- Overvew

- Table of Content

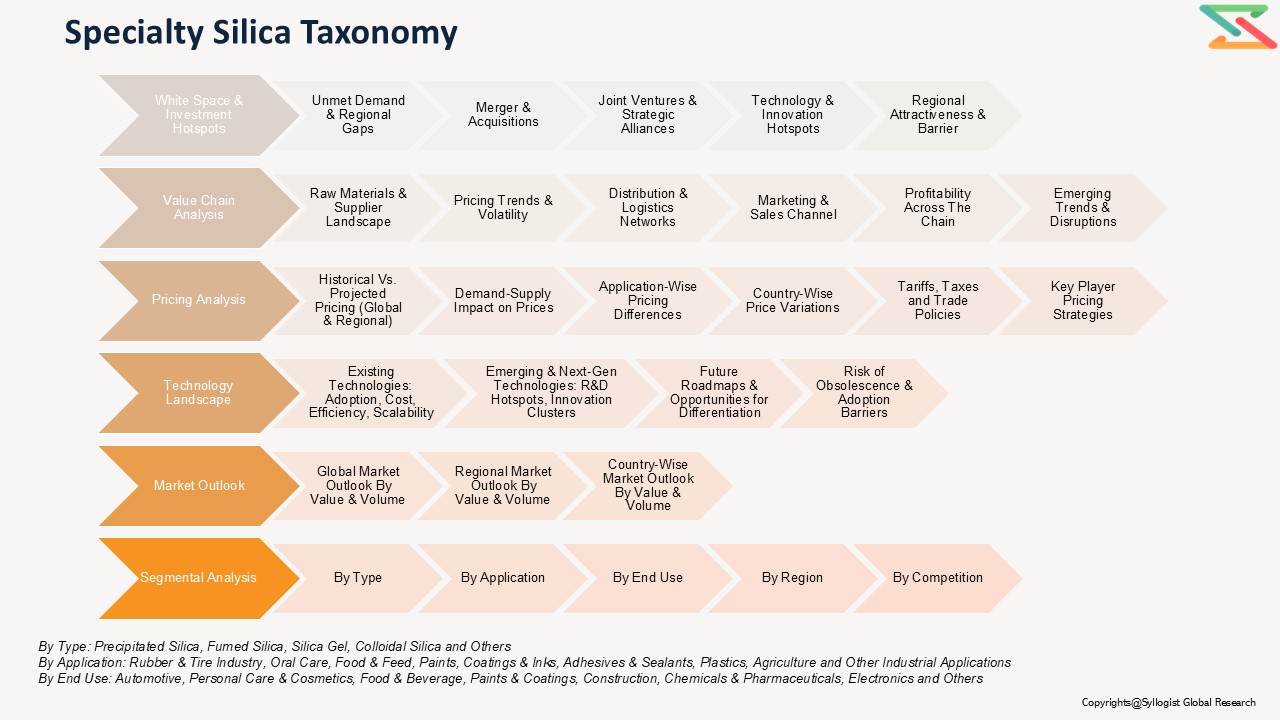

- Segmentation

- Request Sample

Global Specialty Silica Market: Enabling Performance and Sustainability Across Industries

Innovation Driving the Next Wave of Specialty Silica Applications

The global specialty silica market is undergoing a major transformation, powered by innovations in material science, nanotechnology, and application engineering. Specialty silica, in forms such as precipitated silica, fumed silica, colloidal silica, silica gel, and fused silica, is evolving from a functional additive to a strategic enabler of high-performance products. Advances in particle size control, surface modification, and dispersion technologies are enhancing silica’s role in industries ranging from automotive and construction to electronics, personal care, and renewable energy. In the automotive sector, high-dispersible silica (HDS) is at the forefront of “green tire” technology, enabling lower rolling resistance, improved fuel efficiency, and enhanced wet grip. Similarly, fused and colloidal silica are driving precision performance in semiconductors, photovoltaics, and optical components, critical for the digital economy. Beyond performance, sustainability is shaping silica innovation. Bio-based feedstocks, low-carbon production processes, and recyclable silica solutions are increasingly aligned with global decarbonization and ESG agendas. These technological advancements not only improve product performance but also enable customers to meet regulatory and consumer expectations for sustainable solutions, positioning specialty silica as a cornerstone of next-generation materials innovation.

Mapping the Value Chain: From Sand to High-Tech Applications

The specialty silica value chain is highly integrated and resource-dependent, stretching from high-purity quartz sand extraction to specialized downstream applications. Upstream, the availability of high-grade silica feedstock determines both cost competitiveness and supply resilience, with leading suppliers investing in resource security through long-term mining contracts and beneficiation technologies. Midstream, advanced manufacturing processes such as flame hydrolysis, precipitation, and sol-gel techniques transform raw silica into functional materials tailored for specific end uses. Proprietary know-how in particle morphology, surface chemistry, and dispersion control is a key differentiator among global leaders. Downstream, specialty silica finds applications across diverse industries: tires, paints & coatings, adhesives, sealants, plastics, cosmetics, agrochemicals, electronics, and renewable energy. Certification and compliance with stringent standards, whether for automotive safety, food contact, or semiconductor purity, add critical value in the ecosystem. Increasingly, global majors are pursuing vertical integration and regional capacity expansions to stabilize supply and enhance margins, while collaborations with OEMs and R&D institutes are fostering new application innovations. This tightly interlinked value chain underscores the market’s dual imperatives of scale efficiency and customer-centric innovation.

