- Overvew

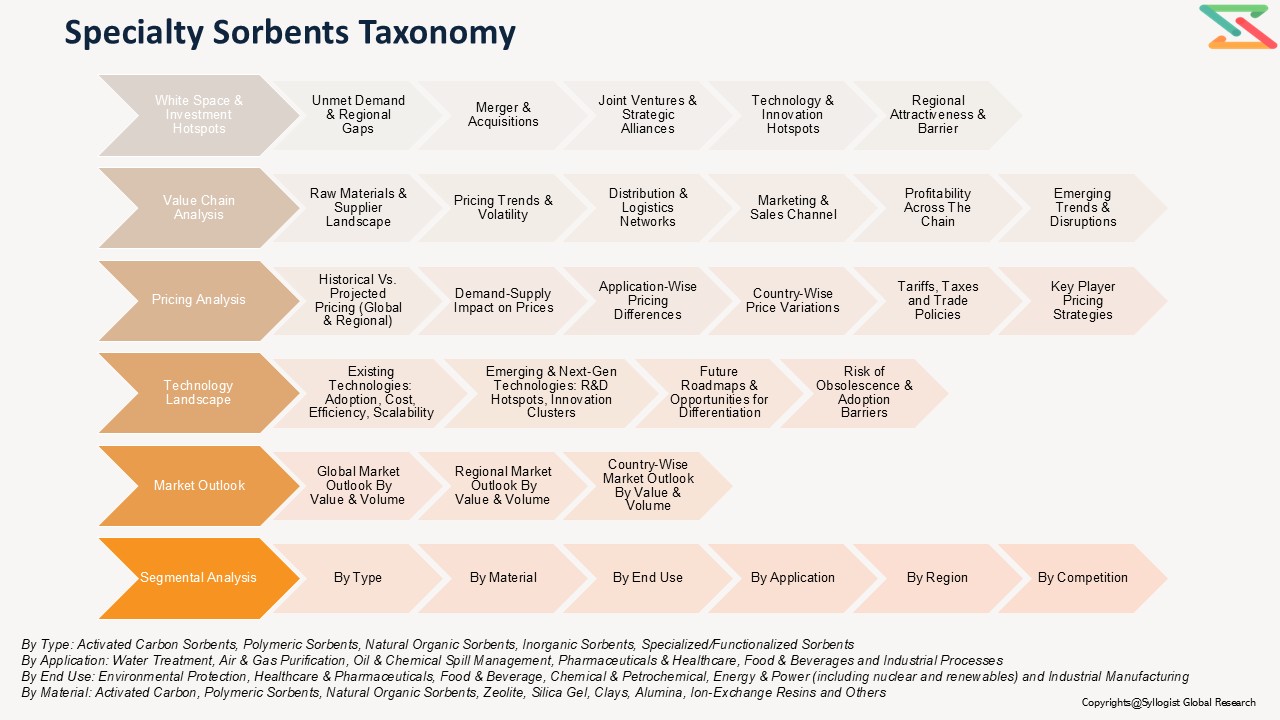

- Table of Content

- Segmentation

- Request Sample

Global Specialty Fiber Market: Innovation at the Core of Future Growth

Revolutionizing Performance through Technological Breakthroughs

The specialty fiber market is entering a transformative phase, driven by rapid advances in material science, process engineering, and application-specific innovations. From carbon and aramid fibers to specialty glass and optical fibers, each category is witnessing disruptive improvements in strength, thermal stability, weight reduction, and functionality. These breakthroughs are not only enhancing performance across aerospace, defense, and automotive industries but are also opening new frontiers in telecommunications, renewable energy, and healthcare. For example, the development of next-generation optical fibers with advanced dispersion management and high-capacity transmission is shaping the backbone of 5G and future 6G networks. Similarly, the emergence of bio-based and recyclable fibers is aligning the industry with global sustainability imperatives, addressing both regulatory and consumer demand for eco-friendly solutions. Automated fiber placement, precision spinning technologies, and digital twin-enabled manufacturing are reducing cycle times and costs, bringing high-performance fibers into mainstream applications. Collectively, these innovations are setting a new trajectory for the specialty fiber market, positioning it as a strategic enabler of industrial competitiveness in the decade ahead.

Mapping the Value Chain: From Precursors to End Applications

The global specialty fiber value chain is highly integrated and capital intensive, stretching from precursor manufacturing to downstream end-use integration. Upstream, the availability and quality of feedstocks such as polyacrylonitrile, aromatic polyamides, and high-purity silica dictate overall cost structures and supply resilience. Midstream processing, including fiber spinning, drawing, weaving, and composite integration, acts as the critical stage where performance specifications are embedded. At this stage, leading producers often deploy proprietary technologies and closely guarded intellectual property to differentiate themselves. Downstream, specialty fibers are incorporated into aerospace components, automotive structures, protective apparel, medical implants, wind turbine blades, and advanced optical cables. The value chain is also shaped by stringent certification requirements in high-risk industries such as aviation, defense, and medical devices, where compliance and traceability add significant value. Increasingly, global leaders are pursuing vertical integration strategies to capture more margin, stabilize supply, and enhance customer intimacy. Meanwhile, collaboration across suppliers, manufacturers, and research institutions is fostering a more agile ecosystem capable of responding to evolving application demands and sustainability goals.

