- Overvew

- Table of Content

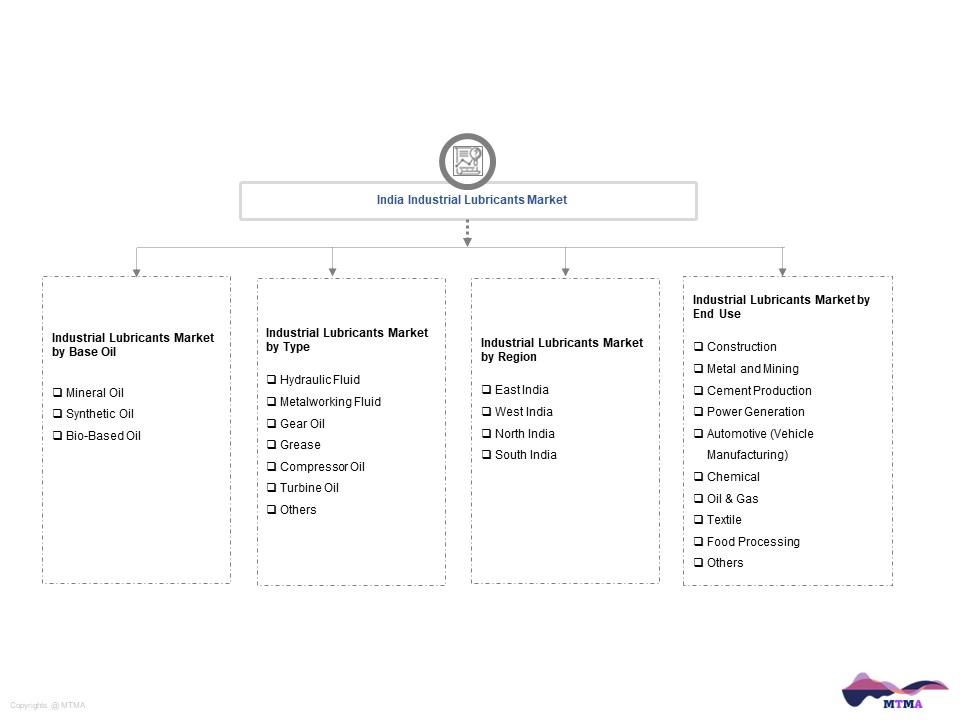

- Segmentation

- Request Sample

Market Definition

Industrial lubricants are fatty or oily fluids that are applied to gears, bearings, and other moving machine parts to lessen friction and wear. In order to promote effective movement between two surfaces, lubricants serve as a boundary layer.

Market Insights

The industrial lubricants market in India, which is currently the second-largest market in APAC, is anticipated to see the highest CAGR in the region in terms of volume and value during the forecast period. The industrial lubricants industry is being driven forward by the country’s booming metal, mining, and construction industries. Industrial lubricant suppliers find the nation to be particularly alluring due to its high consumption and rapid growth. The nation’s economic policies have been deregulated, which has increased the possibility for growth. The government is aiming to create a welcoming environment for investment in a variety of industries, including food processing and cement manufacturing, and to make it easier for large enterprises to be established over the course of the next five years. The country’s industrial lubricants market is anticipated to develop as a result of the expansion of a number of industries, including cement production, automobile manufacture, and construction.

One of the top producers of electricity in the Asia-Pacific region is India. The market for industrial lubricants is primarily driven by the country’s energy industry, along with expanding electrical infrastructure. With resources including coal, lignite, iron ore, bauxite, manganese ore, copper ore, limestone, lead and zinc ore, India also has a broad mining sector. The end-use sector for power generation is anticipated to develop at the fastest rate during the projection period, both in terms of volume and value. India is the third-largest producer and consumer of power worldwide, according to BP Statistics. India is also one of the fastest-developing nations in the world, and in order to maintain this growth, the nation’s electrical demand is rising, which is in turn fueling demand for industrial lubricants.

India’s government has budgeted US$14 trillion for infrastructure spending over the next ten years. The commercial vehicle sector will gain momentum from the government’s sustained emphasis on advancing India’s infrastructure sector. There will be a rise in demand for industrial lubricants in addition to the rising demand for lubricants in commercial vehicles. Grease, metalworking fluid and gear oil gearbox fluid will all see an increase in demand. Additionally, this need is not just for conventional items offered by lubricant players. The growing movement towards sustainability in the automotive industry is driving this discussion. The lubricant business must continually develop due to the need for new EVs and the necessity for solutions that reduce friction, prevent corrosion, and act as coolants. The need for creative and sustainable products is increasing as a result of new discoveries and technology advancements. Some of the new goods that meet these expectations include EV Fluids, Ad Blue products, long drain products, and high-performance synthetic materials. While innovation and agility will be some of the main drivers for lubricant firms in the future, their capacity to serve and grow in the expanding market will also be put to the test. In India, EV is still in its very early stages, and the lubricant sector would still have a lot to offer the market that is presently there. In retrospect, the EV market offers a unique opportunity. Not only are new EV solutions needed, but the lubricant industry is also being pressured to develop and go beyond merely using lubricants as a solution.

Market Dynamics: Drivers

Improved Quality of Industrial Lubricants Will Drive the Market

The enhanced quality of industrial lubricants is a key market driver. Consumers prefer higher-quality items that can withstand high temperatures and pressures primarily because they are more durable, have a longer shelf life, and operate better on machinery and equipment. The majority of industrial lubricants producers concentrate on creating products that are non-toxic, anti-foaming, antioxidant, waterproof, and rust-preventive. High-quality industrial lubricants are in higher demand. It is less expensive to use high-quality industrial lubricants because they require replacement less frequently.

