- Overvew

- Table of Content

- Segmentation

- Request Sample

Market Definition

Green cement is an environmentally friendly alternative to traditional cement, engineered to reduce carbon emissions and conserve natural resources. Unlike conventional Portland cement, it incorporates industrial by-products such as fly ash, slag, and silica fume. It may also use alternative binders like limestone calcined clay cement (LC3) and geopolymer cement or employ carbon capture technologies during its production. By leveraging these innovative methods, green cement provides a low-carbon solution that aligns with global efforts to decarbonize and promote sustainable construction practices.

Market Insights

Cement is a globally traded commodity and, together with the construction industry, forms a cornerstone of national economies. Rising urbanization and large-scale infrastructure investments by governments are accelerating the adoption of green cement. Public housing projects, road development to improve connectivity, and preparations for international sporting events such as the Olympics and FIFA World Cup, requiring stadiums, accommodations, and related facilities, are expected to further drive demand.

The global green cement market was valued at more than $30 billion in 2024 and is projected to expand at a double digit CAGR during forecast period

Sustainability is increasingly central to the industry’s growth, with Environmental, Social, and Governance (ESG) programs shaping business strategies. Leading producers are prioritizing ESG practices to manage risks, unlock opportunities, and align with global climate goals. Companies are investing in alternative raw materials, carbon-negative technologies, and innovative production methods to reduce environmental impact while strengthening their market positioning. Cement is a cornerstone of modern construction, used in foundations, roads, bridges, highways, embankments, and structural frameworks. However, its production is also a major contributor to global air pollution. Clinker manufacturing, the most energy-intensive step in cement production, is responsible for significant carbon emissions. According to the National Center for Biotechnology Information (NCBI), every ton of clinker produced emits approximately 0.83 tons of CO₂, while one ton of Ordinary Portland Cement (OPC) generates around 0.54 tons of CO₂.

The cement industry contributes nearly 4.5% of global GHG emissions and accounts for 7% of total CO₂ emissions, largely driven by limestone decarbonization and fossil fuel combustion in kilns. With the construction sector responsible for roughly 25% of worldwide GHG emissions, decarbonizing cement is critical to meeting sustainability goals. Current technological advancements have enabled a reduction of up to 30% in carbon emissions, supporting the global objective of limiting temperature rise to 1.5°C above pre-industrial levels.

One promising solution is the adoption of Carbon Capture, Utilization, and Storage (CCUS) in cement plants. While this innovation has the potential to significantly curb emissions, its capital-intensive nature and limited market readiness restrict adoption, particularly among small and regional manufacturers.

Against this backdrop, green cement is emerging as a viable alternative. Produced through carbon-negative processes and incorporating industrial by-products such as fly ash, slag, and calcined clay, green cement provides an eco-friendly solution to one of the construction industry’s most pressing challenges, reducing CO₂ emissions without compromising performance.

Market Dynamics: Drivers

Rising Global Carbon Emission Reduction Targets

Cement production is one of the largest industrial contributors to CO₂ emissions, accounting for nearly 8% of global totals. With the Paris Agreement and net-zero pledges shaping international policy, governments are placing increasing pressure on industries to decarbonize. Regulations such as the EU’s Emission Trading System (ETS) and carbon pricing mechanisms in countries like Canada and China are making traditional cement more expensive, pushing manufacturers toward low-carbon alternatives.

At the same time, multinational corporations and construction firms are adopting science-based targets and ESG frameworks, requiring greener materials in supply chains. Financial institutions are also tying access to green bonds and climate-linked loans to the use of sustainable building materials. This convergence of regulation, corporate action, and financial incentives is accelerating the adoption of green cement as producers seek compliance, cost savings, and market competitiveness.

Growth in Green Buildings and Sustainable Infrastructure

The rapid rise of green construction is a key demand-side driver for green cement. Governments worldwide are tightening energy-efficiency standards for buildings, promoting eco-friendly materials in both new projects and renovations. Europe’s Energy Performance of Buildings Directive (EPBD) mandates Minimum Energy Performance Standards (MEPS), while Canada, India, and Brazil are introducing housing schemes that prioritize sustainability.

Commercial and residential developers are also responding to consumer and investor demand for environmentally responsible properties. Certifications such as LEED and BREEAM increasingly require or incentivize the use of green cement, creating strong pull factors in both developed and emerging markets. As urbanization accelerates, especially in Asia-Pacific, the scale of housing and infrastructure projects ensures that green cement will be central to meeting climate and energy goals.

