- Overvew

- Table of Content

- Segmentation

- Request Sample

Market Definition

Semiconductor chips are ubiquitous and form the backbone of modern digital products, devices, and infrastructure, from smartphones and automobiles to healthcare, energy, communications, and industrial equipment. With the rapid advancement of digital transformation, autonomous vehicles, the Internet of Things (IoT), artificial intelligence (AI), cloud and edge computing, quantum technologies, and supercomputers, semiconductors are increasingly recognized as strategic assets vital to global economic and technological progress.

Market Insights

As computing power, AI adoption, and connectivity demands continue to grow, so too does the need to process and manage massive volumes of data generated by electronic devices, industrial machinery, and vehicles. This relentless expansion of digitization across sectors is driving unprecedented demand for semiconductors. Consequently, the global semiconductor market is projected to surpass USD 1 trillion by 2030, cementing its role as one of the most critical industries of the future.

The global semiconductor chips market is projected to expand at a double-digit CAGR between 2025 and 2030. The semiconductor industry faced a major supply–demand imbalance between 2020 and 2023, resulting in widespread chip shortages. These disruptions significantly affected both traditional chip-dependent markets such as data centers and smartphones as well as industries that had become increasingly reliant on semiconductors, including automobiles, consumer electronics, and industrial equipment. While the worst phase of the shortage has eased by late 2023, challenges remain, particularly for advanced nodes and specialized chips.

To address these issues, chip manufacturers, distributors, and end-users have accelerated investments in production capacity and supply chain resilience. In parallel, government-backed initiatives such as the U.S. CHIPS and Science Act, the European Union’s Chips Act, and large-scale investments in China, South Korea, and Taiwan are fueling domestic semiconductor ecosystems to reduce dependency on a few regions. These efforts are gradually improving supply stability, but rising demand from AI, electric vehicles, 5G, and IoT continues to keep the market tight, reinforcing semiconductors’ role as strategic assets in the global economy.

The digital transformation of the semiconductor industry is set to deepen further through 2025 and beyond, driven by rapid advancements in AI, IoT, cloud computing, electric vehicles, and 5G/6G technologies. A majority of semiconductor companies have already embarked on this transformation journey, with many accelerating investments in automation, smart manufacturing, and design innovation to stay competitive amid rising demand.

Although the acute chip shortage of 2020–2023 has eased, structural challenges remain. Certain segments, such as advanced nodes, power semiconductors, and automotive chips, continue to face supply constraints due to the complexity of ramping up capacity. Building new fabs, diversifying supply chains, and developing specialized talent are long-term undertakings, meaning supply–demand pressures are expected to persist in the near term.

As a result, the industry is not only expanding capacity but also reshaping global supply chains with government-backed initiatives like the U.S. CHIPS Act and the EU Chips Act, alongside aggressive investments in Asia’s semiconductor hubs. This transformation underscores the sector’s strategic importance while positioning it for sustained growth through the second half of the decade.

Market Dynamics: Drivers

Rising Demand from AI, IoT, and Cloud Computing

The explosive adoption of artificial intelligence (AI), Internet of Things (IoT), cloud computing, and edge computing is fueling unprecedented demand for advanced semiconductors. AI workloads require high-performance GPUs and specialized AI accelerators, while IoT devices depend on low-power, high-efficiency chips. Similarly, the shift toward cloud-native architectures and data-intensive applications is driving significant investments in data centers, each requiring large volumes of cutting-edge chips. This digital expansion is a primary force propelling semiconductor market growth.

Electrification of Vehicles and Growth in Automotive Electronics

The automotive sector has emerged as a key driver for semiconductors, especially with the global shift toward electric vehicles (EVs), autonomous driving, and smart mobility. Modern vehicles increasingly rely on power semiconductors, sensors, microcontrollers, and AI chips for advanced driver-assistance systems (ADAS), battery management, and connectivity. As EV adoption accelerates worldwide, demand for semiconductors in the automotive sector is projected to grow faster than in traditional consumer electronics.

Expansion of 5G/6G and Connectivity Ecosystems

The global rollout of 5G networks and research into 6G technology are creating strong demand for semiconductors that support higher bandwidth, lower latency, and improved energy efficiency. Chips designed for network infrastructure, smartphones, industrial IoT, and connected devices are central to this transformation. The proliferation of connected ecosystems, from smart homes to smart factories, ensures a sustained and diversified demand for advanced semiconductor technologies.