Market Dynamics: Challenges

Technological Advancements Restricting the Growth of the Market

Electric and hybrid vehicles have been developed as a result of technological breakthroughs. A small internal combustion engine (ICE) and an electric motor are both included in hybrid automobiles. Vehicle technology is constantly improving, primarily to cut emissions from automobiles. Because there is no engine oil in electric cars, they produce no emissions. The rising popularity of electric and hybrid vehicles will practically halve the amount of engine oil, industrial lubricants, and gearbox fluid required for each vehicle. This element will affect the market, along with rising battery parity. Many end-use sectors, including construction, metal and mining, and cement, among others, have adopted compact machine design. The development of small size gearboxes is a top priority for hydraulic equipment manufacturers because to the increasing need for portable and compact machinery. The use of industrial lubricants has decreased as a result of the smaller gearbox and longer drain intervals.

Market Segmentation

- Based on Base Oil, the India Industrial Lubricants market is segmented into

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

- Based on Type, the India Industrial Lubricants market is segmented into

- Hydraulic Fluid

- Metalworking Fluid

- Gear Oil

- Grease

- Compressor Oil

- Turbine Oil

- Others

- Based on End Use, the India Industrial Lubricants market is segmented into

- Construction

- Metal and Mining

- Cement Production

- Power Generation

- Automotive (Vehicle Manufacturing)

- Chemical

- Oil & Gas

- Textile

- Food Processing

- Others

- Based on Geography, the India Industrial Lubricants market is segmented into

- East India

- West India

- North India

- South India

- All market revenue has been given in US Dollar, while the market volumes are given in tons.

Historical Year: 2020-2021

Base Year: 2022

Estimated: 2023

Forecast- 2024-2030

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of India Industrial Lubricants Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the India Industrial Lubricants Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in India Industrial Lubricants Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during India Industrial Lubricants Market study?

- Introduction

- Product Definition

- Market Taxonomy

- Research Process

- Brief on Secondary Sources Used

- Primary Research

- Sample Size

- List of Companies Interviewed

- Market Sizing Model

- Assumptions Used

- Model Description

- Forecast Model

- Executive Summary

- Impact of COVID-19 on India Industrial Lubricants Market

- Trade Dynamics

- India Industrial Lubricants Market Value Chain Analysis

- India Industrial Lubricants Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Base Oil (Both Value & Volume)

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

- By Type (Both Value & Volume)

- Hydraulic Fluid

- Metalworking Fluid

- Gear Oil

- Grease

- Compressor Oil

- Turbine Oil

- Others

- By End Use Industry (Both Value & Volume)

- Construction

- Metal and Mining

- Cement Production

- Power Generation

- Automotive (Vehicle Manufacturing)

- Chemical

- Oil & Gas

- Textile

- Food Processing

- Others

- By Region (Both Value & Volume)

- East India

- West India

- North India

- South India

- By Competition

- By Base Oil (Both Value & Volume)

- Market Size & Forecast

- India Mineral Oil Based Industrial Lubricants Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Type (Both Value & Volume)

- Hydraulic Fluid

- Metalworking Fluid

- Gear Oil

- Grease

- Compressor Oil

- Turbine Oil

- Others

- By End Use Industry (Both Value & Volume)

- Construction

- Metal and Mining

- Cement Production

- Power Generation

- Automotive (Vehicle Manufacturing)

- Chemical

- Oil & Gas

- Textile

- Food Processing

- Others

- By Region (Both Value & Volume)

- By Type (Both Value & Volume)

- Market Size & Forecast

- India Synthetic Oil Based Industrial Lubricants Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Type (Both Value & Volume)

- Hydraulic Fluid

- Metalworking Fluid

- Gear Oil

- Grease

- Compressor Oil

- Turbine Oil

- Others

- By End Use Industry (Both Value & Volume)

- Construction

- Metal and Mining

- Cement Production

- Power Generation

- Automotive (Vehicle Manufacturing)

- Chemical

- Oil & Gas

- Textile

- Food Processing

- Others

- By Region (Both Value & Volume)

- By Type (Both Value & Volume)

- Market Size & Forecast

- India Bio Based Industrial Lubricants Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Type (Both Value & Volume)

- Hydraulic Fluid

- Metalworking Fluid

- Gear Oil

- Grease

- Compressor Oil

- Turbine Oil

- Others

- By End Use Industry (Both Value & Volume)

- Construction

- Metal and Mining

- Cement Production

- Power Generation

- Automotive (Vehicle Manufacturing)

- Chemical

- Oil & Gas

- Textile

- Food Processing

- Others

- By Region (Both Value & Volume)

- By Type (Both Value & Volume)

- Market Size & Forecast

- India Industrial Lubricants Market Policies & Regulatory Landscape

- India Industrial Lubricants Market Trends

- India Industrial Lubricants Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- India Industrial Lubricants White Market Space

- India Industrial Lubricants Pricing Analysis

- Raw Material Pricing

- Industrial Lubricants Pricing

- Competition Outlook

- Competition Matrix

- Target Markets

- Research & Development

- Collaborations & Strategic Alliances

- Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Key Customers, Strategic Alliances/ Partnerships, Future Plans)

- Competition Matrix

- Disclaimer