Technological Innovation in Cement Production

Innovation is transforming green cement from a niche material into a scalable industry solution. Alternative binders such as fly ash-based, slag-based, geopolymers, and limestone calcined clay cement (LC3) are reducing reliance on clinker, the most carbon-intensive component of traditional cement. Simultaneously, carbon capture, utilization, and storage (CCUS) projects are being piloted by major players like Holcim and Heidelberg Materials, showcasing new pathways to slash emissions.

These advances are complemented by digitalization and process optimization in cement plants, which enhance energy efficiency and reduce waste. Governments and investors are increasingly funding R&D in low-carbon materials, while technology partnerships between cement producers, construction firms, and energy companies are accelerating commercialization. Together, these innovations are lowering costs, improving performance, and expanding applications of green cement, making it a critical enabler of the construction sector’s transition toward net-zero.

Market Dynamics: Challenges

Challenges in Implementing Environmental Policies

Despite a surge in environmental legislation over the past three decades, weak execution and enforcement have limited its effectiveness. Global trends show that inadequate compliance continues to worsen environmental issues. In many cases, laws are either misaligned with local conditions, lack clear standards, or fail to include actionable mandates.

For the green cement industry, two key barriers stand out: low awareness and high costs. While traditional raw materials like limestone, sand, clay, and iron remain cheaper, the pricing structure of green cement is still unclear and varies by manufacturer. Ironically, many inputs for green cement, such as fly ash and slag, are industrial by-products, making them less costly; however, expenses rise due to the reliance on sustainable energy sources. Hydrogen, for example, remains far more expensive than biomass or conventional fuels.

The absence of well-defined standards and a strong policy framework around composition, pricing, and applications (residential vs. non-residential) further hampers large-scale adoption.

Limited Scalability & Technical Barriers

Most green cement technologies are still at a pilot or early commercialization stage, with limited large-scale production capacity. Technical challenges such as maintaining consistent quality, performance under varying climatic conditions, and integration into existing construction practices create hesitation among builders and developers. This slows down widespread market adoption.

