- Overvew

- Table of Content

- Segmentation

- Segmentation

- Request Sample

Market Definition

Oleochemicals are bio-based chemical compounds derived primarily from natural fats and oils, most commonly palm oil, palm kernel oil, coconut oil, tallow, and increasingly used cooking oil (UCO). Through processes such as hydrolysis, hydrogenation, transesterification, and saponification, these feedstocks are converted into key oleochemical building blocks: fatty acids, fatty alcohols, methyl esters, glycerine, soap noodles, and specialty derivatives.

These bio-based intermediates are integral to a wide range of downstream applications including personal care & cosmetics, home & fabric care, food additives, pharmaceuticals, lubricants, surfactants, coatings, agrochemicals, and industrial chemicals. As global industries shift toward renewable, biodegradable, and low-carbon raw materials, oleochemicals have emerged as an essential alternative to petrochemical-based feedstocks.

The industry is undergoing a structural transformation driven by deforestation-free supply chains (RSPO, ISCC), bio-based certifications, circular feedstock integration (UCO, waste fats), and green chemistry technologies such as enzymatic catalysis and low-carbon process intensification. This positions oleochemicals as a critical enabler in the global transition toward sustainable, traceable, and renewable chemical manufacturing.

Market Insights

The oleochemical industry represents a large, multi-billion-dollar global market anchored by Southeast Asia’s dominant production base and expanding downstream value addition across Asia-Pacific, Europe, and North America. The market was valued at USD 40 billion in 2024 and is expected to grow at a CAGR of 7% through 2035, supported by rising demand across personal care, detergents, food additives, pharmaceuticals, and industrial applications.

Fatty acids and fatty alcohols remain the largest product categories, driven by their extensive use in surfactants, soaps, detergents, emulsifiers, and cosmetics. Glycerine continues to benefit from expanding pharmaceutical, food, and personal care applications, while methyl esters and specialty esters are gaining traction in bio-lubricants, agrochemicals, and industrial formulations.

Sustainability-led procurement is transforming the value chain. Global FMCG, cosmetic, and food companies are prioritizing RSPO-certified, traceable oleochemicals, while chemical producers are investing in enzymatic processing, low-carbon hydrogenation technologies, and circular feedstock models. As environmental regulations tighten and sustainable supply chain requirements accelerate, oleochemicals are shifting from commodity bio-inputs to a strategic, compliance-linked, high-value raw material class.

Market Dynamics: Drivers

Growing Demand for Bio-Based & Sustainable Alternatives

Oleochemicals offer natural, biodegradable, and renewable substitutes for petrochemical surfactants and intermediates. Rising consumer preference for clean-label, plant-derived ingredients in personal care, home care, and cosmetics is accelerating the shift toward bio-based formulations. Manufacturers across the chemical and FMCG sectors are redesigning product portfolios to incorporate oleo-based surfactants, emulsifiers, solvents, and thickeners.

Expanding Personal Care, Home Care & Food Application Base

Urbanization, rising disposable incomes, and premiumization trends, especially in Asia-Pacific, are driving demand for soaps, detergents, skincare, haircare, and cosmetic formulations that rely heavily on fatty acids, fatty alcohols, glycerine, and esters. The food and pharmaceutical sectors are also increasing their consumption of oleochemical derivatives due to their GRAS status, purity levels, and functional performance.

Technological Innovation Across Processing & Derivatives

The industry is seeing a shift toward enzymatic catalysis, advanced hydrolysis, high-purity fractionation, bio–based hydrogenation, and specialty esterification that improve efficiency, sustainability, and product consistency. Innovations such as algae-based oils, microbial lipids, and circular feedstocks are broadening raw material sources. These advancements enhance application performance and unlock new specialty derivative opportunities in industrial chemicals, lubricants, and agrochemicals.

Market Dynamics: Challenges

Stringent Sustainability, Traceability & Sourcing Requirements

Regulatory frameworks such as RSPO, ISCC, EU Deforestation Regulation, REACH, and global sustainability commitments require producers to maintain strict traceability, environmental compliance, and supply chain audits. Meeting these requirements increases cost burdens and limits feedstock flexibility, particularly for small and mid-sized producers.