Balancing Global Demand and Supply Dynamics

Global demand for specialty fibers is on an upward trajectory, driven by megatrends such as decarbonization, electrification, digitalization, and advanced mobility. Aerospace and automotive industries are increasingly turning to lightweight yet durable fiber solutions to enhance energy efficiency and reduce emissions. Renewable energy sectors, particularly wind power, are fueling demand for long, high-performance fibers used in turbine blades. In parallel, the exponential growth of digital infrastructure and cloud computing is driving unprecedented consumption of specialty optical fibers. On the supply side, production is expanding most aggressively in Asia Pacific, where government support, cost advantages, and large-scale investments are accelerating capacity. However, supply chain vulnerabilities remain evident in precursor availability, energy-intensive production processes, and geopolitical trade dependencies. Furthermore, demand growth in high-specification sectors is often constrained by lengthy qualification cycles, meaning supply cannot be instantly ramped up to match emerging opportunities. This structural imbalance underscores the need for strategic investments in raw material security, advanced manufacturing capabilities, and regional diversification to ensure long-term market equilibrium.

Pricing Dynamics: Navigating Complexity and Volatility

Pricing in the specialty fiber market reflects a delicate balance of technology, scale, and application demand. While costs vary significantly across fiber types, ranging from commodity-grade to aerospace-certified materials, the overarching trend is one of gradual cost rationalization driven by process optimization and capacity expansion. However, volatility remains a defining characteristic. Raw material fluctuations, high energy consumption, and stringent environmental compliance frequently translate into pricing pressure. Smaller tow sizes, higher modulus grades, or customized coatings can command substantial premiums, particularly in aerospace and defense where performance is non-negotiable. In contrast, automotive, industrial, and consumer sectors exert stronger downward pressure, prioritizing affordability without compromising essential performance. Regional pricing disparities are also widening, with Asia offering more competitive structures due to lower production costs, while North America and Europe retain premiums based on quality, certification, and sustainability compliance. As the industry matures, manufacturers are increasingly focusing on total value delivery, such as lifecycle cost savings, reduced maintenance, and sustainability credentials, rather than competing purely on upfront price. This strategic shift is redefining how buyers and suppliers evaluate fiber economics in a globalized market.

White Space and Emerging Investment Hotspots

Beyond the established markets, the specialty fiber sector offers significant white-space opportunities for investors and innovators. Sustainability is emerging as the single largest driver, with strong interest in bio-based precursors, recyclable fiber solutions, and circular economy models. Electric mobility presents another major growth frontier, with lightweight composites and thermal management solutions in batteries and vehicle structures opening new demand streams. Renewable energy, particularly offshore wind and solar infrastructure, is set to absorb vast volumes of specialty fibers in the coming decade. In telecommunications, the next wave of digital transformation, spanning AI data centers, edge computing, and smart cities, will require advanced optical fibers tailored for ultra-low latency and higher data capacity. Regionally, Asia Pacific remains the fastest-growing hotspot, but opportunities in North America and Europe are rising around sustainability and high-tech applications. Strategic collaborations, mergers, and targeted investments in precursor innovation, advanced coatings, and regional manufacturing hubs are expected to unlock new value. For forward-looking stakeholders, these white spaces represent not only attractive investment destinations but also long-term enablers of industrial resilience and competitive differentiation.

- Introduction (Product Definition, Taxonomy and Research Methodology)

- Executive Summary

- Specialty Fiber Demand Supply Analysis

- Production by Country & Company

- Demand Supply Analysis

- Global Specialty Fiber Market Assessment, 2020-2030

- Global Market Outlook (Value, Volume and Segmental Analysis)

- Regional Market Outlook (Value, Volume and Segmental Analysis)

- White Space & Emerging Investment Hotspot

- Market White Space Opportunities (Unmet demand, regional gaps, etc.)

- Mergers & Acquisitions (M&A)

- Joint Ventures & Strategic Alliances

- Technology & Innovation Hotspots

- Regional Investment Attractiveness

- Barriers & Risks in Investment

- Specialty Fiber Market Value Chain Analysis

- Raw Material Sourcing & Suppliers

- Key Raw Materials & Inputs

- Supplier Landscape & Concentration (Country wise)

- Pricing Trends & Volatility

- Dependence on Imports vs Domestic Availability

- Distribution & Logistics

- Marketing & Sales Channels

- Value Addition & Profitability Across Chain

- Emerging Trends & Disruptions

- Raw Material Sourcing & Suppliers

- Specialty Fiber Market Pricing Analysis

- Historical Vs Projected Pricing Analysis (Global vs Regional Price Movements)

- Demand-Supply Impact on Prices

- Application-wise Pricing Differences

- Price Variation Across Key Countries

- Impact of Tariffs, Taxes, and Trade Policies

- Key Player Pricing Strategies

- Specialty Fiber Technology Landscape

- Key Existing Technologies

- Overview of Mainstream / Commercially Adopted Technologies

- Advantages & Limitations

- Cost, Efficiency, and Scalability Aspects

- Emerging & Next-gen Technologies

- Pipeline & Under-development Technologies

- R&D Hotspots & Innovation Clusters

- Potential Disruption to Existing Methods

- Strategic Insights

- Future Technology Roadmap

- Opportunities for Differentiation via Technology

- Risks of Obsolescence & Barriers to Adoption

- Key Existing Technologies

- Policy & Regulatory landscape

- Competition Outlook (Leading 10 Companies)

- Competition Benchmarking

- Market Leaders Vs New Entrants

- Strategic Recommendations