- Overvew

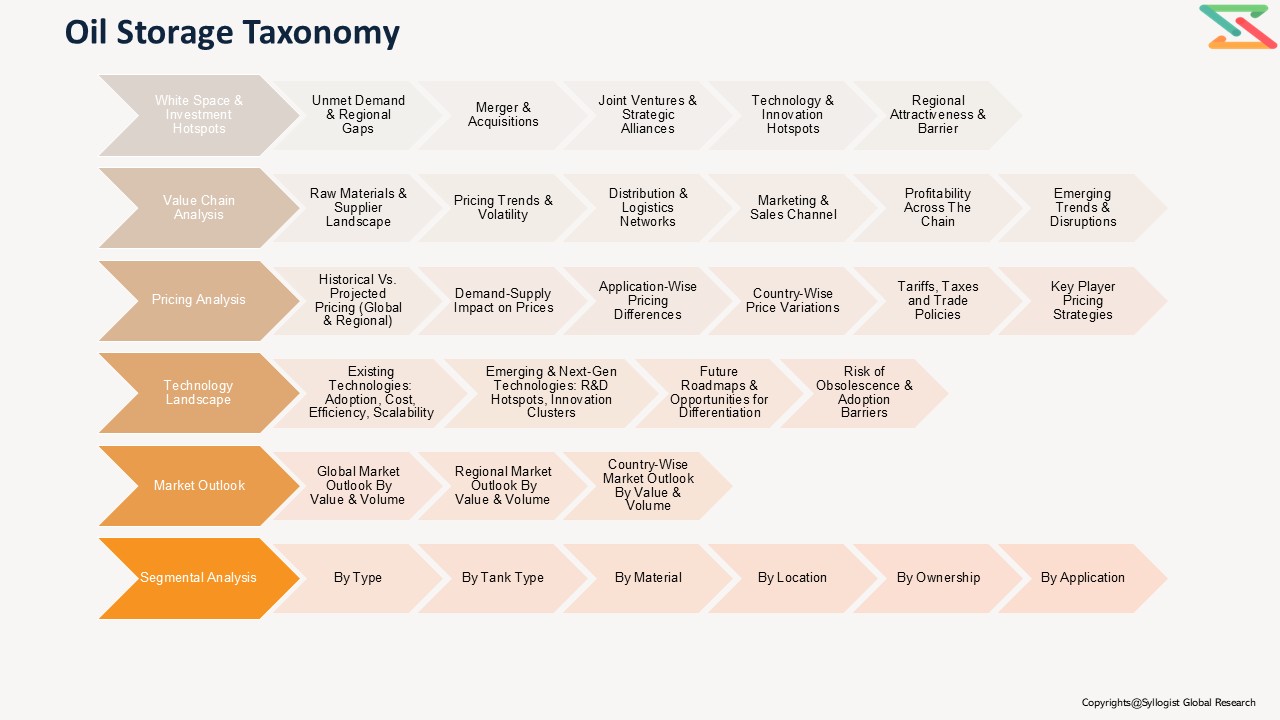

- Table of Content

- Segmentation

- Request Sample

Market Definition

Oil Storage refers to large-scale facilities or containers used to store crude oil, refined petroleum products, and other derivatives across upstream, midstream, and downstream segments. These facilities play a vital role in maintaining energy security, balancing seasonal and strategic demand fluctuations, and ensuring supply continuity during price volatility or disruptions. Over the past two years, the global oil storage market has been significantly influenced by geopolitical tensions, supply chain imbalances, and shifting global energy consumption patterns.

Market Insights

Global oil storage capacity expansion has been strongly shaped by market uncertainties triggered by the Russo-Ukrainian conflict, OPEC+ production adjustments, and fluctuating global oil prices. The years 2021 and 2022 witnessed elevated demand for storage facilities due to disrupted trade routes, refinery outages, and strategic stockpiling by major oil-importing nations. Although demand stabilized in 2023 with improved supply chain dynamics, global storage utilization rates remain high amid continued inventory management needs and the energy transition toward renewables. Other contributing factors affecting the market include fluctuating crude prices, a rise in strategic petroleum reserve (SPR) capacity expansions, and the increased use of floating storage as a hedge against price uncertainty.

According to industry projections, the global oil storage market is expected to grow moderately between 2023 and 2029, supported by a CAGR of around 3.8%. Demand will be primarily driven by Asia-Pacific and the Middle East, where refinery expansions, crude import dependency, and strategic stockpiling initiatives remain strong. Meanwhile, Europe and North America are witnessing a gradual shift toward repurposing storage infrastructure for renewable fuels, hydrogen, and bio-based liquids as part of long-term decarbonization efforts. The adoption of advanced storage technologies, such as floating roof tanks, double-walled tanks, and automated monitoring systems, is further enhancing operational efficiency and safety standards.