Feedstock Price Volatility & Supply Risk

Oleochemical production depends heavily on vegetable oil markets, which are influenced by weather conditions, crop yields, geopolitical disruptions, and biofuel mandates. Fluctuations in palm oil, coconut oil, and alternative feedstock prices directly impact production costs and supply stability, making long-term planning more complex for downstream buyers.

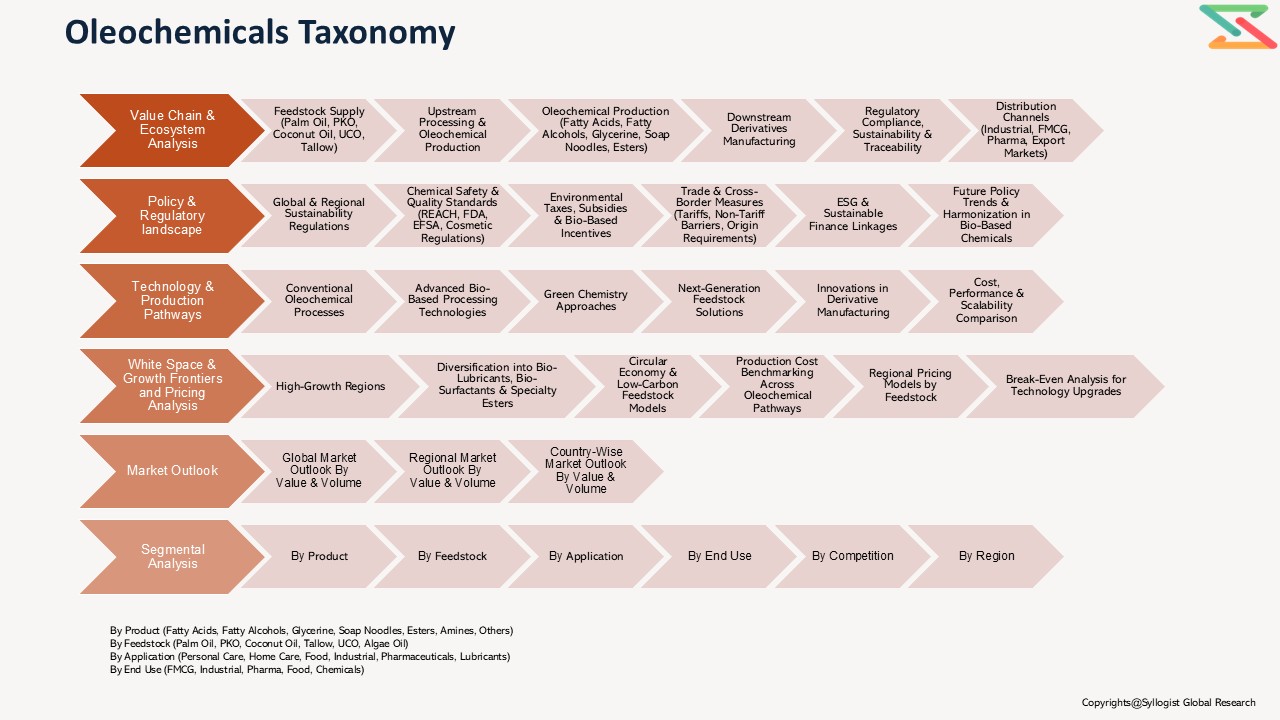

Market Segmentation

- By Product Type

- Fatty Acids

- Fatty Alcohols

- Glycerine (Crude & Refined)

- Methyl Esters

- Soap Noodles

- Specialty Esters

- Amines & Nitrogen Derivatives

- Others (Surfactants, Waxes, Additives)

- By Feedstock

- Palm Oil / Palm Kernel Oil

- Coconut Oil

- Tallow & Animal Fats

- Used Cooking Oil (UCO)

- Other Vegetable Oils

- Algae/Microbial Oils (Emerging)

- By Application

- Personal Care & Cosmetics

- Soaps & Detergents

- Food & Beverages

- Pharmaceuticals

- Industrial Chemicals

- Lubricants & Greases

- Agrochemicals

- Others (Coatings, Plastics, Adhesives)

- By End Use

- Consumer Products

- Industrial & Manufacturing

- Food & Pharmaceuticals

- Chemical Processing & Intermediates

- By Geography

- Asia-Pacific

- Europe

- North America

- Latin America

- Middle East & Africa

Revenue: USD Billion

Volume: Kilotons

Historical Years: 2020–2024

Base Year: 2025

Estimated: 2026

Forecast: 2027–2035

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of Global Oleochemical Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the Global Oleochemical Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in Global Oleochemical Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during Global Oleochemical Market study?

