- Overvew

- Table of Content

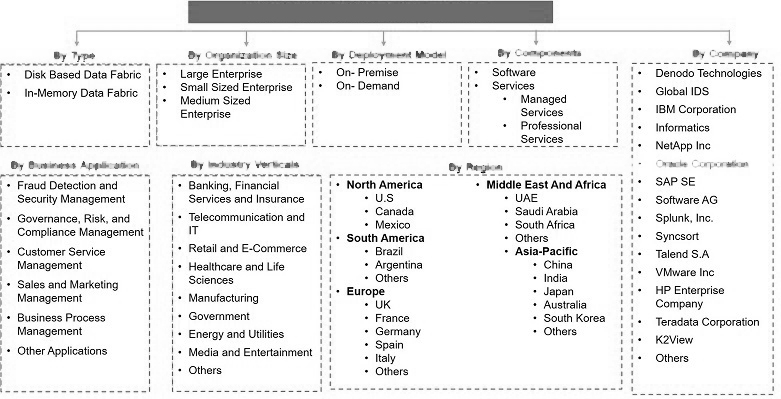

- Segmentation

- Request Sample

Market Definition

Concrete admixtures are a class of construction chemicals, which are added to construction materials to improve physical and chemical properties of concrete. On being added to concrete mix, these admixtures impart strength to concrete, reduce porosity of concrete and contribute to impermeability and durability of concrete structures. Different types of concrete admixtures include Polycarboxylate derivatives (PC), Sulfonated Melamine Formaldehyde (SMF), Sulphonated Naphthalene Formaldehyde (SNF) and others (include Modified Lignosulfonates (MLS) based admixtures; Lignosulfonic Acids, derivatives and their salts, etc.)

Market Insights

India’s market for polycarboxylate ether and naphthalene admixtures is expected to grow as a result of increased government investments in infrastructure development. Additionally, it is anticipated that liberal FDI policy, ease of doing business, and industrial developments in India will attract investments in the construction sector, accelerating infrastructure development in the nation. Infrastructure projects from a variety of sectors, including roads, railways, power & energy, airports, etc. Due to rising infrastructure expenditure, the market for polycarboxylate ether and naphthalene admixtures is anticipated to increase at a CAGR of 12.56% from 2023 to 2030.

The market for concrete admixtures in India was dominated by polycarboxylate ether-based admixtures in 2022, and this trend is anticipated to last through 2030. These admixtures have numerous uses in both residential and commercial construction and infrastructure improvements. Admixtures made of polycarboxylate ether change the chemical and physical characteristics of concrete, giving constructions their longevity. In comparison to other superplasticizers like sulphonated naphthalene formaldehyde condensates (SNF), sulphonated melamine formaldehyde condensates (SMF), and others, polycarboxylate ether has a water reduction capacity of 35%.

In 2022, West India dominated India concrete admixtures market and the trend is expected to continue during the next five years. Maharashtra, Gujarat and Madhya Pradesh are the states experiencing robust growth in infrastructure development. Maharashtra is the financial hub of India. Highly commercialized nature of the state is luring various foreign as well as domestic investors to invest in the region.

Market Dynamics: Drivers

Growing Preference for Specialized Customer-Centric Products

Future infrastructure and construction projects in India are to blame for the country’s rising demand for concrete additives. Different concrete grades are needed for these construction projects, which is increasing demand for certain kinds of admixtures. Companies that operate in the construction chemicals market in India are concentrating on the demand for various types of concrete admixtures and are working to produce specialised admixtures that meet consumer preferences.

Government Restrictions on On-Site Mixing

Due to a rising desire for ready-mix concrete, construction practises in India have changed during the previous five years. The use of ready mix in building activities has replaced the time-consuming and outmoded idea of mixing construction materials on-site during construction. Contractor demand for ready-mix concrete has increased as a result of limits placed by the Indian government on the use of construction chemicals while mixing concrete on-site in order to build long-lasting structures. As a result, the country’s construction industry would experience an increase in demand for admixtures until 2030.

Rising Branding Activities in Retail Segment

In order to draw clients in the retail segment, manufacturers of concrete admixtures are concentrating on putting branding and marketing initiatives into action. Companies can increase their market share in India’s retail admixtures market by using competitive advantages provided by effective branding and marketing tactics. Effective branding techniques, for instance, have aided CICO and Chembond in building their brand equity and becoming major players in the Indian market for concrete admixtures. These competitors are concentrating on creating regional presences for their brands in the Northern and Western parts of the nation.

Market Dynamics: Challenges

Increasing Construction Costs

In India, construction activity is expanding at a strong rate, and the trend is expected to remain for the next five years. However, because they are more focused on reducing building costs, Indian construction businesses often disregard the long-term advantages of using admixtures. Construction costs can be decreased by leaving concrete admixtures out of the building materials. As a result, construction businesses are attempting to avoid using concrete admixtures, which is expected to reduce their need for these materials.

Low Profit Margins

Due to India’s price-sensitive consumers of concrete admixtures, industry participants are forced to operate at reduced profit margins. Construction businesses choose to either ignore or use inexpensive admixtures during construction because they believe that using construction chemicals greatly raises the cost of building construction. Therefore, big companies competing in the construction chemicals industry in India are forced to sell their goods at lower margins in order to satisfy a customer base that is price sensitive.