Because many countries depend on imported crude and refined products, storage infrastructure has become a strategic asset for energy security. Nations like India, China, Japan, and South Korea continue to invest in expanding their SPRs to cushion against global disruptions. However, the sector remains vulnerable to macroeconomic conditions, high capital intensity, and environmental compliance costs associated with leakage prevention and emissions monitoring. Additionally, the transition toward cleaner fuels and electric mobility will gradually alter the demand profile of refined product storage, pushing operators to diversify into low-carbon energy storage solutions.

Market Dynamics: Drivers

Increasing global crude oil consumption, refinery expansions, and strategic petroleum reserve (SPR) programs remain the primary growth drivers for the oil storage market. Rapid urbanization, industrialization, and transport fuel demand, especially in emerging economies, are leading to continuous investments in both onshore and offshore storage facilities. The rising frequency of geopolitical disruptions has further encouraged governments and private players to maintain high inventory levels to ensure price and supply stability.

Market Dynamics: Challenges

Volatile crude oil prices, high initial investment, and stringent environmental and safety regulations remain major challenges for storage operators. The high cost of corrosion prevention, leakage control, and emission mitigation systems increases operating expenditures. Additionally, the growing emphasis on renewable energy and global decarbonization targets is expected to reduce long-term fossil fuel demand, potentially leading to underutilization of conventional oil storage facilities. Market participants must also adapt to digital monitoring requirements and sustainability reporting frameworks that demand real-time operational transparency.

Market Segmentation

Based on Product Type, the Global Oil Storage market is segmented into:

o Crude Oil

o Gasoline

o Diesel

o Aviation Fuel

o Naphtha

o Liquefied Petroleum Gas (LPG)

o Others

Based on Storage Type, the market is segmented into:

o Floating Roof Tanks

o Fixed Roof Tanks

o Spherical Tanks

o Bullet Tanks

o Others

Based on Material, the market is segmented into:

o Steel

o Concrete

o Fiberglass-Reinforced Plastic (FRP)

o Others

Based on Application, the market is segmented into:

o Commercial

o Industrial

o Strategic/Reserve

o Others

Based on Location, the market is segmented into:

o Onshore

o Offshore

All market revenues are provided in US Dollars, while capacities are expressed in million barrels.

Historical Year: 2019–2022 | Base Year: 2023 | Estimated Year: 2024 | Forecast Period: 2025–2029

Key Questions this Study Will Answer

- What is the key overall market statistics or market estimates (Market Overview, Market Size; By Value, Market Size; By Volume, Forecast Numbers, Market Segmentation, Market Shares) of the Global Oil Storage Market?

- What is the region-wise industry size, growth drivers, challenges, and key market trends?

- What are the key innovations, opportunities, current and future trends, and regulations in the Global Oil Storage Market?

- Who are the key competitors, what are their strengths and weaknesses, and how do they perform in the Global Oil Storage Market based on competitive benchmarking?

- What are the key insights derived from market surveys conducted during the Global Oil Storage Market study?

- Market Foundations & Dynamics

- Introduction

1.1. Product Overview (Definition & Scope of Oil Storage)

1.1.2. Oil Supply Chain Overview (Production → Transportation → Storage → Refining → Distribution)

1.1.3. Research Methodology

1.1.4. Executive Summary

1.1.5. Major Trends Shaping the Market (Energy Transition, Strategic Reserves, Digital Terminals)

1.1.6. Short-Term vs. Long-Term Opportunities

1.1.7. Comparison of Storage Applications (Crude, Refined Products, NGLs, Biofuels)

1.1.8. Scenario Planning (Base, Optimistic, Conservative)

1.1.9. Sensitivity Analysis (Crude Prices, Demand, Utilization Rates)

1.1.10. Identification of Regional Investment Hotspots - Market Dynamics

- Introduction

- Drivers (Energy Security, Supply–Demand Imbalance, Strategic Petroleum Reserves)

- Restraints (High Capex, Environmental Concerns)

- Opportunities (Digitalization, Modular Storage, Hydrogen/Ammonia Transition)

- Challenges (Volatility, Maintenance, Regulation)

