, Secondary & Primary Research

- Market Sizing & Validation (top-down, bottom-up, demand/supply analysis)

- Scenario Calibration (oil prices, CAPEX/OPEX, policy shocks)

- Executive Insights

- Strategic snapshot of EOR market status, investment focus, and growth readiness.

- Key findings and insights for boardroom decision-making.

- Future Outlook & Opportunity Mapping (2025–2035)

- Scenario Planning (Base, Optimistic, Conservative).

- Sensitivity Analysis (oil price, carbon credits, technology adoption).

- Identification of regional investment hotspots.

- EOR’s positioning in the low-carbon transition.

- Value Chain & Ecosystem Analysis

- EOR’s role in upstream-midstream integration.

- Digitalization in the value chain (AI, IoT, digital twins).

- Supply chain logistics for CO₂, polymers, and surfactants.

- Stakeholder mapping: NOCs, IOCs, EPCs, service providers, regulators.

- Global Market Outlook (2020–2035)

- Market size and forecast by value.

- Technology, application, reservoir, regional, and company segmentation.

- Regional Deep-Dive Analysis (2020–2035)

- Asia-Pacific (China, India, Indonesia, Malaysia, Australia, etc.)

- Europe (Norway, UK, Russia, etc.)

- North America (U.S., Canada)

- South America (Brazil, Venezuela, Argentina, Colombia)

- Middle East & Africa (Saudi Arabia, UAE, Oman, Kuwait, Nigeria, Angola, etc.)

- Each region includes:

- Market size & forecast.

- Adoption by technology/application.

- Key operators & project pipeline.

- Country-specific regulatory landscape.

- Each region includes:

- Policy & Regulatory Landscape

- CO₂ sequestration & carbon credit incentives.

- Environmental compliance & HSE regulations.

- Cross-border CO₂ infrastructure challenges.

- Comparative analysis of national EOR policies.

- Technology & Innovation Outlook

- Advances in chemical EOR (polymers, surfactants, nanotech).

- Microbial and biotechnology-based EOR.

- Digital & AI-driven reservoir optimization.

- Integration of CCUS into EOR projects.

- Pilot projects & case studies of successful deployments.

- Market Dynamics & Competitive Landscape

- Growth drivers, restraints, challenges, opportunities.

- Impact of oil price volatility, carbon taxes, ESG mandates.

- Competitive benchmarking: leaders, challengers, innovators.

- Key company profiles and strategies (M&A, alliances, partnerships).

- White Space & Growth Frontiers

- Unexplored regional plays and untapped reservoirs.

- Hybrid models (renewables-powered CO₂ injection, hydrogen synergies).

- Offshore EOR potential in deepwater fields

- Pricing & Economics

- Production cost benchmarking across technologies.

- Regional pricing models (logistics, energy input costs).

- Break-even analysis for different reservoir types.

- Competition & Benchmarking

- Competition matrix: NOCs vs. IOCs vs. independents.

- Operator strategies (Saudi Aramco, ExxonMobil, Petrobras, CNPC, Equinor, etc.).

- Case comparisons of early adopters vs. laggards.

- Startups and disruptors in nanotech/MEOR.

- Project Case Studies (Global Best Practices)

- Successful EOR implementations across regions.

- Lessons learned from failures and pilot terminations.

- Benchmarking of project economics (NPV, IRR, payback).

- Technology adoption roadmaps.

- ESG & Sustainability Dimensions

- Carbon intensity reduction via CCUS-EOR.

- ESG compliance and sustainable financing.

- Water management challenges & innovations.

- Circular economy and closed-loop chemical recovery.

- Investment & Financing Models

- CAPEX & OPEX patterns in EOR projects.

- Role of sovereign wealth funds, development banks, and private equity.

- Risk-return models under oil price uncertainty.

- Financing incentives linked to ESG performance.

- Talent, Skills & Workforce Transformation

- Human capital challenges in advanced EOR adoption.

- Reskilling needs: reservoir engineers, data scientists, AI modelers.

- Safety, regulatory compliance, and operational training.

- Digital Oilfield & Smart EOR

- Predictive modeling & digital twins.

- Remote monitoring, AI-driven decision systems.

- IoT-enabled injection tracking & real-time performance analytics.

- Blockchain applications in EOR contracts and CO₂

- Risk Assessment Framework

- Political/geopolitical risk (sanctions, OPEC+ dynamics).

- Operational risk (equipment, water sourcing, subsurface uncertainty).

- Environmental risk (leakage, CO₂ storage safety).

- Financial risk (capex overruns, oil price collapse).

- Strategic Roadmap & Recommendations

- Short-term (2025–2027): Pilot scaling, cost optimization.

- Mid-term (2028–2030): Mainstream CCUS-EOR, digital adoption.

- Long-term (2031–2035): Fully integrated low-carbon EOR business models.

- Tailored recommendations for:

- Operators (maximize ROI, tech adoption pathways).

- Service Providers (partnership models, differentiation).

- Policymakers (incentive design, infrastructure support).

- Investors (portfolio prioritization, risk hedging).