- Overvew

- Table of Content

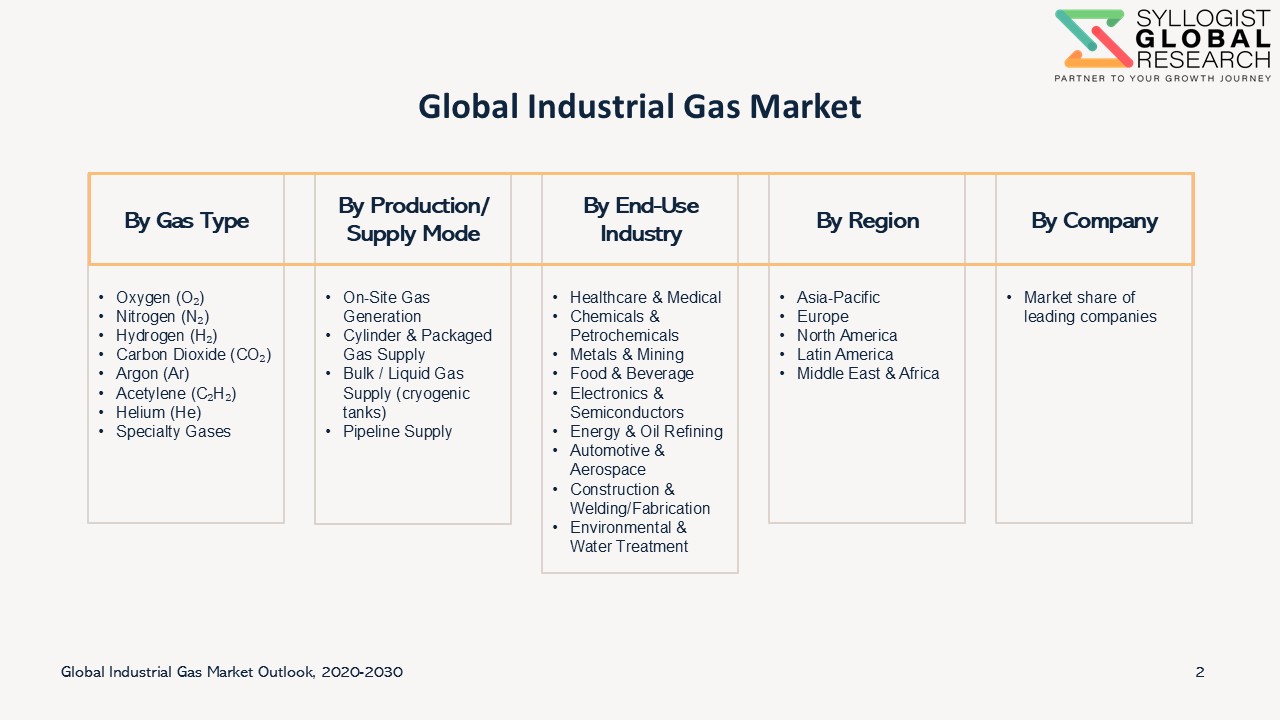

- Segmentation

- Request Sample

Market Definition

The industrial gas market refers to the global industry that produces, distributes, and utilizes gases manufactured for industrial, commercial, and medical applications. These gases, such as oxygen, nitrogen, hydrogen, carbon dioxide, argon, helium, and acetylene, are supplied in compressed, liquid, or gaseous forms through cylinders, bulk deliveries, on-site generation, or pipeline networks.

Industrial gases play a critical role across diverse sectors including metals & mining, chemicals & petrochemicals, energy, food & beverages, healthcare, electronics, and environmental applications. The market is driven by rising demand for clean energy solutions (hydrogen economy), medical oxygen, semiconductor manufacturing, and advanced industrial processes, making it an essential enabler of global industrial growth and innovation.

Market Insights

The industrial gas market forms a critical pillar of the global industrial economy, supplying essential gases such as oxygen, nitrogen, hydrogen, carbon dioxide, argon, helium, and specialty mixtures that are indispensable across diverse industries. These gases are produced through advanced technologies like cryogenic air separation, pressure swing adsorption, or steam methane reforming and delivered via pipelines, bulk supply, cylinders, or on-site generation systems. The market has witnessed significant expansion in recent years, propelled by megatrends in energy transition, healthcare demand, digital transformation, and sustainable manufacturing.