- Porter’s Five Forces Analysis

- PESTLE Analysis

- Market Ecosystem & Value Chain

3.1. Overview of Value Chain Participants

1.3.1.1. Crude Oil Producers

1.3.1.2. Midstream Operators

1.3.1.3. Storage Terminal Operators

1.3.1.4. EPC & Tank Construction Companies

1.3.1.5. Traders and Oil Marketing Companies

1.3.1.6. Refineries and End Users

1.3.1.7. Raw Material & Equipment Suppliers (Steel, Valves, Pumps, Monitoring Systems)

1.3.2. Flow of Value and Material Through the Chain

1.3.3. Value Addition and Margins at Each Stage

1.3.3.1. Construction

1.3.3.2. Operation & Leasing

1.3.3.3. Maintenance & Inspection

1.3.3.4. Trading / Utilization

1.3.4. Integration Trends (Vertically Integrated Oil Majors vs. Independent Terminals)

1.3.5. Impact of Vertical Integration - Mapping of Roles and Interdependencies

- Market Trends & Developments

5.1. White Market Space Analysis (Emerging Terminals, Unutilized Storage)

1.5.2. Demand–Supply Gaps (Storage Capacity vs. Demand)

1.5.3. Investment Hotspots (Middle East, Asia-Pacific, U.S. Gulf Coast)

1.5.4. Unmet Needs (Modernization, Safety Upgrades, Digital Monitoring) - Risk Assessment Framework

6.1. Political / Geopolitical Risk (Sanctions, OPEC Policies, War Impacts)

1.6.2. Operational Risk (Leakage, Fire, Downtime)

1.6.3. Environmental Risk (Emissions, Spills, Wastewater)

1.6.4. Financial Risk (Oil Price Volatility, Utilization Variability)

- Market Ecosystem & Value Chain

- Regulatory Framework & Standards

- Global Regulatory Overview

1.1. API & ASME Standards for Tank Design (API 650, API 653, API 2610)

2.1.2. U.S. EPA & OSHA Regulations

2.1.3. EU Safety and Environmental Directives (Seveso III, COMAH)

2.1.4. Middle East & Asia Local Compliance (ADNOC, CPCB, NEA, etc.) - Storage, Operation & Maintenance Regulations

3. Safety & Quality Standards (Fire Protection, Pressure, Leak Detection)

2.4. Environmental Compliance (Spill Containment, VOC Control, Waste Management)

2.5. Liability and Insurance Requirements

2.6. Digital Traceability & Asset Management Standards

- Global Regulatory Overview

- Technology Landscape

- Storage Tank Technologies

1.1. Fixed Roof Tanks

3.1.2. Floating Roof Tanks

3.1.3. Dome Roof Tanks

3.1.4. Spherical & Bullet Tanks (for LPG/NGL)

3.2. Material Innovations (Carbon Steel, Stainless Steel, Composite Tanks)

3.3. Monitoring and Inspection Technologies (IoT Sensors, Drones, Corrosion Mapping)

3.4. Automation and Digital Twin Applications

3.5. Innovations in Secondary Containment and Safety Systems

3.6. Future Outlook: Hydrogen, Ammonia, and Biofuel Storage Adaptations

- Storage Tank Technologies

- Global, Regional & Country Forecasts (2019–2029)

- Global Oil Storage Market Outlook (Value & Capacity)

2. Market Share by:

4.2.1. Type (Crude Oil, Refined Products, NGL/LPG, Others)

4.2.2. Tank Type (Fixed Roof, Floating Roof, Dome, Spherical, Others)

4.2.3. Material (Carbon Steel, Stainless Steel, Fiberglass, Concrete)

4.2.4. Location (Aboveground, Underground)

4.2.5. Ownership (Strategic Reserves, Commercial Terminals, Refinery-Owned, Independent)

4.2.6. Application (Refining, Trading, Strategic Reserve, Distribution, Others)

4.2.7. Company - Regional & Country Outlook (2019–2029)

3.1. North America (U.S., Canada)

4.3.2. Europe (UK, Germany, France, Netherlands, Spain)

4.3.3. Asia-Pacific (China, India, Japan, South Korea, Singapore)

4.3.4. Middle East & Africa (UAE, Saudi Arabia, South Africa)

4.3.5. Latin America (Brazil, Mexico)

- Global Oil Storage Market Outlook (Value & Capacity)

- Pricing Analysis

- Overview of Pricing Structures (Per Cubic Meter / Barrel Basis)

2. Average Storage Lease Rate Trends by Region and Tank Type

5.3. Cost Benchmark:

5.3.1. Crude vs. Refined Product Storage

5.3.2. Onshore vs. Offshore Terminal Costs

5.4. Price Sensitivity (Oil Price Volatility vs. Storage Demand)

5.5. Historical Price Evolution (2019–2023)

5.6. Forecast Pricing Curve (2024–2029)

5.7. Factors Influencing Price:

5.7.1. Construction Material & Labor

5.7.2. Location & Logistics Access

5.7.3. Maintenance & Insurance

5.7.4. Regulatory Compliance Cost

5.8. Regional Pricing Differentiation (U.S. vs. EU vs. Asia)

5.9. Impact of Energy Transition on Storage Pricing

- Overview of Pricing Structures (Per Cubic Meter / Barrel Basis)