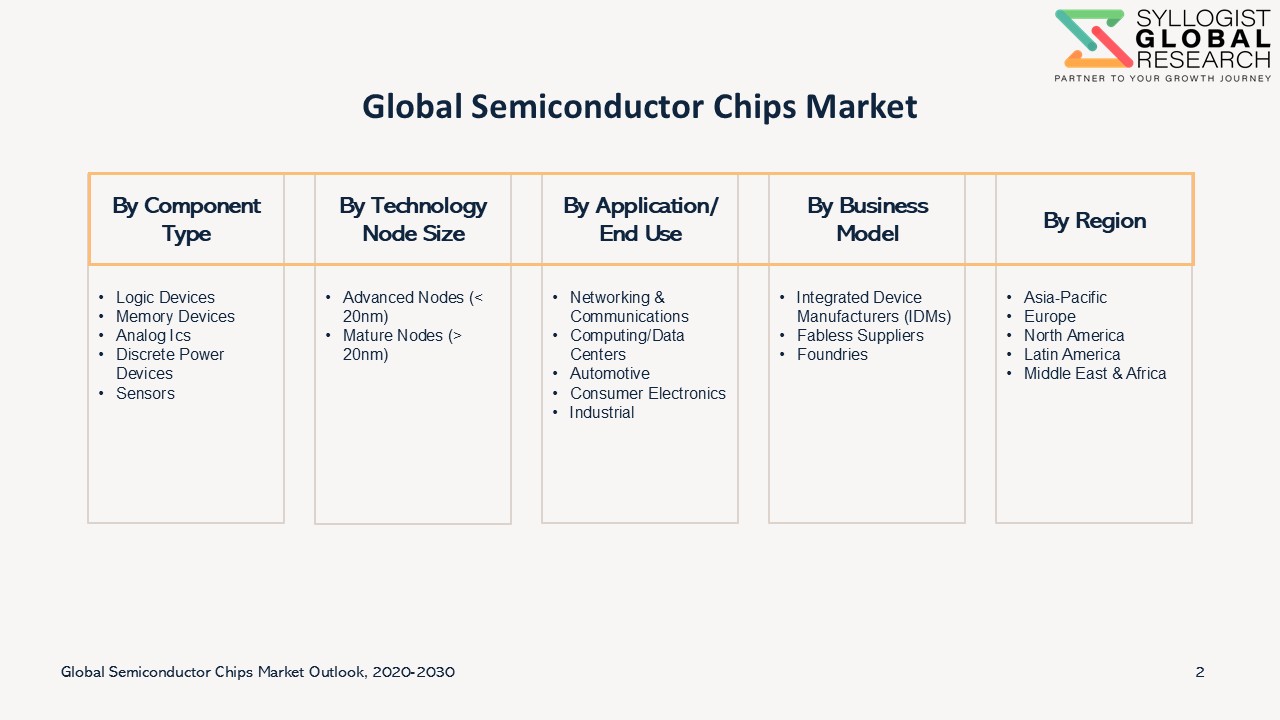

Market Segmentation

- Based on Component Type, the Global Semiconductor Chips market is segmented into

- Logic Devices

- Memory Devices

- Analog Ics

- Discrete Power Devices

- Sensors

- Based on Technology Node Size, the Global Semiconductor Chips market is segmented into

- Advanced Nodes (< 20nm)

- Mature Nodes (> 20nm)

- Based on Application/ End Use, the Global Semiconductor Chips market is segmented into

- Networking & Communications

- Computing/Data Centers

- Automotive

- Consumer Electronics

- Industrial

- Based on Business Model, the Global Semiconductor Chips market is segmented into

- Integrated Device Manufacturers (IDMs)

- Fabless Suppliers

- Foundries

- Based on Geography, the Global Semiconductor Chips market is segmented into

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

- All market revenue has been given in US Dollar, while the market volumes are given in million tons.

Historical Year: 2020-2024

Base Year: 2025

Estimated: 2026

Forecast- 2027-2030

Key Questions this Study will Answer

- What are the key overall market statistics or market estimates (Market Overview, Market Size- By Value, Market Size-By Volume, Forecast Numbers, Market Segmentation, Market Shares) of Global Semiconductor Chips Market?

- What is the region wise industry size, growth drivers and challenges key market trends?

- What are the key innovations, opportunities, current and future trends and regulations in the Global Semiconductor Chips Market?

- Who are the key competitors, what are their key strength and weakness and how they perform in Global Semiconductor Chips Market based on competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during Global Semiconductor Chips Market study?

- Strategic Introduction

- Definition & Scope of Rare Gas

- Market Architecture & Taxonomy

- Research Framework & Methodology

- Data Mining, Secondary & Primary Research

- Market Sizing & Validation (Top-Down, Bottom-Up, Demand/Supply Analysis)

- Scenario Calibration (Technology Evolution, CapEx & OpEx Trends, Supply Chain Dynamics, Geopolitical & Policy Shocks, Demand-Side Drivers, Macroeconomic Variables)

- Executive Insights

- Strategic Snapshot of Market Landscape

- Key Investment Priorities

- Competitive & Ecosystem Dynamics

- Policy, ESG & Risk Considerations

- Boardroom-Level Key Findings

- Future Outlook & Opportunity Mapping (2025–2035)

- Scenario Planning (Base, Optimistic, Conservative)