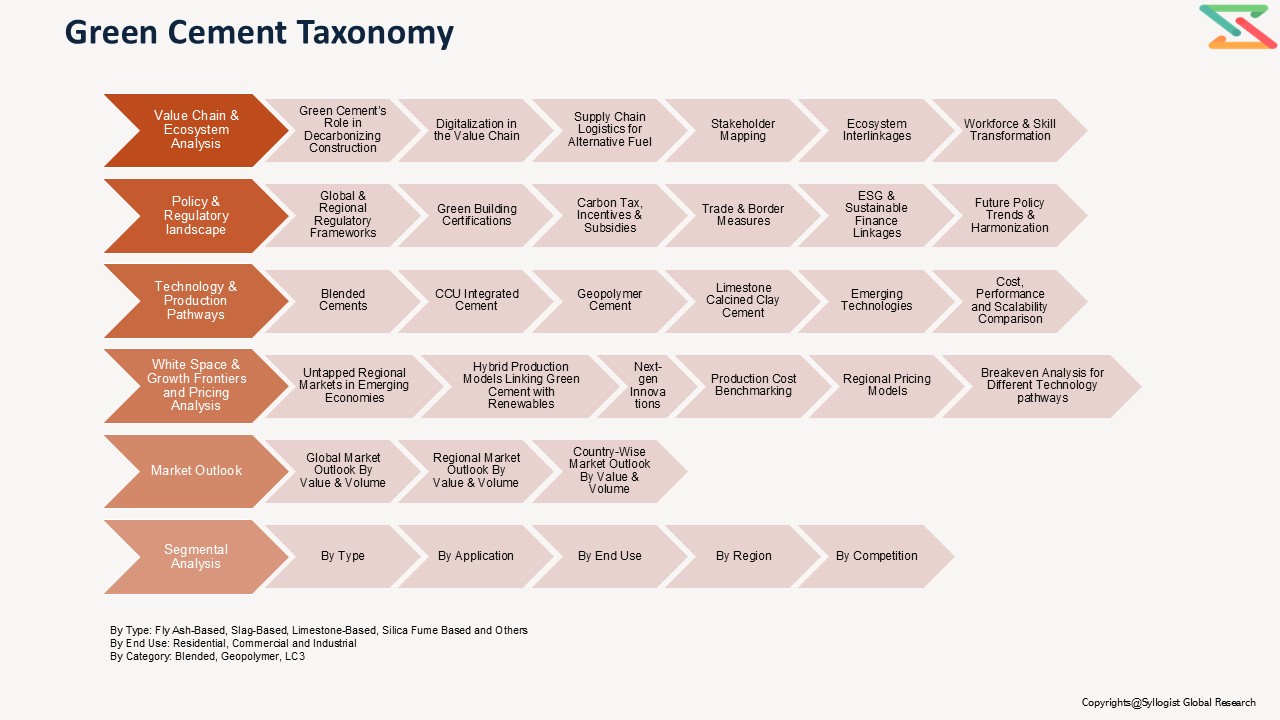

Market Segmentation

- Based on Type, the Global Green Cement market is segmented into

- Fly Ash-Based

- Slag-Based

- Limestone-Based

- Silica Fume Based

- Others

- Based on Category, the Global Green Cement market is segmented into

- Blended

- Geopolymer

- LC3

- Based on End Users, the Global Green Cement market is segmented into

- Residential

- Commercial

- Industrial

- Based on Geography, the Global Green Cement market is segmented into

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

- All market revenue has been given in US Dollar, while the market volumes are given in million tons.

Historical Year: 2020-2024

Base Year: 2025

Estimated: 2026

Forecast- 2027-2030

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of Global Green Cement Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the Global Green Cement Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in Global Green Cement Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during Global Green Cement Market study?

- Strategic Introduction

- Definition & Scope of Green Cement

- Market Architecture & Taxonomy

- Research Framework & Methodology

- Data Mining, Secondary & Primary Research

- Market Sizing & Validation (top-down, bottom-up, demand/supply analysis)

- Scenario Calibration (carbon prices, CAPEX/OPEX, policy incentives & regulatory shifts)

- Executive Insights

- Strategic snapshot of the Green Cement market landscape, highlighting sustainability drivers, investment priorities, and scale-up readiness

- Key findings and actionable insights to guide boardroom decision-making and long-term strategy

- Future Outlook & Opportunity Mapping (2025–2035)

- Scenario Planning (Base, Optimistic, Conservative)

- Sensitivity Analysis

- Identification of regional investment hotspots

- Green Cement’s Positioning in the Low-Carbon Transition

- Value Chain & Ecosystem Analysis

- Green Cement’s Role in Decarbonizing the Construction Value Chain

- Digitalization In the Value Chain

- Supply Chain Logistics for Alternative Fuels

- Stakeholder Mapping

- Cement Producers

- Equipment Manufacturers

- Construction and Infrastructure Companies

- Technology Licensors

- Regulators

- Sustainability Certification Agencies

- Ecosystem Interlinkages with Carbon Markets, Green Financing Platforms, And Government-Led Decarbonization Programs to Accelerate Adoption and Scale-Up

- Workforce and Skills Transformation

- Global Market Outlook (2020–2035)

- Market size and forecast by value

- Type, Category and End-Use, regional, and company segmentation

- Regional Deep-Dive Analysis (2020–2035)

- Asia-Pacific (China, India, Japan, South Korea, Australia)

- Europe (Germany, France, United Kingdom, Italy, Spain, Poland, Nordics)

- North America (U.S., Canada)

- South America (Brazil, Mexico, Chile)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Egypt)

- Each region includes:

- Market size & forecast

- Adoption by Type, Category, End Use

- Key operators & project pipeline

- Country-specific regulatory landscape

- Each region includes:

- Policy & Regulatory Landscape

- Global & Regional Regulatory Frameworks

- Coverage of Emissions Trading Schemes (EU ETS, China’s ETS, US State-Level Carbon Markets)

- Regional Emission Standards (EU Industrial Emissions Directive, India’s CPCB Norms, US EPA Regulations)

- Country-Specific Roadmaps for Net-Zero in Cement and Construction (EU Green Deal, US DOE Initiatives, India’s Low-Carbon Development Strategy, Japan’s Green Growth Strategy)

- Green Building Certifications

- Global Certifications: LEED, BREEAM, WELL, EDGE

- Regional Certifications: IGBC, GRIHA (India), Green Mark (Singapore), Green Star (Australia)