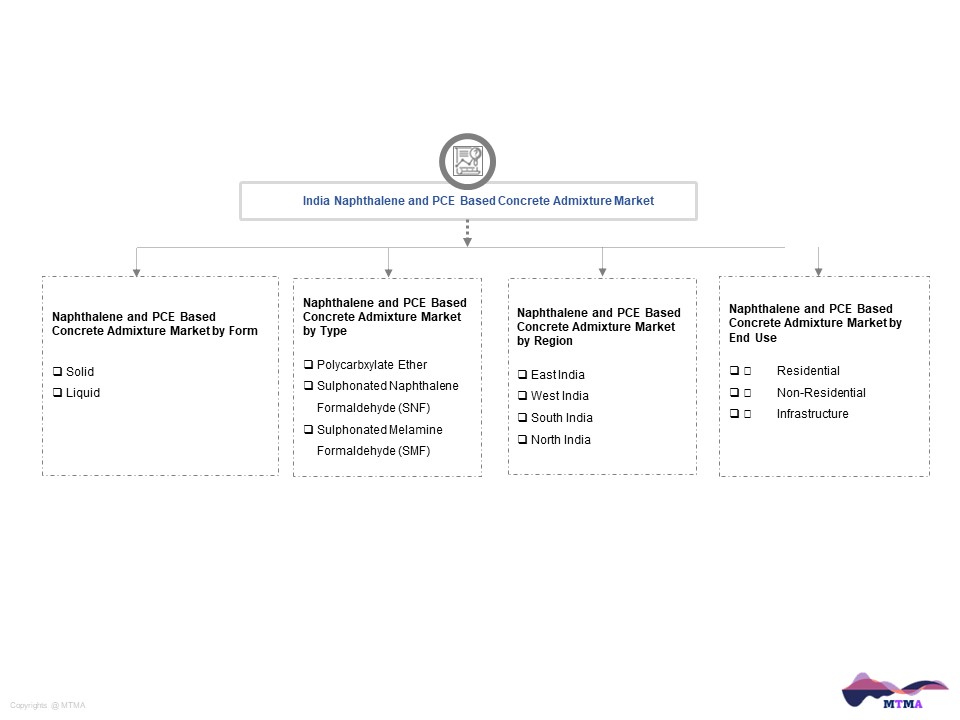

Market Segmentation

- Based on Type, the India Naphthalene and PCE Based Admixtures market is segmented into

- Polycarbxylate Ether

- Sulphonated Naphthalene Formaldehyde (SNF)

- Sulphonated Melamine Formaldehyde (SMF)

- Based on Form, the India Naphthalene and PCE Based Admixtures market is segmented into

- Solid

- Liquid

- Based on End Use, the India Naphthalene and PCE Based Admixtures market is segmented into

- Residential

- Non-Residential

- Infrastructure

- Based on Region, the India Naphthalene and PCE Based Admixtures market is segmented into

- East India

- West India

- North India

- South India

- All market revenue has been given in US Dollar, while the market volumes are given in tons.

Historical Year: 2020-2021

Base Year: 2022

Estimated: 2023

Forecast- 2024-2030

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of India Naphthalene and PCE Based Concrete Admixtures Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends, and regulations in the India Naphthalene and PCE Based Admixtures Concrete Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in India Naphthalene and PCE Based Concrete Admixtures Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during India Naphthalene and PCE Based Concrete Admixtures Market study?

- Introduction

- Product Definition

- Market Taxonomy

- Research Process

- Executive Summary

- Impact of COVID-19 on India Naphthalene and PCE Based Admixtures Market

- India Naphthalene and PCE Based Admixtures Market Ecosystem

- India Naphthalene and PCE Based Admixtures Market Value Chain Analysis

- India Naphthalene and PCE Based Admixtures Market Regulatory Frameworks and Growth Opportunities

- India Naphthalene and PCE Based Admixtures Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Form

- Solid

- Liquid

- By Type

- Polycarbxylate Ether

- Sulphonated Naphthalene Formaldehyde (SNF)

- Sulphonated Melamine Formaldehyde (SMF)

- By End Use

- Residential

- Non-Residential

- Infrastructure

- By Region

- By States (Share of Leading 10 States)

- By Company

- By Form

- Market Size & Forecast

- India Polycarbxylate Ether Based Admixtures Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Form

- Solid

- Liquid

- By End Use

- Residential

- Non-Residential

- Infrastructure

- By Region

- By States (Share of Leading 10 States)

- By Company

- By Form

- Market Size & Forecast

- India Sulphonated Naphthalene Formaldehyde Based Admixtures Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Form

- Solid

- Liquid

- By End Use

- Residential

- Non-Residential

- Infrastructure

- By Region

- By States (Share of Leading 10 States)

- By Company

- By Form

- Market Size & Forecast

- India Sulphonated Melamine Formaldehyde Based Admixtures Market Outlook, 2020-2030

- Market Size & Forecast

- By Value

- By Volume

- Market Share & Forecast

- By Form

- Solid

- Liquid

- By End Use

- Residential

- Non-Residential

- Infrastructure

- By Region

- By States (Share of Leading 10 States)

- By Company

- By Form

- Market Size & Forecast

- India Thermoplastic Elastomer Market Policies & Regulatory Landscape

- India Thermoplastic Elastomer Market Trends

- India Thermoplastic Elastomer Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- India Thermoplastic Elastomer White Market Space

- India Thermoplastic Elastomer Pricing Analysis

- Competition Outlook

- Competition Matrix

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Key Customers, Strategic Alliances/ Partnerships, Future Plans)

- Disclaimer

- Overvew

- Table of Content

- Segmentation

- Request Sample

Overview Tab

Table Of Contents