- Overvew

- Table of Content

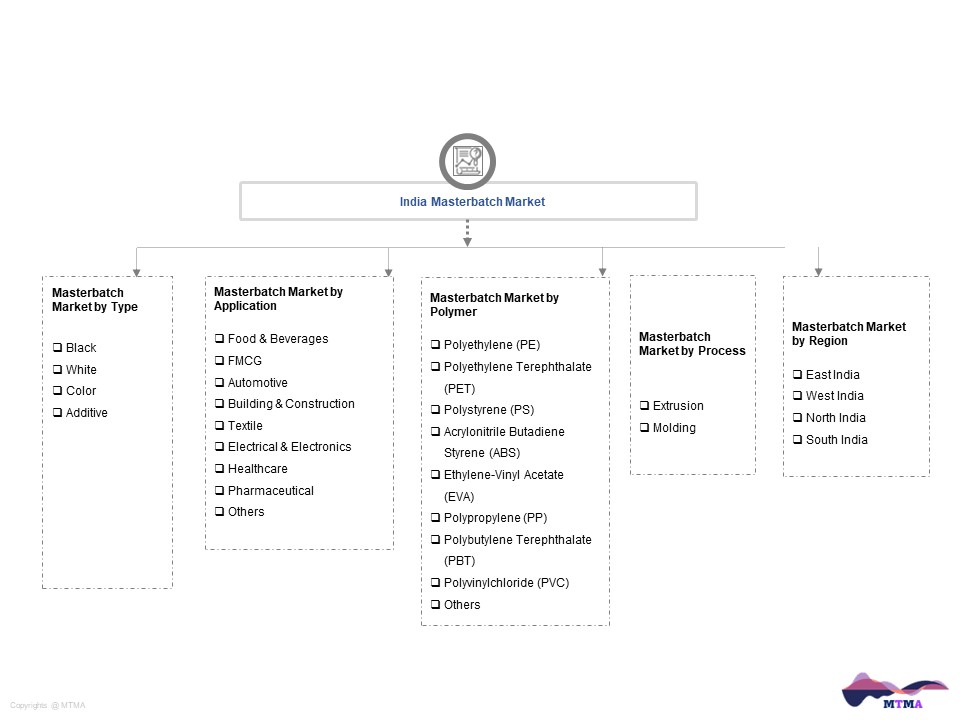

- Segmentation

- Request Sample

Market Definition

Masterbatches are concentrated mixtures of pigments and additives used for coloring and imparting specific properties to polymers. They are prepared by encapsulating pigments in a carrier resin, which are then cut into granular shape or kept in liquid state (liquid masterbatch) and later processed with base polymer. Based on their usage and appearance, masterbatches are classified into four major types, namely black, white, color and additive.

Market Insights

Growth in masterbatch market is largely dependent on its demand from plastic and polymer industries. Increasing applications of plastic and polymers in various end use industries, such as packaging, automotive, building construction, appliances, etc., is one of the major factors driving the demand for masterbatches in India. During 2024-30, India masterbatch market is anticipated to grow at a CAGR of 11.55% on account of strong growth in the plastic and polymer processing industries.

In 2022, India masterbatch market was dominated by white masterbatch with a market share of 40%, and it is anticipated to continue its dominance by 2030 on account of increasing demand from various end use industries, such as packaging, consumer goods, and appliances. Injection moulding and blow moulding are the main application areas of white masterbatch. Moreover, they are also used for providing opacity or base color to plastics, which is further anticipated to increase their demand in various application areas in the coming years.

Black masterbatches are extensively used in automotive (vehicles parts and seat cover), building & construction (pipes & tubes, water tanks), and agriculture sector (plastic pipes). They are also used in the manufacturing of garbage bags. As compared to plastic industry, the end use industries of black masterbatch are growing at a slower pace, thereby the market share of black masterbatch is anticipated to decline during forecast period.

Masterbatches are used during plastic processing through various techniques, which include extrusion processes, such as film extrusion, pipe extrusion, woven & non woven extrusion, injecting moulding, blow moulding and others, which includes roto moulding, spin dyeing, foaming, and casting. Masterbatches are used in extrusion application for manufacturing blow and cast films, monolayer PE/PP films, plastic tubing, pipes, seals, sheets or films, non-woven fabrics using fibres, filaments, molten plastic or plastic films and woven sacks.