One of the strongest drivers of the market is the growing adoption of clean energy and decarbonization initiatives. Hydrogen, in particular, has emerged as a strategic industrial gas due to its potential as a clean fuel and its role in ammonia production, refining, and fuel cell technology. Global efforts to transition towards a low-carbon economy, such as the European Union’s Green Deal, U.S. Inflation Reduction Act, and hydrogen roadmaps in Asia, are stimulating massive investments in green hydrogen production and infrastructure. This trend is expected to reshape the industrial gas landscape over the next decade, making hydrogen one of the fastest-growing gas segments.

Another major growth factor is the healthcare sector. The COVID-19 pandemic highlighted the critical importance of medical gases, particularly oxygen and nitrogen, in patient care and hospital operations. Even beyond the pandemic, rising healthcare expenditure, growth of the pharmaceutical industry, and the need for advanced medical treatments are sustaining long-term demand. Similarly, the food and beverage industry relies heavily on gases like carbon dioxide for carbonation, nitrogen for modified atmosphere packaging, and dry ice for cold chain logistics. With growing consumer demand for processed, packaged, and frozen food, this segment will continue to support market expansion.

The electronics and semiconductor industry is also a vital consumer of specialty gases such as helium, nitrogen, and high-purity hydrogen. As global demand for semiconductors grows with the adoption of AI, 5G, IoT, and electric vehicles, the role of industrial gases in wafer fabrication, chip testing, and microelectronics production is becoming increasingly important. Asia-Pacific, particularly China, South Korea, Taiwan, and Japan, remains the largest regional hub for this application, although North America and Europe are ramping up investments to reduce dependence on Asian supply chains.

However, the market faces notable challenges. The high capital intensity of building large-scale air separation units, hydrogen plants, and distribution networks creates significant barriers to entry. In addition, supply chain vulnerabilities and geopolitical tensions, especially given the concentration of helium reserves and specialized hydrogen infrastructure in specific regions, pose risks to global availability and pricing. Furthermore, the industry must address environmental concerns associated with carbon dioxide emissions from traditional gas production processes. This is driving innovation in carbon capture, utilization, and storage (CCUS) and greater emphasis on green and blue hydrogen technologies.

Geographically, Asia-Pacific dominates the industrial gas market, driven by rapid industrialization in China and India, coupled with strong demand from the steel, chemical, and electronics sectors. North America and Europe remain mature but are seeing renewed growth due to clean energy investments, hydrogen economy initiatives, and medical demand. The Middle East is also emerging as a hydrogen hub, leveraging its abundant renewable energy resources to position itself as a key exporter of green hydrogen.

Looking ahead, the industrial gas market is poised for robust growth, underpinned by its diverse end-use base, integration with the energy transition, and strategic importance in healthcare and high-tech industries. The market will increasingly be defined by innovation, sustainability, and regional self-reliance, making it a dynamic and essential segment of the global industrial landscape.

Market Dynamics: Drivers

Rising Demand from Clean Energy and Hydrogen Economy

One of the most powerful growth drivers for the industrial gas market is the global transition toward clean energy and decarbonization. Hydrogen, in particular, is emerging as a strategic fuel of the future, with applications in fuel cells, green ammonia, refining, and heavy industry. Major economies, including the U.S., EU, China, and Middle Eastern countries, are investing heavily in hydrogen infrastructure, carbon capture technologies, and renewable energy integration. This push toward the hydrogen economy is significantly boosting demand for industrial gases, positioning hydrogen as one of the fastest-growing segments.

Expansion of Healthcare and Food & Beverage Industries

Industrial gases play a vital role in medical and healthcare applications, where oxygen, nitrogen, and specialty gases are used in patient care, imaging, and pharmaceutical manufacturing. The COVID-19 pandemic highlighted their critical importance, creating long-term investments in medical oxygen infrastructure. Similarly, in the food and beverage sector, gases such as carbon dioxide and nitrogen are essential for carbonation, packaging, preservation, and cold storage logistics. With rising global healthcare spending and growing consumer demand for packaged and frozen food, these industries will remain strong contributors to industrial gas market growth.