- Sensitivity Analysis

- Identification of regional investment hotspots

- Value Chain & Ecosystem Analysis

- Introduction to Semiconductor Value Chain

- Upstream: Raw Materials & Inputs

- Midstream: Fabrication & Processing

- Downstream: Distribution & End-Use Applications

- Ecosystem Stakeholder Mapping

- Supply Chain Logistics & Risks

- Policy & ESG Dimensions in Value Chain

- Interlinkages & Collaboration Models

- Future Evolution of the Value Chain

- Global Market Outlook (2020–2035)

- Market size and forecast by value

- Component Type, Technology Node Size, Application/ End Use and Business Model, Regional, and Company Segmentation

- Regional Deep-Dive Analysis (2020–2035)

- Asia-Pacific (Taiwan, South Korea, China, Japan, India, Singapore, Malaysia, Vietnam, Thailand)

- Europe (Germany, The Netherlands, France, United Kingdom, Italy, Belgium, Ireland)

- North America (U.S., Canada)

- South America (Brazil, Mexico)

- Middle East & Africa (UAE, Israel, South Africa)

- Each region includes:

- Market size & forecast

- Market Size by Component Type, Technology Node Size, Application/ End Use and Business Model

- Country-specific insights

- Each region includes:

- Policy & Regulatory Landscape

- Introduction to Policy & Regulatory Frameworks

- Global & Multilateral Frameworks

- Regional Frane work

- Regulatory Frameworks & Compliance

- Incentives & Subsidy Models

- Policy Effectiveness & Challenges

- Future Policy Outlook (2025–2035)

- Technology & Production Pathways

- Introduction

- Wafer Technology & Materials

- Front-End Manufacturing Pathways

- Back-End Manufacturing & Packaging Pathways

- Specialized Production Pathways

- Production Equipment & Technology Enablers

- Recycling & Yield Enhancement Technologies

- Cost, Performance & Scalability Comparison

- Emerging & Next-Gen Pathways (2025–2035)

- Technology Readiness & Adoption Roadmaps

- Market Dynamics

- Growth drivers, restraints, challenges, opportunities

- Future Outlook & Structural Shifts (2025–2035)

- White Space & Growth Frontiers

- Introduction

- Regional White Space Opportunities

- Technology White Spaces

- Demand-Side Growth Frontiers

- Supply-Side Growth Frontiers

- Policy & Strategic Opportunities

- ESG & Sustainability Frontiers

- Emerging Business Models

- Future Outlook (2025–2035)

- Pricing & Economics

- Introduction to Semiconductor Pricing Dynamics

- Production Cost Benchmarking

- Regional Pricing Models

- Break-even & Profitability Analysis

- Pricing Trends (2020–2035)

- Policy & Subsidy Impacts on Economics

- Market Mechanisms & Contracting Models

- Investment Economics & Financial Metrics

- ESG & Cost Implications

- Future Pricing & Economics Outlook

- Project Case Studies (Global Best Practices)

- Introduction to Case Studies

- Successful Fab Implementations Across Regions

- Lessons Learned from Failures & Delays

- Benchmarking of Project Economics

- Technology Adoption Roadmaps in Case Studies

- Partnerships & Collaborations

- ESG & Sustainability in Case Studies

- Replication & Scalability Potential

- Future Outlook from Case Studies

- ESG & Sustainability Dimensions

- Introduction: ESG in Semiconductors

- Environmental Dimensions

- Social Dimensions

- Governance Dimensions

- ESG-Linked Financing & Investment

- Risks & Challenges in ESG Adoption

- ESG Best Practices & Global Benchmarks

- Future Outlook

- Investment & Financing Models

- Introduction to Investment Landscape

- CapEx & OpEx Structures

- Sources of Capital & Financing Instruments

- Incentives & Policy-Linked Financing

- Risk–Return Models

- ESG & Sustainable Finance

- Strategic Investor Participation

- Regional Investment Trends

- Future Outlook (2025–2035)

- Talent, Skills & Workforce Transformation

- Introduction: Workforce in Semiconductor Chips Ecosystem

- Workforce Requirements Across the Value Chain

- Skills Gaps & Reskilling Needs

- Emerging Digital & Technical Skills

- Policy & Institutional Support for Workforce Development

- Regional Workforce Implications

- Social & ESG Dimensions of Workforce

- Future Outlook (2025–2035)

- Risk Assessment Framework

- Political/Regulatory Risk

- Operational Risk

- Environmental & Social Risks

- Financial Risk

- Market & Competitive Risks

- Technology Risks

- Risk Mitigation Strategies

- Future Outlook

- Strategic Roadmap & Recommendations

- Short-Term Roadmap (2025–2027)

- Mid-Term Roadmap (2028–2030)

- Long-Term Roadmap (2031–2035)

- Tailored Recommendations by Stakeholder

- For Foundries & IDMs

- For Fabless Firms

- For Equipment & Materials Providers

- For Policymakers

- For Investors

- Key Success Factors

- Future Outlook & Strategic Priorities