In 2022, packaging sector dominated the India masterbatch market with a volume share of 49.97%, and is anticipated to continue its dominance over the next five years as well. In packaging sector, masterbatches are used in wide applications for flexible and rigid packaging. Flexible packaging is used in various products, such as chips, biscuits, chocolates, meat wraps, and frozen food. Over the years, demand for flexible packaging is increasing as it offers various advantages, such as easy storage and transportation, low cost, etc. Increasing demand for innovative, colourful and user-friendly packaging solutions in health care and food & beverages sector is further anticipated to increase the demand for masterbatch in packaging applications in the coming years. Moreover, growing consumption of plastic products, particularly plastic bags, and increasing inclination towards packaged food are also supporting the masterbatch consumption in packaging sector.

In automotive sector, the demand for light weight vehicles is rising, which is further increasing the demand for plastics and consequently masterbatches. Light weight vehicles production is anticipated to grow at a CAGR of 10.16% during 2023-30. Moreover, by using plastics, the overall weight of the vehicle reduces, and efficiency and overall performance increases. As a result, various types of plastic and polymer materials are used in automotive sector for manufacturing bumper, dashboard, vehicle body and other components. All these factors are anticipated to increase the consumption of plastic in light weight vehicles, and thereby increasing the masterbatch consumption in the automotive sector.

Market Dynamics: Drivers

Expanding Automotive Industry

In automotive sector, in order to reduce the CO2 emissions, demand for light weight vehicles is increasing. Moreover, the use of plastic also helps in reducing the overall cost of the vehicle, as plastic is less costly as compared to heavy metals. Plastic consumption during manufacturing of light weight vehicles is further boosting the demand for plastics as well as masterbatches in the automotive sector.

Increasing Use of Additive Masterbatch Formulation

Over the years, demand for additive masterbatches is increasing in packaging industry on account of its ability to add various add-on properties, such as UV stabilization, antioxidants, antistatic, optical brighteners, antimicrobial, and flame retardants, to the plastic used. A wide range of additive masterbatches are being developed for use in various industries, such as food & beverages, personal care, pharmaceutical, etc., due to their ability to provide high end technical properties to the plastics used in packaging. Moreover, inclination of working population towards packaged food is driving the demand for use of good quality, durable and environment friendly packaging material, which is further anticipated to fuel the demand for plastics as well as masterbatches in the coming years.

Market Dynamics: Challenges

Raw Material Prices

During masterbatch production, various raw materials are required, such as polymer, additives, titanium oxide, pigments (organic or inorganic), and raw polymer or carrier resin (in concentration more than 10% weight/weight). Prices of raw material required is largely dependent on the crude oil prices. For instance, polymer is derived from petrochemical process and so its prices are largely dependent on the crude oil prices. Basic polymers required for masterbatch manufacturing are polyethylene, polypropylene, polystyrene and other polymer-specific material. India import more than 80% of crude oil from other countries. Over the past few years, crude oil prices are fluctuating almost every week. Hence, with fluctuating crude oil prices, the overall production of polymers, and consequently, masterbatch is affecting, thereby hampering the overall production cost, which in turn affects the profit margins of the masterbatch manufacturers.

Market Segmentation

- Based on Type, the India Masterbatch market is segmented into

- White

- Black

- Colour

- Additive

- Based on End Use, the India Masterbatch market is segmented into

- Food & Beverages

- FMCG

- Automotive

- Building & Construction

- Textile

- Electrical & Electronics

- Healthcare

- Pharmaceutical

- Others

- Based on Polymer, the India Masterbatch market is segmented into

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Ethylene-Vinyl Acetate (EVA)

- Polypropylene (PP)

- Polybutylene Terephthalate (PBT)

- Polyvinylchloride (PVC)

- Others

- Based on Process, the India Masterbatch market is segmented into

- Extrusion

- Molding

- Based on Region, the India Masterbatch market is segmented into

- East India

- West India

- North India

- South India

- All market revenue has been given in US Dollar, while the market volumes are given in tons.