Increasing Demand from Electronics and Semiconductor Manufacturing

The rapid expansion of AI, IoT, 5G, and electric vehicles is fueling growth in the semiconductor and electronics sector, which is heavily dependent on high-purity industrial gases such as nitrogen, helium, and hydrogen. These gases are used in wafer fabrication, chip cooling, and cleanroom environments. Asia-Pacific, particularly China, South Korea, Taiwan, and Japan, dominates this space, but new investments in the U.S. and Europe to strengthen semiconductor supply chains are expected to further boost industrial gas consumption globally.

Market Challenges

High Capital Investment and Operational Costs

Producing and distributing industrial gases requires significant capital investment in air separation units, cryogenic plants, hydrogen production facilities, and distribution infrastructure. The cost of building and maintaining such facilities is very high, creating barriers for new entrants and limiting flexibility for producers. These high costs can also make smaller-scale projects less viable in emerging markets.

Supply Chain and Environmental Concerns

The industrial gas industry is vulnerable to supply chain disruptions and geopolitical risks, particularly in the case of rare gases like helium or critical hydrogen infrastructure concentrated in specific regions. At the same time, environmental concerns are becoming more prominent, as the production of gases such as hydrogen (via steam methane reforming) and carbon dioxide contributes to greenhouse gas emissions. This challenge is pushing the industry toward adopting sustainable practices, carbon capture technologies, and green hydrogen production, but these transitions require time and significant investment.

Market Segmentation

- Based on Gas Type, the Global Industrial Gas market is segmented into

- Oxygen (O₂)

- Nitrogen (N₂)

- Hydrogen (H₂)

- Carbon Dioxide (CO₂)

- Argon (Ar)

- Acetylene (C₂H₂)

- Helium (He)

- Specialty Gases

- Based on Production/Supply Mode, the Global Industrial Gas market is segmented into

- On-Site Gas Generation

- Cylinder & Packaged Gas Supply

- Bulk / Liquid Gas Supply (cryogenic tanks)

- Pipeline Supply

- Based on End Use Industry, the Global Industrial Gas market is segmented into

- Healthcare & Medical

- Chemicals & Petrochemicals

- Metals & Mining

- Food & Beverage

- Electronics & Semiconductors

- Energy & Oil Refining

- Automotive & Aerospace

- Construction & Welding/Fabrication

- Environmental & Water Treatment

- Based on Geography, the Global Industrial Gas market is segmented into

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

- All market revenue has been given in US Dollar

Historical Year: 2020-2024

Base Year: 2025

Estimated: 2026

Forecast- 2027-2030

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of Global Industrial Gas Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the Global Industrial Gas Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in Global Industrial Gas Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during Global Industrial Gas Market study?

- Strategic Introduction

- Definition & Scope of Industrial Gas

- Market Architecture & Taxonomy

- Research Framework & Methodology

- Data Mining, Secondary & Primary Research

- Market Sizing & Validation (Top-Down, Bottom-Up, Demand/Supply Analysis)

- Scenario Calibration (Energy & Feedstock Prices, CapEx & OpEx Trends, Policy & Regulatory Shocks, Technology Adoption, Demand-Side Dynamics, Scenario Modeling, Sensitivity Analysis, Regional Scenario Differentiation)

- Executive Insights

- Strategic Snapshot of Market Landscape

- Key Investment Priorities

- Competitive Dynamics & Market Positioning

- Policy, ESG & Sustainability Considerations

- Boardroom-Level Key Findings

- Future Outlook & Opportunity Mapping (2025–2035)

- Scenario Planning (Base, Optimistic, Conservative)

- Sensitivity Analysis

- Identification of regional investment hotspots

- Value Chain & Ecosystem Analysis

- Upstream Inputs & Feedstock Sourcing

- Production & Midstream Processing

- Storage, Distribution & Logistics

- Downstream Applications

- Stakeholder Mapping Across the Ecosystem

- Policy, Certification & ESG Dimensions in the Value Chain

- Ecosystem Interlinkages & Partnerships

- Future Outlook of Value Chain Evolution

- Global Market Outlook (2020–2035)

- Market size and forecast by value

- Type, Production/Supply Mode and End-Use, Regional, and Company Segmentation

- Regional Deep-Dive Analysis (2020–2035)