- Strategic Introduction

- Definition & Scope of the Global Oleochemicals Market

- Market Architecture & Taxonomy (Product Type, Feedstock, Application, End Use, Derivative Class)

- Research Framework & Methodology

- Data Mining, Secondary & Primary Research

- Market Sizing & Validation (top-down, bottom-up, demand/supply analysis)

- Scenario Calibration (feedstock trends, sustainability certifications, input cost volatility, regulatory shifts)

- Executive Insights

- Strategic snapshot of the Global Oleochemicals market landscape, highlighting consumption drivers, sustainability mandates, and derivative-level scale-up readiness

- Key findings and actionable insights to guide boardroom decision-making, innovation strategy, and downstream value-chain expansion

- Future Outlook & Opportunity Mapping (2025–2035)

- Scenario Planning (Base, Optimistic, Conservative)

- Sensitivity Analysis (feedstock pricing, certification requirements, regulatory tightening)

- Identification of regional investment hotspots and high-growth derivative/application clusters

- Oleochemicals’ Positioning in the Global Bio-Based & Green Chemistry Ecosystem

- Value Chain & Ecosystem Analysis

- Oleochemicals’ Role Across Home Care, Personal Care & Cosmetics, Food, Pharma, Industrial Chemicals & Lubricant Value Chains

- Digitalization in the Oleochemical Value Chain (process optimization, quality analytics, traceability & mass-balance tracking)

- Supply Chain Logistics for Feedstock, Fatty Acids, Fatty Alcohols, Glycerine & Specialty Derivatives

- Stakeholder Mapping

- Feedstock Suppliers (Palm, PKO, Coconut Oil, Tallow, UCO, Algae/Microbial Oils)

- Integrated Agro-Industrial Groups and Standalone Oleochemical Producers

- Downstream Chemical, FMCG, Food & Pharma Manufacturers

- Certification Bodies (RSPO, ISCC and other sustainability schemes)

- Distributors, Traders & Industrial Buyers

- Regulators, Standards Bodies & Industry Associations

- Ecosystem Interlinkages with Green Chemistry, Bio-Based Materials, Carbon Footprint Reduction & Circular Economy Programs

- Workforce and Skills Transformation Across R&D, Sourcing, Sustainability, Operations and Compliance

- Global Market Outlook (2020–2035)

- Market size and forecast by value and volume (kilotons)

- Product Type, Feedstock, Application, End Use, Regional, and Company Segmentation

- Regional Deep-Dive Analysis (2020–2035)

- Asia-Pacific (Malaysia, Indonesia, India, China, Japan, South Korea, Others)

- Europe (Germany, Netherlands, France, Italy, Spain, Nordics, Others)

- North America (U.S., Canada)

- South America (Brazil, Argentina, Colombia, Others)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Egypt, Rest of MEA)

- Each region includes:

- Market size & forecast

- Adoption by Product Type, Feedstock, Application & End Use

- Key producers, derivative clusters & export hubs

- Country-specific sustainability, certification & regulatory landscape

- Policy & Regulatory Landscape

- Global & Regional Regulatory Frameworks

- Sustainability & Traceability Certifications (RSPO, ISCC, MSPO, ISPO and other jurisdictional schemes)

- Deforestation-Free Supply Chain & Land-Use Regulations (e.g. EU deforestation rules, national land-use policies)

- Chemical Safety, Food & Pharma Regulatory Standards (REACH, TSCA, cosmetic, food and pharma regulations)

- Country-Specific Roadmaps for Bio-Based Materials & Low-Carbon Chemical Production

- Product Safety, Labeling & Certification Standards

- Global Standards: GHS, ISO, food and pharma quality systems

- Regional & National Standards: BioPreferred, eco-labels and local sustainability labels

- How Certification & Labeling Schemes are Driving Demand for Traceable, Low-Carbon, Sustainable Oleochemicals

- Impact on Procurement by FMCG, Food, Pharma, Industrial and Specialty Chemical Customers

- Environmental Taxes, Incentives & Subsidies

- Carbon pricing, environmental levies and sustainability premiums affecting oleochemical cost structures