Balancing Global Demand and Supply Dynamics

Specialty silica demand is on an upward trajectory, driven by megatrends such as sustainable mobility, digitalization, and urbanization. The automotive industry remains the single largest demand center, with the transition to electric mobility further amplifying the need for lightweight tires, battery separators, and thermal management materials. Construction and coatings are also significant growth contributors, as specialty silica improves durability, weather resistance, and energy efficiency in infrastructure. On the supply side, Asia Pacific dominates production and consumption, led by China, India, and Southeast Asia, where low-cost manufacturing and rising domestic demand are accelerating capacity growth. Europe and North America retain strongholds in high-specification segments such as green tires, high-purity fused silica, and electronics. However, the market continues to face structural challenges: feedstock concentration in limited geographies, energy-intensive production, and exposure to regulatory tightening around emissions and waste. Moreover, qualification cycles in sectors like automotive and electronics can slow demand ramp-up, creating temporary imbalances. Addressing these dynamics requires strategic investment in feedstock security, energy-efficient production, and diversified regional manufacturing hubs to align supply with global demand growth sustainably.

Pricing Dynamics: Navigating Volatility in Feedstock and Energy

Pricing in the specialty silica market is shaped by a complex interplay of feedstock costs, energy consumption, technological sophistication, and regional competition. Precipitated and fumed silica, for example, are highly energy-intensive to produce, making their prices sensitive to fluctuations in oil, gas, and electricity. Regional disparities are also significant: Asia Pacific enjoys cost competitiveness due to scale and lower utility costs, while Europe and North America command premiums tied to quality, certification, and environmental compliance. Application-specific pricing trends further differentiate the market. High-dispersible silica for tires can command a premium due to performance benefits and regulatory push for low-rolling-resistance tires, while commodity-grade silica for paints or rubber operates under stronger price pressure. Market volatility is compounded by supply chain disruptions, raw material shortages, and shifting trade dynamics. To counteract these challenges, producers are increasingly adopting long-term contracts, backward integration into quartz supply, and efficiency-driven process innovations. At the same time, buyers are shifting toward evaluating “total cost of ownership,” including lifecycle performance, reduced maintenance, and sustainability credentials, rather than focusing solely on upfront price. This shift is reshaping buyer-supplier relationships and redefining silica economics in the global marketplace.

White Space & Emerging Investment Hotspots

The specialty silica market presents significant white-space opportunities for forward-looking investors and innovators. Sustainability remains the most powerful growth lever, with bio-based and recyclable silica products, carbon-neutral production processes, and circular economy models gaining traction. Electric vehicles are another high-potential growth frontier, with silica playing a crucial role in green tires, lightweight composites, and advanced battery materials. Renewable energy, particularly solar and wind, represents an emerging demand stream for fused and colloidal silica in photovoltaic cells and turbine composites. The personal care and cosmetics industry is creating niche opportunities for ultra-fine silica with enhanced sensory properties, while the agriculture sector is exploring silica-based formulations for yield improvement and pest control. Regionally, Asia Pacific continues to be the fastest-growing hotspot, but opportunities in North America and Europe are expanding around sustainability-driven innovations and high-purity applications. Strategic partnerships, M&A activity, and targeted investments in feedstock security, advanced processing technologies, and regional hubs are expected to unlock new value. Collectively, these white spaces are not only attractive investment opportunities but also long-term enablers of industrial competitiveness and resilience in the specialty silica landscape.

- Introduction (Product Definition, Taxonomy and Research Methodology)

- Executive Summary

- Specialty Silica Demand Supply Analysis

- Production by Country & Company

- Demand Supply Analysis

- Global Specialty Silica Market Assessment, 2020-2030

- Global Market Outlook (Value, Volume and Segmental Analysis)

- Regional Market Outlook (Value, Volume and Segmental Analysis)

- White Space & Emerging Investment Hotspot

- Market White Space Opportunities (Unmet demand, regional gaps, etc.)

- Mergers & Acquisitions (M&A)

- Joint Ventures & Strategic Alliances

- Technology & Innovation Hotspots

- Regional Investment Attractiveness

- Barriers & Risks in Investment

- Specialty Silica Market Value Chain Analysis

- Raw Material Sourcing & Suppliers

- Key Raw Materials & Inputs

- Supplier Landscape & Concentration (Country wise)

- Pricing Trends & Volatility

- Dependence on Imports vs Domestic Availability

- Distribution & Logistics

- Marketing & Sales Channels

- Value Addition & Profitability Across Chain

- Emerging Trends & Disruptions

- Raw Material Sourcing & Suppliers

- Specialty Silica Market Pricing Analysis

- Historical Vs Projected Pricing Analysis (Global vs Regional Price Movements)

- Demand-Supply Impact on Prices

- Application-wise Pricing Differences

- Price Variation Across Key Countries

- Impact of Tariffs, Taxes, and Trade Policies

- Key Player Pricing Strategies

- Specialty Silica Technology Landscape

- Key Existing Technologies

- Overview of Mainstream / Commercially Adopted Technologies

- Advantages & Limitations

- Cost, Efficiency, and Scalability Aspects

- Emerging & Next-gen Technologies

- Pipeline & Under-development Technologies

- R&D Hotspots & Innovation Clusters

- Potential Disruption to Existing Methods

- Strategic Insights

- Future Technology Roadmap

- Opportunities for Differentiation via Technology

- Risks of Obsolescence & Barriers to Adoption

- Key Existing Technologies

- Policy & Regulatory landscape

- Competition Outlook (Leading 10 Companies)

- Competition Benchmarking

- Market Leaders Vs New Entrants

- Strategic Recommendations