- How Certification Schemes are Increasingly Mandating/Encouraging Low-Carbon Cement and Clinker Substitution

- Impact On Procurement by Developers, Infrastructure Agencies, And Governments

- Carbon Tax, Incentives & Subsidies

- National And Regional Carbon Pricing Frameworks (EU CBAM, Canada’s Carbon Pricing, South Korea ETS)

- Incentives For Carbon Capture and Utilization (E.G., Us 45q Tax Credits)

- Subsidies For Renewable Fuels and Energy Efficiency in Cement Kilns

- Green Procurement Policies (Government Contracts Mandating Low-Carbon Cement)

- Public-Private Funding For R&D And Scale-Up (Horizon Europe, Us Doe Grants, India’s Green Hydrogen Mission Linkages)

- Trade & Border Measures

- Carbon Border Adjustment Mechanism (CBAM) and Its Impact on Cement Exports

- WTO Implications and Competitiveness of Developing Country Producers

- ESG & Sustainable Finance Linkages

- Role of Green Bonds, Climate Funds, and ESG-Linked Loans for Cement Projects

- Disclosure Frameworks (TCFD, ISSB, EU Taxonomy) Requiring Cement Companies to Demonstrate Decarbonization Pathways

- Future Policy Trends & Harmonization

- Global Convergence on Cement Emission Standards By 2030–2035

- Integration With National Net-Zero Roadmaps and Urban Development Policies

- Anticipated Shift Toward Mandatory Embodied Carbon Reporting in Construction Projects

- Global & Regional Regulatory Frameworks

- Technology & Production Pathways

- Blended Cements

- Carbon Capture and Utilization (CCU) Integrated Cement

- Geopolymer Cement

- Limestone Calcined Clay Cement (LC3)

- Emerging Technologies

- Magnesium-Based Cements

- Algae-Derived Bio-Cements

- Electrochemical Cement Production

- Novel Binders & Nanomaterials

- Cost, Performance, And Scalability Comparison

- Cost Analysis

- Performance Metrics

- Scalability Assessment

- Commercial Readiness Levels (CRL/TRL)

- Market Dynamics

- Growth drivers, restraints, challenges, opportunities

- Impact of Carbon Pricing, Regulatory Mandates, and ESG Compliance on Green Cement Adoption and Competitiveness

- White Space & Growth Frontiers

- Unexplored Regional Markets and Untapped Opportunities in Emerging Economies with High Urbanization and Infrastructure Demand

- Hybrid Production Models Integrating Green Cement with Renewable Energy, Carbon Capture Utilization & Storage (CCUS), And Circular Economy Solutions (Industrial By-Products, Waste Valorisation)

- Next-Generation Innovations Such as Electrochemical Cement Production, Bio-Based Binders, And Large-Scale Deployment of LC3 And Geopolymer Cements

- Pricing & Economics

- Production Cost Benchmarking Across Green Cement Technologies (Blended Cements, LC3, Geopolymers, CCU-Integrated Pathways)

- Regional Pricing Models Factoring Logistics, Raw Material Availability, and Energy Input Costs

- Break-Even Analysis for Different Technology Pathways and Scale-Up Scenarios

- Competition & Benchmarking

- Competition Matrix: Global Leaders vs. Regional Producers vs. Emerging Players

- Comparative positioning of multinational cement majors, regional leaders, and local producers in adopting green cement technologies.

- Market share analysis by technology adoption (blended, LC3, geopolymers, CCU).

- Competitive edge in cost, scale, certification, and sustainability credentials.

- Producer Strategies

- Decarbonization roadmaps and public commitments toward net-zero targets

- Integration of carbon capture pilots, clinker substitution strategies, and renewable energy adoption

- Vertical integration strategies with construction companies and policymakers

- Case Comparisons of Early Adopters vs. Laggards

- Regional leaders (e.g., Europe’s aggressive decarbonization via LC3 and CCU pilots) vs. slower adopters in markets with weak policy push

- Lessons from early demonstration projects and first-mover advantages in securing green finance and premium contracts

- Competitive Benchmarking: Leaders, Challengers, Innovators

- Leaders: Global cement majors scaling low-carbon cement across multiple geographies

- Challengers: Regional mid-sized producers piloting LC3 or blended cements

- Innovators: Startups commercializing novel binders (geopolymers, bio-cements, electrochemical pathways)