Historical Year: 2020-2021

Base Year: 2022

Estimated: 2023

Forecast- 2024-2030

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of India Masterbatch Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the India Masterbatch Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in India Masterbatch Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during India Masterbatch Market study?

- Market Scope & Definitions

- Technologies, Terms and Jargon

- Research Methodology

- Baseline Methodology

- Primary Interviews Sample Size

- List of Companies Interviewed

- List of Sources

- Executive Summary

- Impact of Covid-19 on India Master batch Market

- Policy & Regulatory Overview

- Mega Market Trends

- Market Drivers & Challenges

- India Master batch Market Overview & Analysis

- Market Size Overview & Forecast

- By Revenue

- By Volume

- Market Share Overview & Forecast

- By Type

- White

- Black

- Color

- Additive

- By End-User

- Food & Beverages

- FMCG

- Automotive

- Building & Construction

- Textile

- Electrical & Electronics

- Healthcare

- Pharmaceutical

- Others

- By Polymer

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Ethylene-Vinyl Acetate (EVA)

- Polypropylene (PP)

- Polybutylene Terephthalate (PBT)

- Polyvinylchloride (PVC)

- Others

- By Process

- Extrusion

- Molding

- By Region

- By Competition

- By Type

- Market Size Overview & Forecast

- India White Master batch Market Overview & Analysis

- Market Size Overview & Forecast

- By Revenue

- By Volume

- Market Share Overview & Forecast

- By End-User

- Food & Beverages

- FMCG

- Automotive

- Building & Construction

- Textile

- Electrical & Electronics

- Healthcare

- Pharmaceutical

- Others

- By Polymer

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Ethylene-Vinyl Acetate (EVA)

- Polypropylene (PP)

- Polybutylene Terephthalate (PBT)

- Polyvinylchloride (PVC)

- Others

- By Process

- Extrusion

- Molding

- By Region

- By Competition

- By End-User

- Market Size Overview & Forecast

- India Black Master batch Market Overview & Analysis

- Market Size Overview & Forecast

- By Revenue

- By Volume

- Market Share Overview & Forecast

- By End-User

- Food & Beverages

- FMCG

- Automotive

- Building & Construction

- Textile

- Electrical & Electronics

- Healthcare

- Pharmaceutical

- Others

- By Polymer

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Ethylene-Vinyl Acetate (EVA)

- Polypropylene (PP)

- Polybutylene Terephthalate (PBT)

- Polyvinylchloride (PVC)

- Others

- By Process

- Extrusion

- Molding

- By Region

- By Competition

- By End-User

- Market Size Overview & Forecast

- India Color Master batch Market Overview & Analysis

- Market Size Overview & Forecast

- By Revenue

- By Volume

- Market Share Overview & Forecast

- By End-User

- Food & Beverages

- FMCG

- Automotive

- Building & Construction

- Textile

- Electrical & Electronics

- Healthcare

- Pharmaceutical

- Others

- By Polymer

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Ethylene-Vinyl Acetate (EVA)

- Polypropylene (PP)

- Polybutylene Terephthalate (PBT)

- Polyvinylchloride (PVC)

- Others

- By Process

- Extrusion

- Molding

- By Region

- By Competition

- By End-User

- Market Size Overview & Forecast

- India Additive Master batch Market Overview & Analysis

- Market Size Overview & Forecast

- By Revenue

- By Volume

- Market Share Overview & Forecast

- By End-User

- Food & Beverages

- FMCG

- Automotive

- Building & Construction

- Textile

- Electrical & Electronics

- Healthcare

- Pharmaceutical

- Others

- By Polymer

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Ethylene-Vinyl Acetate (EVA)

- Polypropylene (PP)

- Polybutylene Terephthalate (PBT)

- Polyvinylchloride (PVC)

- Others

- By Process

- Extrusion

- Molding

- By Region

- By Competition

- By End-User

- Market Size Overview & Forecast

- India Masterbatch Market Policies & Regulatory Landscape

- India Masterbatch Market Trends

- India Masterbatch Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- India Masterbatch White Market Space

- India Masterbatch Pricing Analysis

- Competition Outlook

- Competition Matrix

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Key Customers, Strategic Alliances/ Partnerships, Future Plans)

- Disclaimer