- Competition Outlook

- Market Concentration and Fragmentation Level

2. Company Market Shares (Top 10 Players)

6.3. Competitive Strategies

6.3.1. Capacity Expansion & Terminal Modernization

6.3.2. Joint Ventures & Strategic Partnerships

6.3.3. Long-Term Leasing and Storage-as-a-Service Models

6.4. Benchmarking Matrix (Business Model vs. Scale vs. Integration)

6.5. Recent Developments (M&A, Greenfield Projects, Digitalization)

- Market Concentration and Fragmentation Level

- Cost Structure & Margin Analysis

- Detailed Cost Breakdown

1.1. Land Acquisition & Site Preparation

7.1.2. Tank Construction (Materials, Welding, Testing)

7.1.3. Piping, Pumps, Valves, Instrumentation

7.1.4. Safety & Environmental Systems

7.1.5. Labor & Maintenance

7.2. Average Cost per Stage ($/m³ or $/bbl)

7.3. Profitability and Margin Distribution Along the Value Chain

7.3.1. EPC Margin

7.3.2. Operator Margin

7.3.3. Trader / Leasing Margin

7.4. Sensitivity Analysis (Oil Price, Utilization, Financing Costs)

7.5. Cost Reduction Opportunities via Modularization & Automation

- Detailed Cost Breakdown

- Business Models & Strategic Insights

- Integrated Oil Major–Owned Models

2. Independent Terminal Operators

8.3. Public–Private Partnership (PPP) Storage Models

8.4. Leasing & Storage-as-a-Service Models

8.5. Strategic Petroleum Reserve (SPR) Management Frameworks

8.6. Economic Viability Comparison of Models

8.7. SWOT Analysis of Leading Business Models

- Integrated Oil Major–Owned Models

- Investment & Financial Analysis

- CAPEX and OPEX Benchmarks for Storage Projects

2. Payback Period and IRR Sensitivity (by Region and Type)

9.3. Financial Modeling Assumptions (Utilization Rate, Lease Duration, Price Spread)

9.4. Revenue Streams:

9.4.1. Storage Leasing Income

9.4.2. Blending / Throughput Fees

9.4.3. Strategic Reserve Management Fees

9.4.4. Value from Energy Transition (Biofuels / Hydrogen Integration)

9.5. Investment Case Studies

9.6. Funding Landscape (Institutional, Sovereign, Private Equity)

- CAPEX and OPEX Benchmarks for Storage Projects

- Sales & Distribution Channel Analysis

- Overview of Go-to-Market Channels

1.1. Direct Sales / Lease to Oil Majors & Traders

10.1.2. Independent Terminals & Brokers

10.1.3. Long-Term Strategic Partnerships (Government + Private Operators)

10.2. Channel Share by Region

10.3. Typical Channel Flow Diagram (Production → Storage → Refining → Distribution)

10.4. Sales Process (Negotiation → Lease → Operation → Renewal)

10.5. Distribution Strategies by Leading Players

10.6. Emerging Trends:

10.6.1. Storage-as-a-Service (SaaS) Models

10.6.2. Digital Marketplace for Tank Leasing

10.6.3. AI-Based Inventory & Capacity Optimization

- Overview of Go-to-Market Channels

- Strategic Recommendations & Roadmap

- Competitors’ Strategic Initiatives

2. Future Outlook (2024–2029, Emerging Terminals, New Energy Storage Integration)

11.3. Strategic Recommendations

11.3.1. Technology Advancements to Watch (Automation, Digital Twins)

11.3.2. Energy Transition Integration Roadmap (Biofuel, Hydrogen, CO₂ Storage)

11.3.3. Strategic Recommendations for Stakeholders

11.4. Oil Storage Market Acceleration Roadmap

11.4.1. Short-Term (2019–2022)

11.4.2. Mid-Term (2023–2025)

11.4.3. Long-Term (2026–2029)

11.5. Tailored Recommendations for:

11.5.1. Storage Operators / Terminal Owners

11.5.2. EPC Companies & Equipment Suppliers

11.5.3. Investors & Financial Institutions

11.5.4. Policymakers & Regulators

11.6. Recommendations on Key Success Factors

11.6.1. Strategic Location & Partnerships

11.6.2. Digitalization & Predictive Maintenance

11.6.3. Policy Alignment & Compliance Excellence

11.6.4. Investor Confidence & Long-Term Contracts

- Competitors’ Strategic Initiatives