- Asia-Pacific (China, Japan, South Korea, India, Australia, Singapore, Indonesia, Vietnam)

- Europe (Germany, France, Russia, United Kingdom, The Netherlands, Poland)

- North America (U.S., Canada)

- South America (Brazil, Mexico, Argentina)

- Middle East & Africa (UAE, Saudi Arabia, Turkey)

- Each region includes:

- Market size & forecast

- Adoption by Type, Production/Supply Mode, End Use

- Country-specific regulatory landscape

- Each region includes:

- Policy & Regulatory Landscape

- Global & International Frameworks

- Regional & Country-Level Regulations

- Safety & Environmental Regulations

- Carbon Pricing & ESG Integration

- Incentives & Financing Mechanisms

- Certification & Standards

- Trade & Border Measures

- Comparative Policy Analysis

- Future Policy Outlook (2025–2035)

- Technology & Production Pathways

- Oxygen, Nitrogen & Argon (Air Separation Technologies)

- Hydrogen Production Pathways

- Carbon Dioxide Production & Utilization

- Specialty & Rare Gases Production

- Distribution & Storage Technologies

- Cost, Efficiency & Scalability Comparison

- Technology Providers & Licensors

- Emerging & Next-Generation Pathways (2025–2035)

- Technology Outlook & Adoption Roadmap

- Market Dynamics

- Growth drivers, restraints, challenges, opportunities

- Future Outlook & Structural Shifts (2025–2035)

- White Space & Growth Frontiers

- Unexplored Regional Markets

- Next-Generation Gas Pathways

- Hybrid & Integrated Business Models

- Demand-Side White Space Opportunities

- Policy & Financing White Spaces

- Sustainability & ESG Frontiers

- Digitalization & Workforce White Spaces

- Long-Term Growth Outlook (2030–2040)

- Pricing & Economics

- Introduction to Pricing & Economics

- Production Cost Benchmarking Across Technologies

- CapEx & OpEx Breakdown

- Regional Pricing Models

- Break-even Analysis

- Comparative Pricing Trends (2020–2035)

- Role of Carbon Pricing, Subsidies & Incentives

- Pricing Mechanisms & Market Models

- Investment Economics & Financial Metrics

- Future Outlook

- Project Case Studies (Global Best Practices)

- Successful Implementations Across Regions

- Lessons Learned from Failures & Challenges

- Benchmarking of Project Economics

- Technology Adoption Roadmaps

- Partnerships & Collaborations

- Sustainability & ESG Dimensions

- Replication & Scalability Potential

- Future Outlook from Case Studies

- ESG & Sustainability Dimensions

- Environmental Dimensions

- Social Dimensions

- Governance Dimensions

- ESG-Linked Financing & Investment

- ESG Risks & Challenges

- ESG Best Practices in the Industrial Gas Sector

- Future ESG Outlook (2025–2035)

- Investment & Financing Models

- CapEx & OpEx Patterns

- Sources of Capital & Financing Structures

- Incentives & Policy-Linked Financing

- Risk–Return Models

- ESG & Sustainable Finance Dimensions

- Strategic Investor Participation

- Regional Investment Trends

- Future Outlook (2025–2035)

- Talent, Skills & Workforce Transformation

- Workforce Requirements Across the Value Chain

- Skills Gaps & Reskilling Needs

- Emerging Digital & Technical Skills

- Policy & Institutional Support for Workforce Development

- Social & Regional Workforce Implications

- Future Outlook (2025–2035)

- Risk Assessment Framework

- Political/Regulatory Risk

- Operational Risk

- Environmental & Social Risks

- Financial Risk

- Market & Competitive Risks

- Technology Risks

- Risk Mitigation Strategies

- Future Outlook

- Strategic Roadmap & Recommendations

- Short-Term Roadmap (2025–2027)

- Mid-Term Roadmap (2028–2030)

- Long-Term Roadmap (2031–2035)

- Tailored Recommendations by Stakeholder

- For Producers

- For Policymakers & Regulators

- For Investors & Lenders

- For End-Users (Steel, Chemicals, Healthcare, Electronics)

- For Technology Providers

- Key Success Factors

- Future Outlook & Strategic Priorities