- Incentives for Circular Feedstock, Renewable Energy & Low-Carbon Processing

- Subsidies and Grants for Process Upgrades, Effluent Treatment and Energy Efficiency

- Green Procurement Policies Favoring Bio-Based and Certified Oleochemicals

- Public-Private Funding for R&D and Scale-Up of Advanced Oleochemical Technologies

- Trade & Cross-Border Measures

- Impact of Trade Agreements, Import Duties, Rules-of-Origin and Non-Tariff Barriers on Oleochemicals and Feedstocks

- Compliance Requirements, Testing, Documentation & Traceability for Cross-Border Shipments

- ESG & Sustainable Finance Linkages

- Role of Green Bonds, Sustainability-Linked Loans & Climate Funds for Oleochemical Projects

- Disclosure Frameworks (TCFD, ISSB, EU Taxonomy and other taxonomies) Requiring Companies to Demonstrate Progress on Sustainable Sourcing & Low-Carbon Production

- Future Policy Trends & Harmonization

- Global Convergence on Sustainability, Deforestation-Free Supply Chains & Bio-Based Content Standards by 2030–2035

- Integration with National Net-Zero, Bioeconomy and Circular Economy Strategies

- Anticipated Shift Toward Mandatory Environmental Footprint, Land-Use & Product-Carbon-Intensity Reporting

- Technology & Production Pathways

- Conventional Oleochemical Processes (Hydrolysis, Hydrogenation, Fractionation, Transesterification, Saponification)

- High-Purity Fractionation & Specialty Derivative Pathways (distilled fatty acids, high-purity glycerine, specialty esters, surfactants)

- Enzymatic & Bio-Catalytic Technologies (lipase-catalyzed reactions, mild-condition processing)

- Next-Generation Feedstocks (algae oils, microbial oils, waste & residue oils)

- Emerging Technologies

- Circular Raw Materials (UCO, waste fats and side streams)

- Advanced Bio-Based Surfactant, Lubricant & Ester Technologies

- Low-Carbon Process Intensification (energy recovery, green hydrogen integration, carbon capture linkages)

- Cost, Performance and Scalability Comparison

- Cost Analysis (feedstock, utilities, chemicals, capex, logistics)

- Performance Metrics (purity, consistency, functionality, application performance)

- Scalability Assessment Across Technologies, Feedstocks and Regions

- Commercial Readiness Levels (CRL/TRL) for Key Oleochemical Technologies

- Market Dynamics

- Growth drivers, restraints, challenges, opportunities

- Impact of Sustainability Mandates, Feedstock Shifts, Certification Requirements and ESG Compliance on Oleochemical Adoption and Competitiveness

- White Space & Growth Frontiers

- High-Potential Regions & Emerging Markets with Growing Demand for Bio-Based Chemicals

- Bio-Lubricants, Bio-Surfactants, Specialty Esters, Agrochemical Adjuvants & Personal Care Actives as High-Value Growth Areas

- Next-Generation Innovations & Circular Feedstock Models (residue-based oleochemicals, integrated biorefineries)

- Pricing & Economics

- Production Cost Benchmarking Across Feedstocks (palm, PKO, coconut, tallow, UCO, alternative oils)

- Regional Pricing Models Factoring Feedstock Availability, Certification Premiums, Logistics and Energy Costs

- Break-Even Analysis for Different Technology Pathways, Sustainability Upgrades and Capacity Expansions

- Competition & Benchmarking

- Competition Matrix: Global Leaders vs Regional Producers vs Integrated Palm Players vs Niche Specialty Producers

- Comparative positioning of integrated agro-industrial groups, independent oleochemical producers and specialty chemical players

- Market share analysis by product family (fatty acids, fatty alcohols, glycerine, esters, etc.) and by application clusters

- Competitive edge in feedstock access, cost position, derivative depth, technology, certification and customer relationships

- Producer Strategies

- Sustainability & traceability roadmaps (certification coverage, no-deforestation commitments, Scope 1/2/3 reduction)

- Investments in technology upgrades, high-purity derivatives and specialty product portfolios

- Vertical and horizontal integration strategies across plantations, refineries, oleochemical units and downstream chemicals

- Case Comparisons of Early Adopters vs. Laggards

- Regional leaders with advanced certification, high-purity derivatives and diversified portfolios vs. lagging producers