- Comparison on cost structure, scalability, TRL, market adoption, and sustainability alignment

- Key Company Profiles and Strategies

- M&A activity in green cement startups and technology firms

- Strategic alliances with universities, research institutes, and clean-tech developers

- Partnerships with construction majors, infrastructure agencies, and governments to secure demand

- Supply chain integration: securing supplementary cementitious materials (SCMs), renewable energy contracts, and CCU integration

- Startups and Disruptors in Next-Gen Cement

- Startups in geopolymers, electrochemical cements, and carbon-mineralized products

- Pilot-scale disruptors in bio-cement (algae/bacteria-based binders)

- Role of VC funding, climate-tech accelerators, and corporate venture arms

- Sustainability Benchmarking & Certifications

- Benchmarking of companies based on lifecycle CO₂ emissions, embodied carbon intensity, and circular economy practices

- Certification landscape (LEED, BREEAM, EU taxonomy alignment) as a differentiator

- Regional Competition Dynamics

- Europe: Policy-driven leadership through RePowerEU and Green Deal targets

- Asia-Pacific: Large-scale potential (India, China) with slower but accelerating adoption of LC3 and blended cements

- North America: Strong focus on CCU pilots supported by IRA and DOE funding

- Middle East & Africa: Early-stage adoption, but rising potential under Vision 2030 frameworks

- Competitive Risks & Barriers

- Technology lock-ins and high CAPEX entry barriers

- Feedstock availability (slag, fly ash) and supply volatility

- Regulatory and certification delays slowing commercialization

- Competition Matrix: Global Leaders vs. Regional Producers vs. Emerging Players

- Project Case Studies (Global Best Practices)

- Successful Green Cement Implementations and Scale-Ups Across Regions

- Lessons Learned from Technology Challenges, Failed Pilots, And Market Adoption Barriers

- Benchmarking of Project Economics (CAPEX, OPEX, LC-SAF Equivalent, NPV, IRR, Payback)

- Technology Adoption Roadmaps for Blended Cements, LC3, Geopolymers, And CCU-Integrated Pathways

- ESG & Sustainability Dimensions

- Carbon intensity reduction through clinker substitution, LC3, geopolymers, and CCU-integrated cement

- ESG compliance and access to sustainable financing via green bonds, climate funds, and ESG-linked loans

- Resource efficiency and water management innovations in cement kilns and production processes

- Circular economy integration

- Transparent carbon accounting and MRV (monitoring, reporting, verification) aligned with international frameworks

- Investment & Financing Models

- CAPEX & OPEX Structures Across Green Cement Technologies

- Risk-Return Models Under Carbon Pricing, Policy Incentives, And Embodied Carbon Reporting Mandates

- Financing Incentives Linked to ESG Performance and Green Taxonomies (EU Taxonomy, ISSB, TCFD)

- Public–Private Partnerships (PPPs) For Pilot Plants, Industrial Clusters, and Carbon Capture Hubs

- Talent, Skills & Workforce Transformation

- Human Capital Challenges in Scaling Low-Carbon Cement Technologies

- Reskilling Needs

- Training For Safety, Regulatory Compliance, ESG Reporting, and Operational Excellence in Digitalized Cement Plants

- Building Interdisciplinary Teams Bridging Materials Science, Data Science, and Construction Engineering

- Risk Assessment Framework

- Political/Regulatory Risk

- Operational Risk

- Environmental Risk

- Financial Risk

- Market Risk

- Strategic Roadmap & Recommendations

- Short-term (2025–2027)

- Scale pilot and demonstration plants for LC3, CCU, and geopolymers

- Expand SCM adoption and optimize clinker substitution rate

- Accelerate digitalization for energy efficiency and emission monitoring

- Mid-term (2028–2030)

- Commercialize low-carbon cement technologies at scale across multiple regions

- Integrate with carbon markets and green financing platforms

- Strengthen supply chains for alternative raw materials and circular inputs

- Long-term (2031–2035)

- Establish fully integrated net-zero cement plants with renewable energy, CCUS, and digital twins

- Achieve mainstream adoption of green cement across infrastructure, housing, and industrial construction

- Align industry with global net-zero roadmaps and mandatory embodied carbon reporting

- Tailored recommendations for:

- For Cement Producer

- For Construction & Infrastructure Companies

- For Policymakers & Regulators

- For Investors & Strategic Partners

- Short-term (2025–2027)