- Lessons from early investments, market repositioning and premium contract wins

- Competitive Benchmarking: Leaders, Challengers, Innovators

- Leaders: Global integrated and large-scale producers with broad certified portfolios

- Challengers: Regional and mid-sized players upgrading technology and sustainability credentials

- Innovators: Specialty producers and startups developing new derivatives, process technologies and circular-feedstock-based solutions

- Comparison on cost structure, scalability, TRL, market adoption, customer stickiness and sustainability alignment

- Key Company Profiles and Strategies

- M&A activity in plantations, oleochemical assets and specialty derivative companies

- Strategic alliances with surfactant, lubricant, agrochemical and personal care formulators

- Partnerships with brand owners, industrial users and retailers on sustainable sourcing commitments

- Supply chain integration: securing certified feedstock, logistics, storage and derivative distribution capabilities

- Startups and Disruptors in Next-Gen Oleochemicals

- Startups focusing on algae/microbial oils, advanced esters, bio-surfactants and circular feedstocks

- Pilot-scale disruptors integrating biorefinery concepts and new process technologies

- Role of VC funding, climate-tech and bio-based materials accelerators, and corporate venture arms

- Sustainability Benchmarking & Certifications

- Benchmarking of companies based on land-use impact, carbon intensity, certification coverage and circularity

- Certification and eco-label landscape as a differentiator in B2B and B2C value chains

- Regional Competition Dynamics

- Asia-Pacific: Global production hub with integrated plantation–oleochemical chains

- Europe: Specialty derivatives, sustainability leadership and stringent regulatory environment

- North America: Focus on specialty applications, certifications and downstream integration

- Latin America & Middle East/Africa: Growing feedstock and derivative potential

- Competitive Risks & Barriers

- Technology lock-ins, high CAPEX for process upgrades and sustainability compliance

- Feedstock availability, climate risk and price volatility

- Regulatory and certification delays impacting market access

- Project Case Studies (Global Best Practices)

- Successful Oleochemical Investments, Upgrades and Portfolio Transformations Across Regions

- Lessons Learned from Technology Challenges, Feedstock Disruptions and Market Adoption Barriers

- Benchmarking of Project Economics (CAPEX, OPEX, payback, ROI for sustainable, high-value oleochemical projects)

- Technology Adoption Roadmaps for High-Purity Derivatives, Enzymatic Processes, Circular Feedstocks and Integrated Biorefineries

- ESG & Sustainability Dimensions

- Carbon intensity reduction via feedstock diversification, energy efficiency and process optimization

- Land-use and biodiversity impacts; deforestation-free and regenerative sourcing practices

- ESG compliance and access to sustainable financing via green bonds, climate funds and sustainability-linked loans

- Resource efficiency and waste management innovations in processing, effluent treatment and by-product valorization

- Circular economy integration (residue valorisation, side-stream conversion, UCO-based oleochemicals)

- Transparent environmental footprint accounting and MRV (monitoring, reporting, verification) aligned with international frameworks

- Investment & Financing Models

- CAPEX & OPEX Structures Across Conventional and Next-Generation Oleochemical Technologies

- Risk-Return Models Under Feedstock Volatility, Sustainability Premiums and Regulatory Tightening

- Financing Incentives Linked to ESG Performance, Certification Coverage and Taxonomy Alignment

- Public–Private Partnerships (PPPs) for Biorefinery Clusters, Circular Feedstock Infrastructure and Technology Pilots

- Talent, Skills & Workforce Transformation

- Human Capital Challenges in Scaling Next-Generation Oleochemical Technologies

- Reskilling Needs in Process Engineering, Sustainability, Certification Management and Supply-Chain Traceability

- Training for Safety, Regulatory Compliance, ESG Reporting and Operational Excellence in Modern Oleochemical Plants

- Building Interdisciplinary Teams Bridging Agronomy, Chemistry, Process Engineering, Data Science and Commercial Strategy

- Risk Assessment Framework

- Political/Regulatory Risk

- Operational Risk

- Environmental & Land-Use Risk

- Financial Risk

- Market & Customer Risk

- Strategic Roadmap & Recommendations

- Short-term (2025–2027)

- Mid-term (2028–2030)

- Long-term (2031–2035)

- Tailored recommendations for Oleochemical Producers, Integrated Agro-Industrial Groups, Downstream Users, Regulators and Investors